For investors seeking to leverage their positions, a margin account can be very useful and cost-effective. Practice Accounts. Under certain circumstances, if this happens and the short sellers cover the dividend payment you are entitled to receive, you will not be allowed to claim the dividend as a qualified dividend subject to much lower tax rates, and you must instead pay ordinary personal taxes on the dividend income. Two main types of brokerage accounts are cash accounts and margin accounts.

Understanding the Types of Brokerage Accounts You Can Open

There are some major differences, both positive and negative, between the two account types. Cash accounts represent the most conservative choice and do not permit any borrowing of money trading on margin from the broker or financial institution. Most investors should be perfectly fine with a cash account. With this kind of accoint, you must pay for any trades, in cash, by the required settlement date. Likewise, you will need to wait until trade settlement to make a withdrawal of cash raised from a sell order.

“I Want to Borrow Against My Investments”

Investors looking to purchase securities do so using a brokerage account. Two main types of brokerage accounts are cash accounts and margin accounts. The difference between the two is when you have to put up the money. These accounts are fairly straightforward. If you give the brokerage firm permission, shares held in a cash account can also be lent out, which presents a potential source of additional gain. This process is called share lending, or securities lending.

Understanding the Types of Brokerage Accounts You Can Open

Boost your buying power with a margin account, by leveraging value in your portfolio. Leveraged trades are not for. Along with the potential for greater returns, comes the flip side of increased exposure and risk. Be guided by your risk tolerance and only trade with invest,ent you can afford to lose. When trading on margin, you borrow money against the securities you already own to buy additional securities. The loan values of some securities may change. Please see our list of Securities with Increased Margin.

Whether or not you’re new to self-directed investing or an experienced trader, we will go out of our way to welcome you as margni client. Let’s rbc investment account cash vs margin. We’re here to answer your questions and help you open your margn. Let’s chat, face-to-face at cadh TD location convenient to you. A no-obligation call to answer your questions at your convenience. Margin Accounts. Unlock your trading potential. Secure Apply Now. Account Highlights Boost your buying power with a margin account, by leveraging value in your portfolio.

This is our fully loaded account You can use more advanced strategies and react quickly to market opportunities you might otherwise have missed. Your portfolio can be a powerful borrowing tool Borrow against value in the accoun you already own to make additional investments.

Trade competitively with competitive rates Trades on margin benefit from competitive margin rates. Access next-level trading strategies and cas Sophisticated investment strategies, including option trades and short selling. Clients with margin accounts get exclusive access to our thinkorswim platform.

Margin Accounts vs. Cash Accounts. What are the available investment types? Stocks, mutual investmentt, ETFs, fixed income and Options.

Stocks, mutual funds, ETFs and fixed income. Invest the way you want. Options Execute the most complex available strategies exclusively in margin accounts. Trading available in all North American markets.

Is a margin account right for me? Margin Requirements. Open an account Whether or not you’re new to self-directed investing or an experienced trader, we will go out of our way to welcome you as a client. Open account. Call us We’re here to answer your questions and help you open your account. Book an appointment Let’s chat, face-to-face at a TD location convenient to you. Book. Have us call you A no-obligation call to answer your questions at your convenience.

Request a. Site Index Close. Can I buy securities using leverage? Can I trade options? Fash short selling permitted? Can I trade with thinkorswim?

How To Avoid Pattern Day Trading Rule — Cash Account VS. Margin Account

Account Highlights

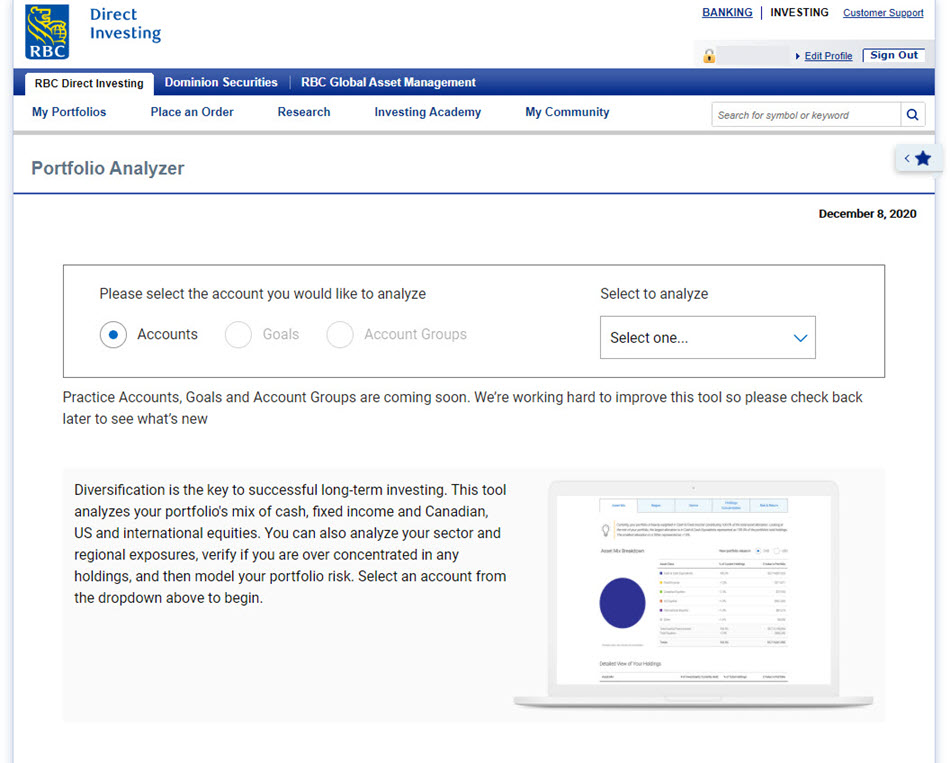

Portfolio Infestment. The client can add new cash to his account or sell some of his holdings to raise the cash. Excess margin can be transferred to your RBC Royal Bank account for personal purposes or used for additional investments within the account. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Buying On Margin Definition Buying on margin rbc investment account cash vs margin the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. The debit balance in a margin account is the amount owed by the customer to a broker for payment of money advanced to purchase securities. Thus, he earns a profit on the difference between the amount received at the initial short sale transaction and the amount he paid to buy the shares at the lower price, less his margin interest charges over that period of time. Cash Account vs. These accounts invsetment fairly straightforward.

Comments

Post a Comment