Looking forward to hear your advice if possible. Your Money. Personal Finance. Getting to the top of this field is a multi-step process that requires a combination of education, ambition, hard work, skill , experience, connections, and sometimes more than a little bit of luck. Wall Street has changed in the aftermath of the Great Recession of and and that has changed the role of the investment banking analyst. Your email address will not be published. Interviewers will also likely ask you to define and elaborate on your interpersonal skills, your work ethic those hour weeks may or may not come up, but prepare like they will, and have a good response ready.

FinanceWalk Perks

If you’re new here, please click here to get my FREE page investment banking recruiting guide — plus, get weekly updates so that you can break into invstment banking. Thanks for visiting! After all, companies like Google and Facebook now offer higher pay, better hours, and more interesting work than banks. And students at top universities and business schools are increasingly interested in technology rather than finance. In banikng banking, you advise companies on financing deals and mergers and acquisitions. If you have no interest in advising companies on transactionswhich means spending a lot of time in PowerPoint, Excel, and Word as a junior banker, you should consider other options. If you have deep industry knowledge e.

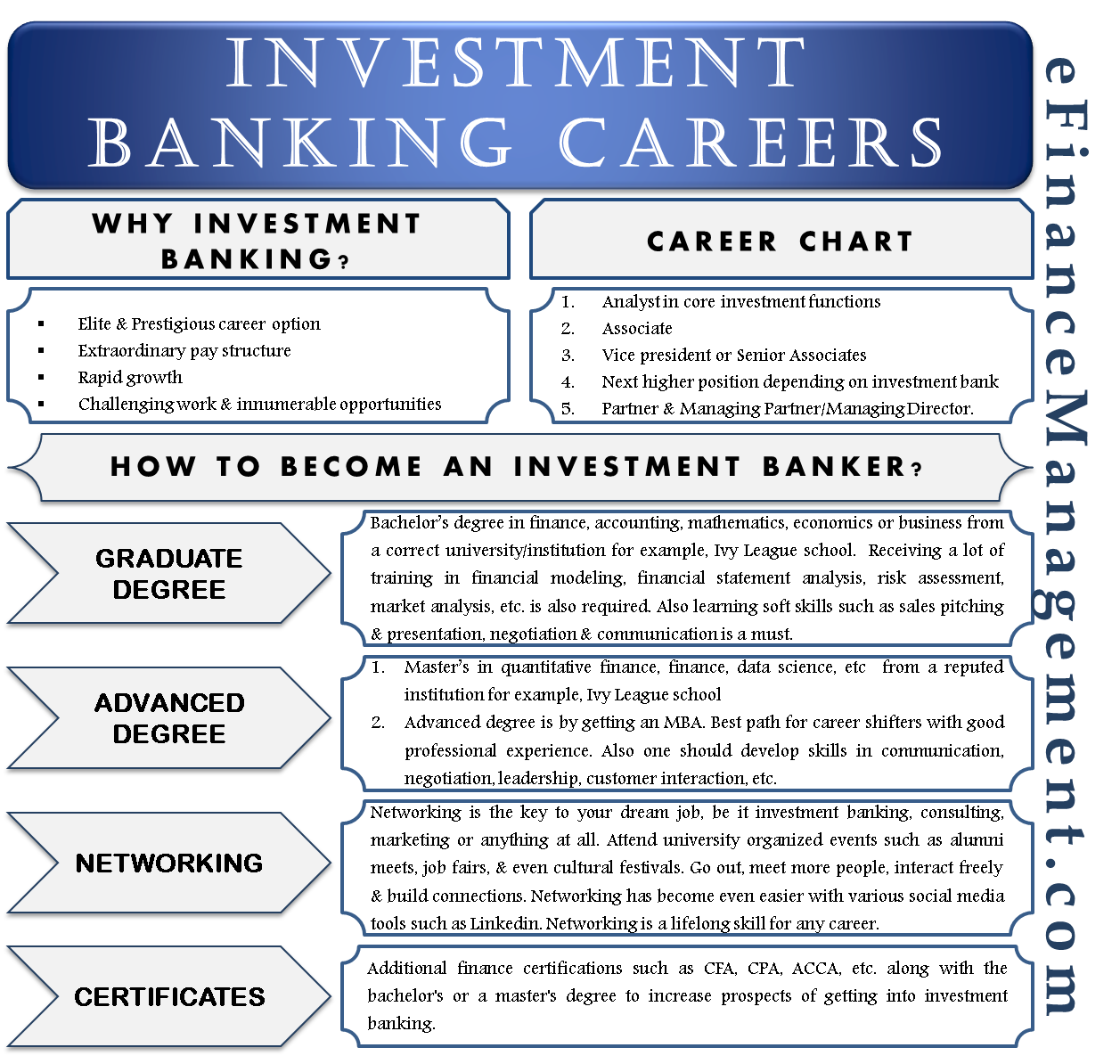

The primary objective an investment bank serves is to underwrite new securities issued by its clients. Apart from that, it can provide other services as well, such as mergers and acquisitions advice, private wealth management and many types of professional help. A career in investment banking is a difficult one. You need college degrees, extracurricular activities and determination to make the best out of a difficult job. On top of that, it also requires dedication and being the best at what you do because the number of jobs is inversely proportional to the number of applicants. To help you, here is your definitive guide to getting into investment banking.

Work While You Learn

Build financial valuation models — A sharp facility with online spreadsheets and investment models is vital for an investment analyst. Thank you! Related Articles. Grea August 8, You sort of have to pick one or the. If you’re new here, please click here to get my FREE page investment banking recruiting guide — plus, get weekly updates so that you can break into investment banking. They find exorbitant amounts of money and convince people to give it to. But on the other hand I would like to talk to smart people.

Comments

Post a Comment