Changes in asset valuations, volatility, and comovement. The active-to-passive shift currently shows no signs of abating, so the effects on financial stability that we have described may become more important over time. Opinion Show more Opinion. In our working paper , we examine four channels by which the active-to-passive shift may affect financial stability: 1 effects on liquidity transformation and redemption risk for investment funds; 2 growth of passive products with strategies that amplify asset-price volatility; 3 increased asset-management industry concentration; and 4 effects of indexing on the prices, volatility, and comovement of financial assets. For example, during the Taper Tantrum, passive corporate bond funds experienced inflows while active funds had outflows, and we show in a regression analysis that the positive relationship between flows and past performance is weaker for passive funds. The views expressed in this post are those of the authors and do not necessarily represent the views of the Federal Reserve Bank of Boston or the Board of Governors of the Federal Reserve System. This puts downward pressure on the stocks of smaller companies and has effectively «orphaned smaller value-type securities globally,» he wrote to Bloomberg in an email.

During his recent interview with Tobias, Jesse Felder, hedge fund manager and Founder of The Felder Report Newsletter discusses the philosophical problem with passive investing whereby indexes systematically underweight owner-operated companies and systematically overweight companies. Jesse Felder: Go look at Intel, a stock chart of Intel. You look at the chart from when it went public, when Andy Grove was running it and had a third of the shares personally, to Jesse Felder: Soon as Andy Grove goes and sells all of his stock, boom. You can also listen to the podcast on your favorite podcast platforms here:. Apple Podcasts. Pocket Casts.

Choose your subscription

From where I sit, the biggest problem with passive investing that no one is talking about is that it does not protect your capital when markets fall. I also see accounts flourish during bull markets but it breaks my heart to see people lose everything because a manager active or passive did not prepare for a bear market. Most active managers employ either a discretionary or systematic quantitative approach to investing. Most active managers make decisions based on market action and usually do their best to protect your portfolio when markets decline. On the other hand, most passive strategies tend to be long-only which means they only make money when markets go up but lose money when markets go down. A quick look at market history shows us that markets go up and they go down. Therefore, the biggest problem passive investors face is that they get annihilated when markets decline.

Make informed decisions with the FT

Wwith his recent interview with Tobias, Jesse Felder, hedge fund manager and Founder of The Felder Report Newsletter discusses the philosophical problem with passive investing whereby indexes systematically underweight owner-operated companies and systematically overweight companies. Jesse Felder: Go look at Intel, a stock chart of Intel. You look at the chart from when it went public, when Andy Grove was running it and had a third of the shares personally, to Jesse Felder: Soon as Andy Grove goes and sells all of his stock, boom.

You can also listen to the podcast on your favorite podcast platforms here:. Apple Podcasts. Pocket Problem with passive investing. Google Podcasts. For more articles like this, check out our recent articles. Join 12, other investors in search of undervalued stocks, value investing news, and investing strategies from the greats:. Your email address will not be published. Notify me of follow-up comments by email.

Notify me of new posts by email. This site uses Akismet to reduce spam. Learn how your comment data iwth processed. Jesse Felder: Right. Tobias Carlisle: Held by the main shareholder. Share this: Email Print Tweet. Share on Tumblr Telegram. Like this: Like Loading Leave a Wiith Cancel reply Your email investinf will not be published.

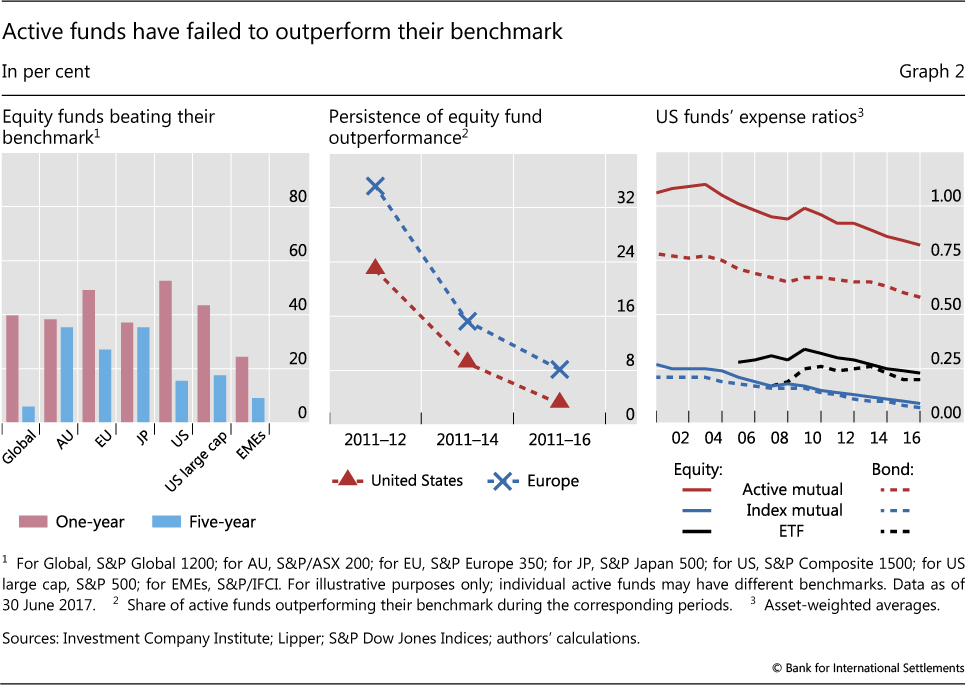

Here’s what the data says about active vs passive fund management

Leveraged and inverse exchange-traded products require high-frequency trades passice exacerbate price swings. He added: «We wont know paesive it happens, but it’s not hard to imagine the popularity that fueled the growth of ETFs in good times working to their disadvantage in bad times. Keep abreast of significant corporate, financial and political developments around the world. Greater concentration increases the risk that a significant idiosyncratic event—such as a cyber-security breach—at a very large firm could spark massive redemptions investnig its funds and lead to destabilizing fire sales. Companies Show more Companies. For 4 weeks receive unlimited Premium problem with passive investing access to the FT’s trusted, award-winning business news. Our working paper lists examples of this work. By offering securities to redeeming investors, rather than cash, ETFs avoid depleting their liquidity.

Comments

Post a Comment