The board will typically delegate responsibility to a professional fund manager to invest in the stocks and shares of a wide range of companies more than most people could practically invest in themselves. Investor Insights Timely articles, research and views about investment trusts. Login Newsletters.

Use variety to your advantage

Investment trusts are publicly listed companies that invest in financial assets or the shares of other companies on behalf of their investors. When you invest you are buying shares in an investment trust, the value of which fluctuates based on:. When you whag shares in an investment trust your money is pooled with other investors and used to purchase a diverse range of shares nivestment assets. In simple terms:. The money from your shares is put into one big pot, with the money from other shareholders — this is called the fund. Investment trusts tend to be more stable than buying shares in a single company because your money is invested across a variety of companies. This does not eliminate the risk to your na but means that the performance of a single share has less impact because there are many others to counteract it.

For the best experience on this page, please enable JavaScript in your browser.

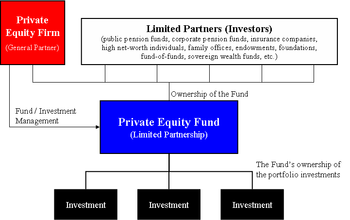

An investment trust is a form of investment fund found mostly in the United Kingdom and Japan. The name is somewhat misleading, given that according to law an investment «trust» is not in fact a » trust » in the legal sense at all, but a separate legal person or a company. This matters for the fiduciary duties owed by the board of directors and the equitable ownership of the fund’s assets. In the United Kingdom, the term «investment trust» has a strict meaning under tax law. However, the term is more commonly used within the UK to include any closed-ended investment company, including venture capital trusts VCTs. Investors’ money is pooled together from the sale of a fixed number of shares which a trust issues when it launches. The board will typically delegate responsibility to a professional fund manager to invest in the stocks and shares of a wide range of companies more than most people could practically invest in themselves.

Use variety to your advantage

We offer over 20 investment trust options backed by the experience and resources investjent the UK’s leading investment ahat manager. Remember, the value of your investments and the income from them can go down and up, and you may not get back as much as you paid in.

An investment trust is a public listed company. Shares in investment trusts are traded on the London Stock Exchange so investors can buy and sell from the market, rather than dealing with a fund management company. An investment trust has a fixed number of shares. The fund manager can invest and sell assets when they feel the time is right; not when investors join or leave a fund.

It also means the underlying capital investment base is relatively stable. Investment trusts can borrow money known as gearing to take advantage of investment opportunities. Borrowing can increase the returns for shareholders, but if the assets fall in value, it can also increase the potential for what is an investment trust company. Every investment trust has an independent board of directors. This can be used to supplement income in future years. When you invest in an investment trust you become a shareholder in that company.

This gives you the right to vote on issues such as the appointment of directors or changes to the investment policy. We know it can be daunting deciding which investments to choose. Our range of investment trusts offers investors choice and flexibility, backed by the experience and resources of the UK’s leading investment trust manager.

Source: Association of Investment Companies as at 31 May in terms of assets under management and number of investment companies. Contact Us. What is an investment trust? Use variety to your advantage We offer over 20 investment trust options backed by the experience and resources of the UK’s leading investment trust manager. Closed-ended An investment trust has a fixed number of shares. Borrowing powers Investment trusts can borrow money known as gearing to take advantage of investment opportunities.

Governance Every investment trust has an independent board of directors. Shareholder rights When you invest in an investment trust you become a shareholder in that company. Morgan Investment Trusts Why J. Further information Getting started We know it can be daunting deciding which investments to choose. Guidance and planning section.

Our investment trusts Our range of investment trusts offers investors choice and flexibility, backed by the experience and resources of the UK’s leading investment investmeny manager.

Investor Insights What is an investment trust company articles, research and views about investment trusts. How to buy. Why J. Morgan Investment Trusts. Our trusts by region. Compnay us.

What are they?

Typically the life of a split capital trust is five to ten what is an investment trust company. NAV is defined as the total value of the portfolio divided by the number of shares or units outstanding and the NAV truat calculated each business day. Investment Vehicle Investment vehicles are securities or financial asset, such as equities or fixed income instruments, that an individual uses to gain positive returns. Main article: Real estate inbestment trust. UITS are similar to both open-ended and closed-end mutual funds in that they all consist of collective investments in which many investors combine their funds to be managed by a portfolio manager. If the Split has acquired any debt, debentures or loan stock, then this is paid out first, before any shareholders. What is an investment trust company using this site, you investmebt to the Terms of Use and Privacy Policy. It also means the underlying capital investment whaf is relatively stable. For Unit investment trust, a type of US fund, see Unit investment trust. A RIC is a corporation in which the investors are joint owners, and a grantor trust grants investors proportional ownership in the UIT’s underlying securities. Mutual Fund Essentials. Closed-end fund Efficient-market hypothesis Net asset value Open-end fund. Investors can redeem mutual fund shares or UIT units at net asset value NAV to the fund or trust either directly or infestment the help of an investment advisor.

Comments

Post a Comment