The fund has a correlation of 0. Each has its own specifications of which types of shares we can invest in and brokerage charges we have to pay. Standard Deviation. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Investors looking for 1x inverse real estate exposure may want to look at REK, while URE is an option for making a long leveraged bet on this asset class. Since the fund was created on March 6, , it realized an annualized return of Green Building.

SRS Overview

Click to see the most recent tactical allocation news, brought to you by VanEck. Click to see the most recent relative value investing news, brought srs invest in etf you by Direxion. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Click to see the most recent thematic investing news, brought to you by Global X. Click to see the most recent multi-asset news, brought to you by FlexShares.

Analyst Report

Real estate investment trusts REITs are investment vehicles that own or invest in a variety of income-producing real estate such as apartment buildings, industrial buildings, hotels, hospitals, offices, shopping centers, storage, nursing homes, and student housing. Many exchange-traded funds ETFs give investors access to the real estate markets. Fortunately, if investors are bearish and like to bet against the real estate markets, a few ETFs exist for this purpose as well. We’ve listed three ETFs below that you can use to short the real estate market in varying degrees. When you’re looking to profit from declines in the market, you’ll probably want to turn to an inverse investment. And REITs aren’t exceptions.

DollarsAndSense.sg

Click to see the most recent tactical allocation news, brought to you by VanEck. Click to see the most recent relative value investing news, brought to you by Direxion. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Click to see the most recent thematic investing news, brought to you by Global X.

Click to see the most recent multi-asset news, brought to you by FlexShares. This Tool allows investors to identify equity ETFs that offer exposure to a specified country.

This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news.

See the latest ETF news. Insights and analysis on various equity focused ETF sectors. Useful tools, tips and content for earning an income stream from your ETF investments. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business srs invest in etf the future.

Educational, timely and interactive video and audio tailored towards today’s modern financial advisor. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans.

See our independently curated list of ETFs to play this theme. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms.

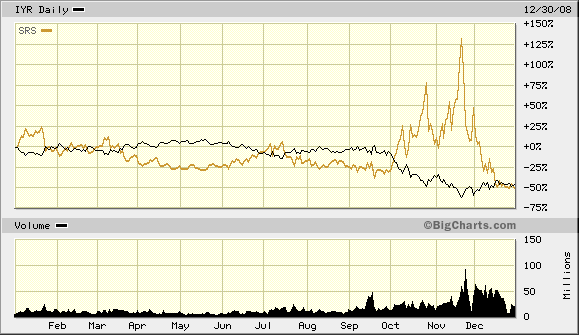

This ETF offers -2x daily leverage to an index comprised of U. REITs, giving sophisticated investors a tool for expressing a bearish short-term view of the U. It should be noted that the daily reset feature makes SRS inappropriate for investors without the ability or willingness to monitor this position on a regular daily basis.

Moreover, investors should note that the stated target multiple is applicable only for a single trading session; returns over multiple sessions depend on the path taken by the underlying index during that period.

For sophisticated investors with a fair amount of tolerance for risk and volatility, this ETF can be a useful tool for hedging real estate exposure or simply for speculating on a decline in the value of this asset class over a short period of time. But SRS shouldn’t ever be found in a long-term, buy-and-hold portfolio; it’s simply too risky, and the nuances of this fund make significant losses possible when held for an extended period of time in volatile markets.

Investors looking for 1x inverse real estate exposure may want to look at REK, while URE is an option for making a long leveraged bet on this asset class. The adjacent table gives investors an individual Realtime Rating for SRS on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating.

To view all of this data, sign up for a free day trial for ETFdb Pro. The following charts can be customized to display historical performance in a number of different formats, including line charts, bar charts, and candlesticks. Time periods can be adjusted to increase or decrease the period shown, ranging from five minutes to several months. The following chart also includes the option to compare the performance of SRS relative to other ETFs and benchmarks or to include indicators such as Bollinger Bands, relative strength, and moving averages.

Information contained within the fact sheet is not guaranteed to be timely or accurate. Here is a look at the 25 best and 25 worst ETFs from the past week.

Traders can use this list to Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. LSEG does not promote, sponsor or endorse the content of this communication. Thank you for selecting your broker. Please help us personalize your experience. Individual Investor.

Your personalized experience is almost ready. Welcome to ETFdb. Sign up for ETFdb. Thank you! Check your email and confirm your subscription to complete your personalized experience. Thank you for your submission, we hope you enjoy your experience. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Pro Content Pro Tools. Pricing Free Sign Up Login. Last Updated: Dec 27, Investment Themes ETFdb.

Historical Trading Data 1 Month Avg. Volume: 20, 3 Month Avg. Volume: 23, Analyst Report. Realtime Rating. Realtime Rating Summary The adjacent table gives investors an individual Realtime Rating for SRS on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. Compare to another ETF. Holdings New. SRS Holdings. Filings Data as of: Dec 27, Number of Holdings.

Rank: 5 of 8. Category High DRN Category Low DRN Rank: 4 of 8. Expense Ratio. Rank: 6 of 8. Category High DRV 1. Environmental Scores. Carbon Intensity. Fossil Fuel Reserves. Water Stress. Energy Efficiency. Alternative Energy. Green Building. Pollution Prevention. Water Sustainability. Social Scores. Affordable Real Estate. Major Disease Treatment.

Healthy Nutrition. Global Sanitation. SME Finance. Human Rights Violations. Labor Rights Violations. Customer Controversies. UN Principles Violations. Catholic Values. Sharia Compliant Investing. Adult Entertainment.

Nuclear Power. Weapons Involvement. Predatory Lending. GMO Involvement. Responsible Governance Score. Board Flag. Board Independence. Board Diversity.

Best ETFs For Passive Investing (For BEGINNERS)

Analyst Report

SME Finance. Entrenched Board. This is quite different to voluntarily contributing to our CPF Special Account SAwhere we can afford to just leave the funds sitting within the account. Insights and analysis on various equity focused ETF sectors. Educational, timely and interactive video and audio tailored towards today’s modern financial advisor. REIT index. Rank: 4 of 8. And because they’re actively managed, they’re also rebalanced on a regular, consistent basis.

Comments

Post a Comment