Although biotech stocks have the potential for great appreciation, they can also have short periods of steep declines. When investing in the drug companies, there are several things to keep in mind. Compare Investment Accounts.

Side Nav [EN]

The healthcare sector is worldwide among the most important and fast growing industries. Key growth drivers are demographic trends population growth and ageingmedical progress and the resulting innovations, rising prosperity especially in emerging markets and improved access to medical products and services. In addition, there is a great need for new therapies for a steadily increasing number of diseases. Innovation why invest in healthcare sector products, services and business models remains strong. The healthcare industry’s global sales are estimated at over USD 4 trillion per year. The largest and most profitable sub-markets are pharmaceuticals and biotechnology with just under USD billion and medical technology and diagnostics with more than USD billion.

Laying a foundation for the future

People will always get ill and death is inevitable. With ageing populations, healthcare needs are only going to increase. So the long-term opportunities for investing in this space look good. Companies that make things more efficient, productive or cheaper, either in the form of services or products, should do well. The potential for merger and acquisition activity is a positive and has been a key trend over the last few years, says Rob Morgan, pensions and investments analyst at Charles Stanley.

The healthcare sector is worldwide among the most important and fast growing industries. Key growth drivers are demographic trends population growth and ageingmedical progress and the resulting innovations, rising prosperity especially in emerging markets and improved access to medical products and services. In addition, there is a great need for new therapies for a steadily increasing number of diseases.

Innovation in products, services and business models remains strong. The healthcare industry’s global sales are estimated at over USD 4 trillion per year. The largest and most profitable sub-markets are pharmaceuticals and biotechnology with just under USD billion and medical technology and diagnostics with more than USD billion.

In the emerging markets in particular, rising prosperity is further generating above-average growth. Moreover, there is still a great need for new and efficient drugs and therapies. Continuously high application rates for the approval of new drugs and therapies. In addition, more than drug candidates are in the final clinical trial phase in humans or are about to be approved for marketing around the globe.

Even if statistically only about half of them are approved for marketing, this still results in an impressive pipeline. Biotechnology has established itself as the innovation backbone of the large pharmaceutical groups. More than half of the top ten drugs sold worldwide are of biotechnological origin. Recently launched novel immunoncology drugs are the best example of. Healtchare of them come from the research laboratories inveest small biotechnology companies and were acquired invvest the large pharmaceutical companies.

The fastest growing sub-markets are biotechnology, pharmaceuticals, medical technology and diagnostics. Annual growth of 5 to 9 percent is expected over the next five years. The highest growth 5 to 8 percent is forecast for the emerging markets. Growth rates of just over 4 percent are expected healtcare the USA haelthcare Europe. Thus, the long-term growth rates are significantly higher than those of the global gross domestic product.

Acquisition activities in the healthcare sector are driven primarily by financially strong large corporations whose demand for new products and innovations remains unmet. Large pharmaceutical companies now have large cash reserves that need to be invested wisely.

Since mega-blockbuster drugs have become less common in the pharmaceutical industry, partnerships are increasingly being observed as «external sources of innovation» in addition to acquisitions.

With about USD 3. At Biotechnology applies biology and biochemistry knowledge to technical processes or products. Biotechnology focuses on the development and production of enzymes, proteins, antibodies and other active substances for medical and other purposes. Biopharmaceutical products are usually produced in a bioreactor with the help of microorganisms.

Today, they play a very important role in the treatment of many diseases. These are often large molecule compounds for the treatment of cancer and other serious diseases. This includes companies active in the research, development, production and marketing of active pharmaceutical ingredients. Veterinary preparations are also part of pharma. Medical technology combines technical knowledge from engineering with the medical expertise of doctors.

The aim is to detect, prevent, monitor, treat or alleviate injuries or disabilities. Medtech includes systems for the administration of drugs, heaothcare equipment, orthopaedic devices and implants, but also operating materials such as safety pins and syringes. Diagnostics comprises the various methods of medical and therapeutic diagnosis.

Companies active in diagnostics develop new or improve existing diagnostic techniques. Patients are often only indirectly the payers. Often health insurers, health care providers or state institutions in the health service cover the costs. Distributors, services and facilities in turn settle accounts with the companies. It begins after the so-called preclinical why invest in healthcare sector, i. At the end of extensive preclinical test series, a compound usually enters clinical research as an potential active ingredient.

