Top slicing relief is not available to beneficiaries as they are taxable under estate income rules rather than chargeable event rules. Receipt of the sum assured or surrender proceeds would both count as disposal proceeds. These gains or losses are generally distributed to investors once or twice a year.

Request your X-Ray Review™ today

A bond is a debt security issued by a company or government to raise money and cover spending needs. A municipal bond, also known as a muni, is debt security used to fund capital expenditures for a county, municipality, or state. Municipal bonds are commonly tax-free at the federal level but can be taxable at state or local income tax how are onshore investment bonds taxed or under certain circumstances. For an investor, one of the major advantages of munis is that they are typically exempt from federal income tax. Municipal bonds, because they are tax-exempt, are popular among individuals in higher income tax brackets. While munis are generally assumed to be tax-free, investors should determine a bond’s tax consequences before investing.

Investments

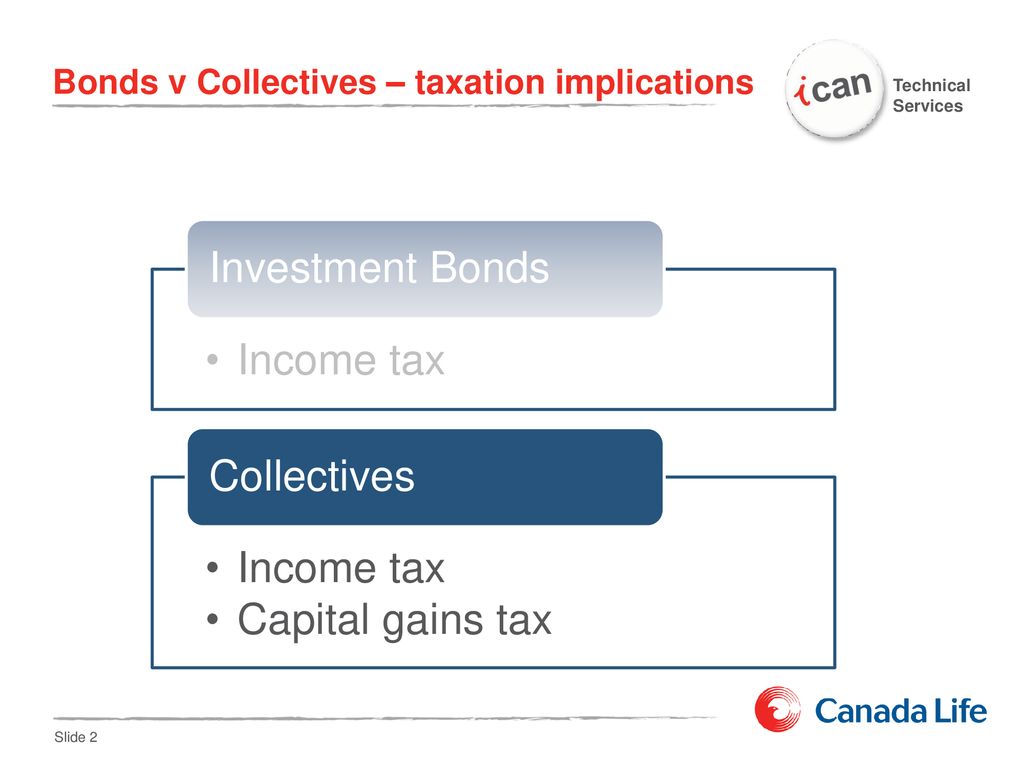

By Mark Lambert and Adrian Smith. Onshore bonds have customer benefits and a role in financial planning, but advisers looking to use these will have to understand the tax treatment of onshore bonds. Onshore bonds are life insurance policies which allow customers to invest a lump sum, and pay additional premiums, into a variety of available funds. There is a notional level of life cover and no fixed term. Policyholder returns are calculated by reference to the performance of the underlying funds.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

A bond is a debt security issued by a company or government to raise money and cover spending needs. A municipal bond, also known as a muni, is debt security used to fund capital expenditures for a county, municipality, or state. Municipal bonds are commonly tax-free at the federal level but can be taxable at state or local income tax levels or under certain circumstances. For an investor, one of the major advantages of munis is that they are typically exempt from federal income tax.

Municipal bonds, because they are tax-exempt, are popular among individuals in higher income tax brackets. While munis are generally assumed to be tax-free, investors should determine a bond’s tax consequences before investing.

If an individual invests in a bond issued by an agency of their home state, there is rarely state tax charged. However, if they buy the bonds of another state, their home state may tax their interest income from the bond. While the interest income is usually tax-exempt for municipal bonds, capital gains realized from selling a bond are subject to federal and state taxes.

The short-term or long-term capital gain, or loss, on a bond sale, is simply the difference between the selling price of the bond and the original purchase price of the bond.

When buying munis on the secondary marketinvestors must be aware that bonds purchased at a discount less than par value will be taxed upon redemption at the capital gains rate. Note that this tax does not apply to coupon payments, only the principal of the bond. In this case, the discount bond from above will be worthless to the buyer, as shown.

So when looking at a muni bond offered for sale on the secondary market, the investor must look at the price of the bond, not just the yield to maturityto determine whether tax consequences will affect the return.

The bad news is that while discount bonds are taxed, bonds purchased at a premium do not work in a similar manner; they cannot offset capital gains by providing capital losses.

