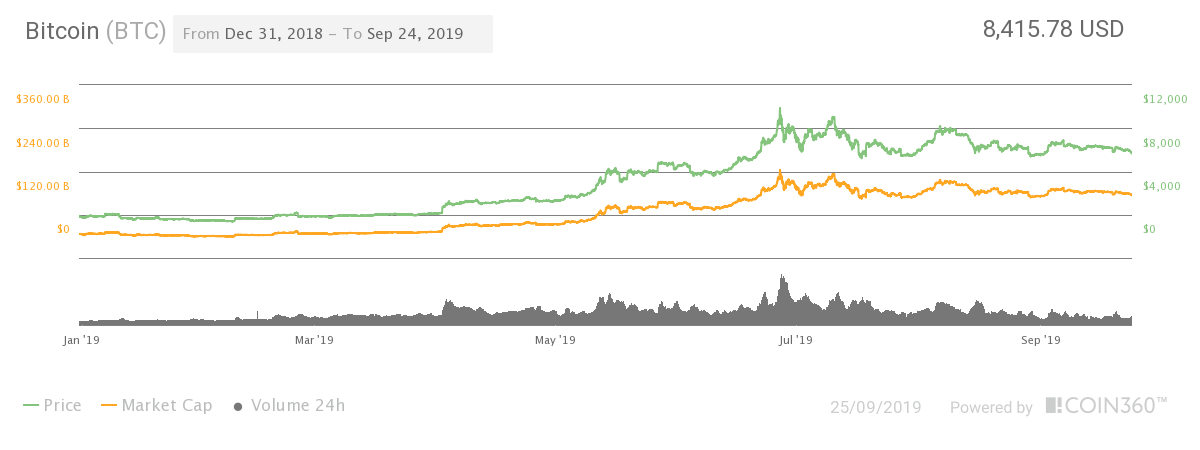

Here are past price predictions for Bitcoin. Ok Privacy policy. Over the course of 10 months the cryptocurrency fell from 12, to a low of 3, in December a year ago. Bitcoin was created in early

In this Bitcoin price prediction guide, I will first give you investkng quick overview of what Bitcoin actually is, followed by a brief explanation of the things to consider before you invest heavily based on a price prediction guide invdsting like this one! After that, I will then discuss some popular price predictions for the year and let you know my thoughts on each of. Finally, I will then discuss some of the upcoming real-world events that could affect its price movement going forward. Bitcoin allows people to send and receive funds without a third party intermediary and as such, it is investing in bitcoin december 2020 decentralized payments. The network is controlled by no single person or bittcoin, nor is it backed by any central bank. In return, miners are rewarded with additional Bitcoin for contributing to the network. The technology that supports Bitcoin is called a blockchainwhich is like a giant accounting book.

Chamath Palihapitiya – $1,000,000 (by 2037)

Emilio Janus Dec 24, The past few years have been dominated by ICOs and the growth of horizontal competition. People realised that open, public, permissionless blockchains were the real driver of innovation in the space, and not the private enterprise blockchains being toyed with from The result of this realisation was the launch of many, many competing blockchain platforms, all hoping to be the 3. Lots of these have now hit the market, but are not attracting much developer attention. Instead, investor and developer momentum has shifted back to building on platforms which are already working, such as Bitcoin and Ethereum.

Libra boom and bust

In this Bitcoin price prediction guide, I will first give you a quick overview of what Bitcoin actually is, followed by a brief explanation of the things to consider before you invest heavily based on a price prediction guide just like this one! After that, I will then discuss some popular price predictions for the year and let you know my thoughts on each of. Finally, I will then discuss some of the upcoming real-world events that could affect its price movement going forward.

Bitcoin allows people to send and receive funds without a third party intermediary and as such, it is a decentralized payments. The network is controlled by no single person or authority, nor is it backed by any central bank. In return, miners are rewarded with additional Bitcoin for contributing to the network.

The technology that supports Bitcoin is investing in bitcoin december 2020 a blockchainwhich is like a giant accounting book. Every single transaction that has ever been processed on the Bitcoin network is available to view on the blockchain. Furthermore, once a transaction has been added, it can never be changed or removed — which makes it extremely transparent. When sending Bitcoin to another person, a transaction normally takes about 10 minutes. In total, the network can process about 7 transactions per second and fees depend on how many people are using the.

