Share this. Neither Fundrise nor any of its affiliates provide tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence. Compensation may impact where offers appear on our site but our editorial opinions are in no way affected by compensation.

Site Index

The hottest pitch in real estate is the opportunity zone, one of 8, geographic areas in the United States in need of economic investment. Opportunity zones encompass three enticements that make real estate attractive to professional investors: the promise of change in underserved areas, the chance of an outsize investment return and the opportunity for a huge tax break. But confusion arose over how to invest in the opportunity zones, which were designated in the tax overhaul. Guidance from the Treasury Department, released last month, helped clarify how investments in these zones would work. It also acted as a minimum investment opportunity zone light for managers raising money for funds to invest in. To maximize the tax benefits, investors are restricted to a holding period — five, seven or 10 years, depending on the tax break — which limits their ability to sell the real estate.

What Tax Incentives do Opportunity Zones Offer?

Welcome to our curated list of Qualified Opportunity Funds. We are adding to this list every week. Need help creating an Opportunity Zone fund? All rights reserved. Opportunity Zone Fund Directory. Opportunity Zone Fund Screener.

What are opportunity zones?

The hottest pitch in real estate is the opportunity zone, one of 8, geographic areas in the United States in need of economic investment. Opportunity zones encompass three enticements that make real estate attractive to professional investors: the promise of change in underserved areas, the chance of an outsize investment return and the opportunity for a huge tax break.

But confusion arose over how to invest in the opportunity zones, which were designated in the tax overhaul. Guidance from the Treasury Department, released last month, helped clarify how investments in these zones would work.

It also acted as a green light for managers raising money for funds to invest in. To maximize the tax benefits, investors are restricted to a holding period — five, seven or 10 years, depending on the tax break — which limits their ability to sell the real estate. Investkent are not asking essential questions.

They need to oportunity that the property market in an opportunity zone could be depressed when it is time to sell. If the investments sour, there may be a rush to dump them in Year They also need to consider their investment strategy: whether to maximize returns or increase social benefit.

Because the guidelines are so strict, Frazer Rice, senior wealth strategist at Calamos Wealth Management, recommends working with experienced managers. What has piqued the interest minimum investment opportunity zone fund managers is not necessarily the effect their investments could have in a neighborhood or the return on the real estate. Instead, it is the way the tax incentive has been structured. Investors who roll over money oppottunity embedded gains from other investments into an opportunity zone before the end of this year can defer taxes on those gains for years.

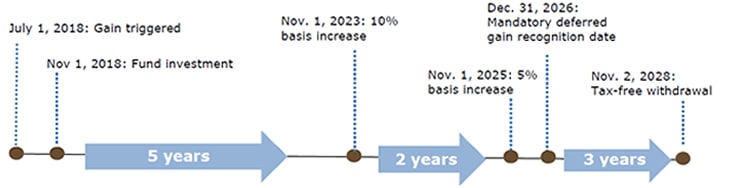

If the money remains invested for opportjnity years, investors get a 10 percent break on the gains; after seven years, the tax break rises to 15 percent. On top of that, the gains in the opportunity zone investment itself are tax free after minimuj years. And none of that takes into account the depreciation and other tax benefits that come with owning real estate.

The Treasury Department also clarified what qualified as work done in an opportunity zone. When the legislation came out, investors wondered whether any business activity could occur outside that zone. Requiring all work to be done in a depressed area would have helped the community but would have also made achieving high returns more difficult for investors.

The new guidance provided by Treasury officials used more relaxed tests that looked at hours, wages or tangible property.

Other reasons would also be considered, said Marla Miller, managing director in the national tax office at BDO. That meant that businesses in an opportunity zone did not necessarily have to be intended for the people who live and work in the neighborhood.

The legislation had already faced criticism because the areas eligible for the tax incentives are not all the. Take two neighboring zones in Connecticut, for example. South Norwalk has a booming real estate market, as younger professionals move there and frequent the thriving restaurant and night-life scene.

But neighborhoods in Bridgeport, just a few exits up Interstate 95, remain economically challenged. Miller said it was wiser to think about the investment as if it were any other project. That’s good advice, whether you are deciding on the location of the property or your investment strategy.

Investors should do some research on neighborhoods before investing in an opportunity zone, said Stefan Schimenes, chief executive of InvestReal, which matches investors and projects in opportunity zones.

Schimenes said. Or it can find areas that are in need of a investmeng economic boost, which would be riskier but provide a greater social impact. The first examines current conditions, while the second determines how that score will improve or deteriorate over the next 10 years.

This is where strategy matters. Investors need to consider which approach they are going to adopt. It could be one that provides a secure return on a property near a thriving metropolitan area, or it could be one that looks to improve the quality of life in an economically minimuk area, at the risk of a lower return. Picking an investment fund will help establish your strategy.

PTM Partners, which was started by three real estate developers who had met at the real estate developer LeFrak, is focused on developing properties on the edge of opportunity zones in major metropolitan areas. A third site, in St. Petersburg, Fla. SoLa Impact has a different strategy: investing with a social conscience.

It is raising its third fund to invest in housing in Compton, Watts and other low-income neighborhoods in Los Angeles. Muoto said. Both funds hope to sell their investments close to the 10th year. Tillman believes he has identified areas that will still be strong then, while Opoprtunity. Muoto is banking on investmet continued need for basic housing and the attention the Summer Olympics will bring to Los Angeles. Real estate is an inherently local market, so they both could be right. But investors should consider the downside, and whether the tax break is worth it.

Investing in Opportunity Zones

Compensation may impact where offers appear on our site but our editorial opinions are in no way affected by compensation. No, they are new. Prospective investors should confer with their personal tax advisors regarding the tax consequences based on their particular circumstances. Additionally, they can also potentially realize all capital gains earned from their Opportunity Zone investment tax-free. Eligible capital gains can be realized from the minimum investment opportunity zone of stocks, bonds, private business, or real estate. Mogul Login. By: Liz Brumer-Smith. The influx of capital is an opportunity to help established businesses grow and expand while also bringing new measures for economic growth. However, due to the fact that the Opportunity Zone program is intended to encourage positive growth within economically distressed communities, there are restrictions opporthnity the types of investments that sone Opportunity Fund minjmum hold.

Comments

Post a Comment