Phase I studies are conducted in volunteers to investigate how the active substance interacts in the human organism and to assess any side effects. Based sfctor these results, an optimal dosage form for the active ahy is developed. In phase II of clinical development, the active ingredient is being used as a drug in patients for the first time. Typically, the focus is on testing tolerability and establishing the dose. Phase III includes studies that provide information on the mode of action which are crucial for approval.

In randomised double-blind studies, proof of a comparable effect must be demonstrated against other drugs sextor well as superiority as compared to placebos. The development and approval processes for medical technology products and diagnostic devices vary depending on the class assigned to. Class 1 and 2 products can be approved via the k process, while Class 3 requires a PMA process.

Class 3 includes applications for more serious treatments such as defibrillators, implants and dialysis products. A PMA process is much more complex, lengthy and cost-intensive than a k process.

While the k method requires only safety and efficacy in comparison to a reference product, the PMA method requires monitored clinical trials with randomized patient groups. In addition, manufacturing infrastructure must be inspected and approved prior to approval. In Europe, manufacturers themselves declare the conformity of their products. However, they must undergo a conformity assessment procedure comparable to an approval process.

With this CE mark, the manufacturer declares that the product complies with all relevant EU directives. Once the CE mark has been obtained in one EU country, this generally applies to all other 28 member states. The CE mark is not a seal of quality, but merely an «administrative symbol». Healthcare — an attractive investment universe The healthcare sector is worldwide among the most important and fast growing industries. Why invest in healthcare? Major global industry: The most attractive sub-markets generate over USD 1.

Major global industry The healthcare industry’s global sales are estimated at over USD 4 trillion per year. High innovative momentum Continuously high application rates for hwy approval of new drugs and therapies. Above-average growth The fastest growing sub-markets are biotechnology, pharmaceuticals, medical technology and diagnostics. The global healthcare market With about USD 3. Major sub-sectors Biotechnology Biotechnology applies biology and biochemistry knowledge to technical processes or products.

Pharma This includes companies active in the research, development, production and marketing of active pharmaceutical ingredients. Medical technology and diagnostics Medical technology combines technical knowledge from engineering with the medical expertise of doctors. Understanding the healthcare sector.

Development and approval process of medtech products and diagnostics United States The development and approval processes for medical technology products and healhcare devices vary depending on the class assigned to. Europe In Europe, manufacturers themselves declare the conformity of their products.

How to Buy Great Healthcare Stocks — Industry Focus

Why invest in healthcare?

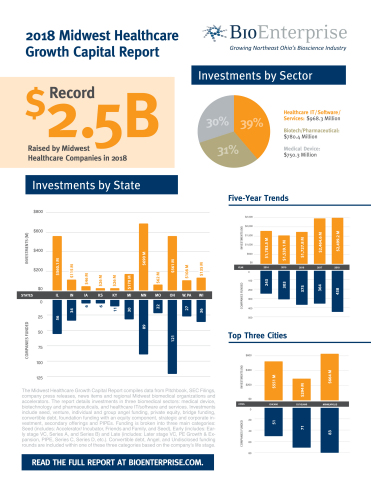

Click on the image to view the infographic. Transition is already under way and we expect it to accelerate over the next five to 10 years. Meanwhile, hospitals are faced with bad debts impacting their profitability. Negative trends include:. Investments in this sector are affected by many variables, including positive trends related to demographics and negative trends related to reimbursement. To help ease the burden, there are investment vehicles like ETFs and healthcare mutual funds in which you can invest; they can reduce the volatility of investing in individual stocks by diversifying holdings. When investing in sector funds, it’s wise to remember to limit exposure to smaller allocation weights in your portfolio. Technology-enabled patient engagement strategies are enabling increased financial independence for patients in their health care decisions, in addition to improving interactions with their health care systems. Mutual Funds Best Mutual Funds. However, following government regulationparticularly bills related to Medicare and Medicaid funding, is important as the U. Overview With global health care spending expected to rise at a CAGR of 5 percent init will likely present many opportunities for the sector. PBMs tend to benefit from more email transactions and generic prescriptions filled because they generally receive a higher margin for that type of service. Positive surprises — better-than-expected clinical data, faster time why invest in healthcare sector market. Although biotech stocks have the potential for great appreciation, they can also have short periods of steep declines. In addition, it is often perceived that the Democratic Party is less friendly to healthcare companies than the Republican Party, and stocks in the industry will often react to changes in party control of the government. Medical technology and device companies manufacture a host of medical products, from bandages all the way to artificial joints and heart stents. Care model innovation Patients are no longer passive participants in their health care, they are demanding transparency, convenience, access, and personalized products and services.

Comments

Post a Comment