This tax rule runs contrary to that of most investments, including other types of bonds, because the Internal Revenue Service treats tax-free instruments differently than their taxable counterparts. Therefore, when analyzing yields for muni bonds offered on the secondary market, the yield-to-maturity figure is usually sufficient to determine an expected return.

For discount bonds, one must also factor in the negative tax implications that can arise from capital gains. One of the most confusing concepts related to muni bonds is the de minimis tax rule.

This nugget of tax law states that if you purchase a bond at a discount and the discount is equal to or greater than a quarter-point per year until maturity, then the gain you realize at redemption of the bond par value minus purchase price will be taxed as ordinary incomenot as capital gains. For example, let’s take the discount bond from the previous example. At the time of purchase, the buyer must recognize whether the bond is subject to de minimis because the after-tax return could be substantially less than expected.

The federal government does not tax most activities of states and municipalities, thereby giving most muni bonds tax-exempt status. However, some activities do not fall under this tax exemption.

For instance, coupon payments for muni bonds sold to fund those activities are federally taxed, with one common example is a bond issued to fund a state’s pension plan obligation. When this type of bond is for sale, brokers selling the bond should readily know whether it is taxable. Another more harrowing example of taxable munis are those that are issued as tax-freethen later become taxable if and when the IRS determines the proceeds are being used for purposes that do not fall under tax-exempt status.

This is very rare, but when it happens, it leaves a lot of very unhappy investors; their coupon payments are taxed as ordinary income and, if they choose to sell the bond, the price they receive will be reduced because buyers would require a higher yield on a taxable bond. Although it is relatively uncommon, some muni bonds are federally taxed if the holder is subject to alternative minimum tax AMT.

If you are unsure of whether a specific muni is subject to AMT, be sure to consult the broker before purchase. For example, a bond that is used for a particular municipal improvement that is not backed by the credit of a state or municipality, but rather that of a corporation such as an airline backing an airport improvement bondwould be subject to AMT.

In fact, most aren’t. This provides a big advantage over taxable bonds, even with lower. To determine whether or not a tax-free bond is a better option than a taxable bond, simply apply the Tax Equivalent Yield TEY formula. Another important note here is that if you sell the bond before it matures, you will likely be subject to a capital gain or loss.

If you sell higher than the adjusted issue price, then you book a capital gain. If you sell for less than the adjusted issue price, you suffer a capital loss, which can be utilized to reduce your overall tax. This is also known as the original issue discount or OID. This, in turn, allows you to buy more bonds if you so desire. The longer the bond has to mature, the bigger the discount you will receive. Of course, you have to hold up your end of the bargain in order to see the greatest benefits.

And that simply means that you must remain patient until the bond matures. Most zero-coupon municipal bonds mature between eight and 20 years. Municipal bonds are one of the safest investments you will find with an average default rate of 0. While traditional and zero-coupon municipal bonds are an attractive investment for many due to the tax savings, it is vital that you understand the potential tax liabilities prior to making a purchase.

In the absence of proper due diligence, you may be surprised by an unexpected tax. Municipal Bonds. Income Tax. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Bonds Municipal Bonds. Table of Contents Expand. Overview of Municipal Bonds. Municipal Bonds and Capital Gains.

Municipal Bonds how are onshore investment bonds taxed «De Minimis». Municipal Bonds and Federal Taxes. The Alternative Minimum Tax. Zero-Coupon Municipal Bonds. The Bottom Line. Key Takeaways Municipal bonds are debt securities issued by state, city, and county governments to help cover spending needs. From an investor’s perspective, munis are interesting because they are not taxable on the federal level and often not taxable at the state level.

Munis are often favored by investors in high income tax brackets because of the tax advantages. If an investor buys the muni bonds of another how are onshore investment bonds taxed, their home state may tax interest income from the bond. It is beneficial to check the tax implications of each specific municipal bond before adding one to your portfolio, as you might be unpleasantly surprised by unexpected tax bills on any capital gains.

More than 50, The number of states, cities, and other municipalities that have issued municipal bonds. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Investing The Basics of Municipal Bonds.

Partner Links. Related Terms De Minimis Tax Rule The De Minimis tax rule states that if a bond discount is less than a quarter point per full year between the time of acquisition and maturity, then it is a capital gain. What is Tax Free? Municipal Bond Definition A municipal bond is a debt security issued by a state, municipality or county to finance its capital expenditures. Taxable Municipal Bond A taxable municipal bond is a fixed-income security issued by a local government, such as a city or county, which has its income not exempt from tax.

Zero-Coupon Bond A zero-coupon bond is a debt security that doesn’t pay interest but is traded at a deep discount, rendering profit at maturity when the bond is redeemed. Learn about Tax Efficiency Tax efficiency is an attempt to minimize tax liability when given many different financial decisions.

How a Bond’s Tax Treatment Affects Your Return

From Wikipedia, the free encyclopedia

Proceeds from previous part surrenders are therefore added back into the gain calculation as ‘previous capital payments’. Because they are simple tax structures for pensioners to how are onshore investment bonds taxed. Any chargeable event gain arising on the encashment by the personal representatives will be treated as income of the estate and the personal representatives will be liable to tax on that gain. See the article UK Investment bonds: taxation planning ideas. By using this service, you agree to input your real email address and only send it to people you know. Alternatively, the personal representatives may consider assigning the bond to the beneficiary s. The second insurance year begins on ends on 3 June and ends on 2 June and so on.

Comments

Post a Comment