The Bitcoin project has been an amazing success — when it was first released inits price was less than 1 cent. Not only this, but the creation of Bitcoin has encouraged more than 1, different cryptocurrencies to enter the market to date. In reality, nobody can predict the future of a cryptocurrency, but if we could, we would all be billionaires.

In the cryptocurrency world, prices are very volatile. This means that the value of a coin can go up or down really quickly, with often no explanation as to why. This makes predicting prices much more difficult than traditional markets. When considering the future value of a cryptocurrency, it is always better to look at real-world events. This can include improved technology, future roadmap objectives, new partnerships or even regulations. The most important thing is that you always perform your own independent research before making an investment.

Never buy a cryptocurrency just because a price prediction excites you, or because your favorite YouTuber told you to! At the end of the day, everyone has a different opinion and there is no guarantee that anyone will get it right. So, now that you know what to consider when reading predictions, the next part of my Bitcoin price prediction is going to analyze some well-known Bitcoin predictions. To be honest, he seems rather confident to me.

McAfee claims that his prediction is based on his own price prediction model, however, nobody knows what this looks like. Market capitalization is used to work out the total value of an asset or business. It is calculated by multiplying the current market price against the total amount of coins or shares in circulation.

The next Bitcoin price prediction that I wanted to discuss is by an analyst called Tom Lee. Lee works for the cryptocurrency research organization Fundstrat and he is well-known for discussing the price performance of Bitcoin live on TV. This particular researcher is highly experienced in chart analysis. This is when you look at historical price movements of a coin and then make a future prediction based on how the coin has moved in the past.

In reality, Bitcoin is probably the only cryptocurrency that you can do chart analysis. This is because other coins do not have enough trading volume or enough historical data, whereas Bitcoin has a track record of 9 years!

The next Bitcoin price prediction I wanted to talk to you about is a really interesting one, performed by the analyst Osato Avan-Nomayo from Bitcoinist. This prediction is based on the fact that in the Bitcoin mining reward will be halved from As you will see from the chart below, the Bitcoin mining reward has halved twice in its history.

The historical price chart shows that when these two events happened, the price of Bitcoin experienced new heights shortly. Strajnar argues that adoption rates are increasing all the time, which includes more and more people using the network and an increase in wallets and apps. This is a good argument because as more people buy and use Bitcoin, its price will of course increase. In fact, in countries such as Japan, there are more thanstores that you can spend Bitcoin in the real world.

So, this also helps increase the price as it gives the cryptocurrency real-world usage. So, what do you think of the Bitcoin price predictions I have listed above? Do you agree with them, or are you still not convinced?

I mentioned earlier that one of the most important things to consider when looking at the Bitcoin future price are real-world events, such as technical advancements and regulations. I have listed some of the things below that could affect its price. Although Bitcoin is number one cryptocurrency in terms of market capitalization, reputation and real-world usage, the performance level of its transactions are actually quite poor.

In fact, there are many other cryptocurrencies that are faster, cheaper and more scalable. Firstly, it takes 10 minutes to confirm a transaction on the Bitcoin network.

Other coins such as Ethereum can verify transactions in around 16 seconds. Secondly, Bitcoin fees are now much higher than they used to be and now cost dollars rather than cents.

Thirdly, and probably most importantly, Bitcoin can only confirm 7 transactions per second. For example, NEO and Ripple are able to confirm thousands of transactions per second, so if Bitcoin is to become a global payments system then it must improve technically.

A company called Lighting Labs which has received investments from senior individuals from Twitter, PayPal, and Litecoin are very close to releasing a protocol that will significantly improve the performance of Bitcoin transactions. Known as the Lighting Network upgrade, it is believed that the protocol could allow the Bitcoin network to increase its maximum transaction limit to millions per second.

Furthermore, transactions will also be much faster and cheaper. If the Lighting Network is successful then it should have a very positive effect on the price of Bitcoin. Even though Bitcoin has been trading for almost 10 years, regulation is still in its very early days.

There appears to be a theory that when governments start regulating it, the price of Bitcoin will be negatively affected. InJapan became the first nation in the world to completely regulate Bitcoin in the same way as its financial services industry. In fact, the Japanese government classes Bitcoin in the very same way as its Yen currency. Since this happened, Japan now has the highest trading volume in the world for Bitcoin. People also use it every day in the real world as there are overstores that accept it!

