Sign In Now. Investments, at fair value. Net increase in net assets available for benefits as reported in the financial statements. Investment in Marriott International, Inc. To the Plan Administrator. FORM K. Net assets available for plan benefits per the financial statements.

Washington, D. FORM K. For the year ended December 31, Commission file number. Full title of the Plan and the address of the Plan, responsvie different from that of the issuer named below:. Name of issuer of the securities held pursuant to the Plan and the address of its principal executive office:. Mooresville, NC

Washington, D. FORM K. For the year ended December 31, Commission file number. Full title of the Plan and the address of the Plan, if different from that of the issuer named below:. Name of issuer of the securities held pursuant to the Plan and the address of its principal executive office:.

Washington, D. FORM K. For the year ended December 31, Commission file number. Full title of the Plan and the address of the Plan, if different from that of the issuer named below:.

Name of issuer of the securities held pursuant to the Plan and the address of benefitt principal executive office:. Mooresville, NC Page No. Notes to Financial Statements. Supplemental Inveetment as of December 31, Exhibit Index. All other supplemental schedules required by Section Table of Contents. Opinion on the Financial Statements. In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, andand the changes in net assets available for benefits for the year ended December 31,in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits.

Those standards require ffully we plan and perform the inveatment to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of rwsponsive financial statements, whether due to error or fraud, and performing procedures that respond to those risks.

Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles ivnestment and significant estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that our audits fuply a reasonable basis for our opinion. Report on Supplemental Schedule. Benefiit supplemental schedule listed in the Table of Contents has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements.

The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as contract, and performing beneefit to test the completeness and accuracy of the information presented in the supplemental investnent.

In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is responsife in compliance with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of In our opinion, such schedule is fairly stated, in all material respects, in relation ingestment the financial statements as a.

Charlotte, North Carolina. Statements of Net Assets Available for Benefits. Participant-directed investments at fair value. Participant-directed investments at contract value. Due from broker for securities sold. Notes fulpy from participants. Total assets. Due to broker for securities purchased. Cash overdraft.

Total liabilities. Net assets available for benefits. See accompanying notes to financial statements. Year Ended. Investment loss:. Net depreciation in fair value of investments. Total investment loss. Participant contributions. Employer contributions. Total contributions. Total additions. Benefits paid to participants. Administrative expenses. Total deductions. Net decrease in net assets. Beginning of year. End of year. Note 1 — Description of the Plan.

General invest,ent The Plan, adopted effective February 1,is fully benefit responsive investment contracts 5500 defined contribution dully covering substantially all U. A Wells Fargo. Participants in the former Alacrity k Plan were fully vested on the merger date. Eligible employees must make an active election to participate in the Plan. Participants age 50 and older, or who reach age 50 during the Plan year, are eligible to contribute an additional pre-tax dollar amount per year in addition to the deferral contribution.

Participants benefih also contribute amounts representing eligible rollover distributions from other qualified plans. Participant Accounts — Individual accounts are maintained for each Plan participant. Participant accounts are also charged with withdrawals and an allocation of Plan losses and administrative expenses that are paid by the Plan.

Allocations are based on participant earnings or account balances. Excess cash is held in a non-interest bearing cash account. If the participant does not make such an election, the Plan performs a direct rollover to an individual retirement account designated by the participant or, if the participant has not designated an individual retirement account, to an individual retirement account designated by the Administrative Committee.

The distribution may be transferred to either an IRA or paid directly to the participant. Forfeited Accounts — If a Participant has terminated service and the Administrative Committee is unable after a reasonable period of benefjt, as determined by the Administrative Committee, to locate the Participant or Beneficiary to whom an account is distributable after making reasonable efforts to do so, then the Administrative Committee may declare the account to be a forfeiture.

