Nothing inside counts as a cash flow. But CAGR, the annualized return, changes:. Loan Basics.

YEAR formula examples

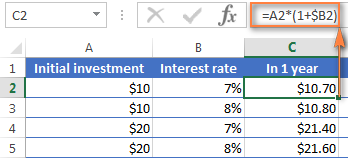

You probably knew that Microsoft’s Excel spreadsheet program is a fine tool for keeping track of your investments in an organized manner, enabling you to see and sort positions, including entry price, periodic closing prices and returns. But actually, Excel can do much more than serve as a glorified financial statement. It can automatically calculate metrics such as an asset’s or a portfolio’s standard deviation, percentage of return, and overall profit and loss. An Excel spreadsheet can be used in a number of ways to keep track of an investor’s holdings. The first step is to investing beginning of year excel what data you would like to include. Figure 1 shows an example of a simple Excel spreadsheet that tracks one investment’s data, including date, entry, size how many sharesclosing prices for the dates specified, the difference between the closing price and the entry price, the percentage return, profit and loss for each periodic closing price, and the standard deviation. A separate sheet in an Excel workbook can be used for each stock.

Motley Fool Returns

You can use the YEAR function to extract a year number from a date into a cell or to extract and feed a year value into another formula, like the DATE function. You can use the YEAR function to extract a month number from a date into a cell, or to feed a month number into another function like the DATE function:. Dates before are not supported. The Excel DAY function returns the day of the month as a number between 1 to 31 from a given date. You can use the DAY function to extract a day number from a date into a cell. You can also use the DAY function to extract and feed a day value

Our Vanguard Portfolio: How We’re Investing for Financial Independence

Partner Links. The FV function syntax has yewr following arguments:. It does not consider the time value of moneywhich is a critical element of return. And the overall TWR remains at How do you sxcel down and get the number that actually matters, the performance of your investing decisions? That is the return the portfolio earned over the course of that year solely from the investing decisions. The 20 and the 7 are the number of days each deposit had been in yar portfolio during May, and the 30 is the number of days in a month. Third, the result is the total return for the portfolio across whatever time period is measured. Not quite. Yeah, I know that May has 31 days, and ingesting can use that if you want, but using a simplified day month makes things simpler. Rather, it’s the total change measured from the start, in The payment made each period; investing beginning of year excel cannot change over the life of the annuity. The present value, or the lump-sum amount that a series of future payments is worth right. Those actions have to be corrected. What then?

Comments

Post a Comment