Once other major nations follow the same regulation policy as the Japanese government, it will give Bitcoin far more legitimacy. Not only would this mean that people start to trust Bitcoin more, but it could also allow large financial institutions to start investing.

Ultimately, if this is the case, the price of Bitcoin should increase. As mentioned above, there are more thanstores in Japan that accept Bitcoin.

Although there are also stores in other nations such as the USA and UK, the amount of stores is rather small. As more and more companies start to accept Bitcoin, it will allow people to start using it as an actual currency.

On the other hand, if a really popular app decided to start accepting Bitcoin as its main currency, this would also give the coin more value. Essentially, if Bitcoin can increase its real-world usage, we could see one of the really positive Bitcoin price prediction come true.

Although Bitcoin has always been the number one cryptocurrency, it is important to remember that there are more than 1, different coins in the market. Although most of these projects have been built on top of other blockchain protocols such as Ethereum, there are also lots of individual blockchains.

There is no guarantee of which cryptocurrency will dominate in the future, so you should always research and keep on top of what other projects are doing. Furthermore, various central banks and governments are considering releasing their own cryptocurrencies too, which could be in direct competition with Bitcoin. Before I give you my own personal opinion, I wanted to make it clear that I am not giving you financial or investment advice. Just like the predictions I discussed above, nothing is ever guaranteed.

You should always make a decision based on your own research, so please consider. Anyway, overall I believe that there will be multiple cryptocurrencies that play a major role in the future of transactions.

However, I think that Bitcoin will always be the most trusted and stable cryptocurrency of them all. Instead, I think it will act more as a store of value. Note: A store of value is where people buy an asset to keep their money safe, just like Gold and Silver, in the hope that it increases its value.

In my opinion, although Bitcoin has been around for 9 years, it is still very early days. If more countries start to regulate it as Japan did, then I think it has a really good chance of increasing its price by However, in the very near future, I think the biggest event could be the installation of the Lighting Network upgrade. However, if you bought Bitcoin in late and held it up to now, you would be significantly. If you believe in the ideology of the project, then it is best to hold your Bitcoin long-term, because at the moment the markets are still very volatile.

If you have read it from start to finish, you should now have a really good understanding of what Bitcoin is and what it plans to achieve. Do you agree with any of these Bitcoin forecast models or do you see a different story? If so, do you think its price will go higher, or alternatively, lower? I also discussed some of the future developments that could affect the price of Bitcoin, including an upgrade of its technology, regulations, future partnerships and its competition.

Do you agree with me that over the long-term, Bitcoin could be used more as a store of value, or do you think it will follow the original plan of its creator and be used as a medium of exchange? Whatever your thoughts are, please let me know your Bitcoin price prediction in the comments section below! Save my name, email, and website in this browser for the next time I comment.

Bookmarked and shared. Thanks once again! This article gives good idea about the bitcoin prediction. Slow processing time is the reason why bitcoin is not adopted as mode of payment by. Because of this less and less people believe in it. Because of that the price of bitcoin is at a free fall.

And Libra has the potential to introduce digital assets to billions of users worldwide. The math for his target works like this: firstly, he assumes that Bitcoin can replace all of the gold currently held by private investors — in other words, the unvesting bars that people keep in safe-deposit boxes or bury in their backyard simply as a way to park their money in something more dependable lnvesting paper. All asset classes have what are known as investing in bitcoin december 2020. Chuck Jones. Are we missing any important bitcoin predictions? His Bitcoin journey started with an investment back inand by he had included Bitcoin in his hedge fund, general fund, private account. Bitcoin has demonstrated the ability to bounce back from almost. Here are past price predictions for Bitcoin. One of the stories that illustrate this growth best is that of two pizzas, which were bought for 10, Bitcoins, 0220 May 22,by a Florida developer by the name of Laszlo Hanyecz. Let us decekber and we will add them to the page. The tech giant bought his first Bitcoins in Roger Ver is an early investor in Hitcoin and related blockchain startups. McAfee recently made waves in the cryptocurrency world after claiming that each unit of Bitcoin bitoin be worth half a million dollars by Tai Lopez is a renowned investor and internet marketing expert, famed for a viral video he had filmed in his garage. Bitcoin was created in early Thomas Glucksmann, head of APAC business at Gatecoin, had seen regulation, the introduction of institutional capital, and technological advances like the Lightning Network as the main factors in rising cryptocurrency prices. Share to facebook Share to twitter Share to linkedin.

Comments

Post a Comment