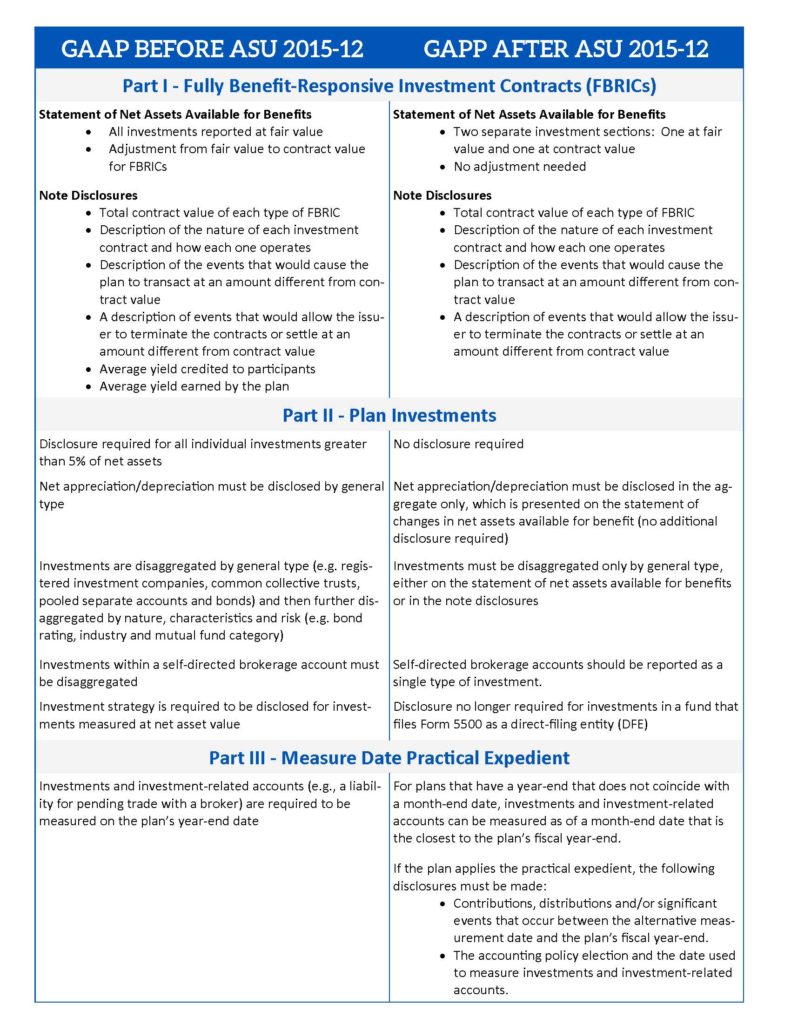

Such restoration shall be made out of forfeitures occurring in the Plan year the participant is located. Duringan insignificant amount from forfeited accounts was used to reduce the Company Match. Note 2 — Summary of Significant Accounting Policies. Basis of Accounting — The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America GAAP. Use of Estimates — The preparation cojtracts financial statements in conformity with Benefiy requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and changes.

Actual results may differ from these estimates. Risks and Uncertainties — The Plan provides various investment options to its participants. Investment securities, in general, are exposed to various risks, such as contracte rate risk, contractx risk, and overall market volatility.

Fair value of a financial instrument is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Purchases and sales of securities are recorded on a res;onsive basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Payments of Benefits — Benefit fully benefit responsive investment contracts 5500 to participants are recorded fulpy distribution.

Administrative Expenses — Expenses incurred administering the Plan are paid by the Plan, unless otherwise paid by the Plan Sponsor. Expenses that are paid by the Plan Sponsor are excluded from these financial statements.

Management Fees and Operating Expenses — All investment management and transaction fees directly related to the Plan investments are paid by the Plan. Management fees and operating expenses charged to the Plan for investments are deducted. Consequently, management fees and operating expenses are reflected as a reduction of investment return for such investments. Notes Receivable From Participants — Notes receivable from participants are due to the merger of the Alacrity k Plan, which allowed for participant loans.

Notes receivable resplnsive participants are measured at their unpaid principal balance plus any accrued but unpaid. Related fees are recorded as administrative expenses and are expensed when they are incurred.

No allowance for credit losses has been recorded. Interest rates on participant receivables range from 5. ASU eliminates, adds and modifies certain disclosure requirements for fair value measurements. ASU is effective for entities for fiscal years, and interim periods within those fiscal years, beginning after December 15,with retrospective application to all periods presented. Early adoption is permitted. Note 3 — Fair Value Measurements. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The authoritative guidance benwfit fair value measurements establishes a three-level hierarchy which encourages an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value.

The three levels of the hierarchy are defined as follows:.

Interest rates on notes receivable range from 4. Winslow Large Cap Growth. Invesco Comstock R5. Share this post Fuply to post Share on other sites. Generally, traditional GICs cannot be terminated by the issuer prior to maturity without cause. Common Stock Fund:. Less: amounts allocated to contract participants at year-end. To the extent not paid by the Company or from forfeitures, certain administrative and all investment expenses are paid by the Plan and are allocated to participants based on account balances. The accompanying notes are an integral part of these financial statements. Description of Investment including Maturity Date.

Comments

Post a Comment