Anyone promising a reliable and higher investment return is taking big risks. Liquidity: You can buy or sell your fund shares every business day. If you try to sell your bond before maturity, you may experience a capital loss. Risk: Treasury securities are considered virtually risk-free because they are backed by the full faith and credit of the U. Liquidity: Growth stocks — like many stocks trading on a major U. How to use the safety of CDs to boost returns on your portfolio. However, they do carry reinvestment risk — the risk that when interest rates fall, investors will earn less when they reinvest principal and interest in new CDs with lower rates.

Reasonable Return Expectations Can Help Avoid Too Much Risk

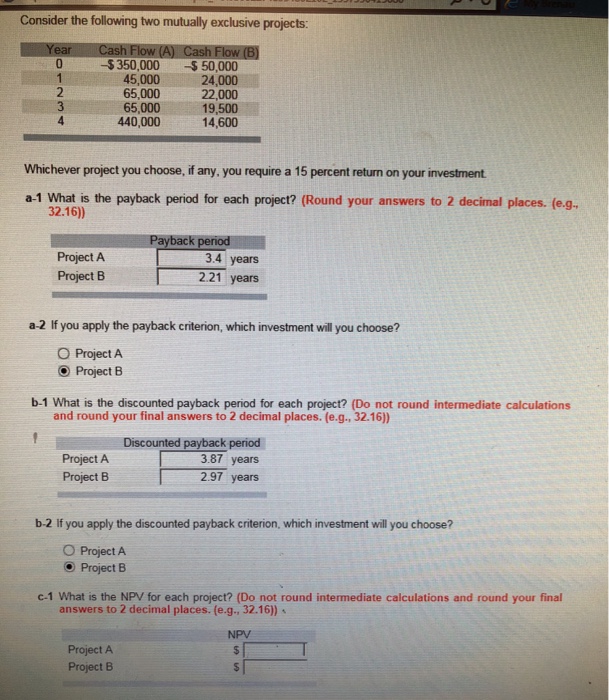

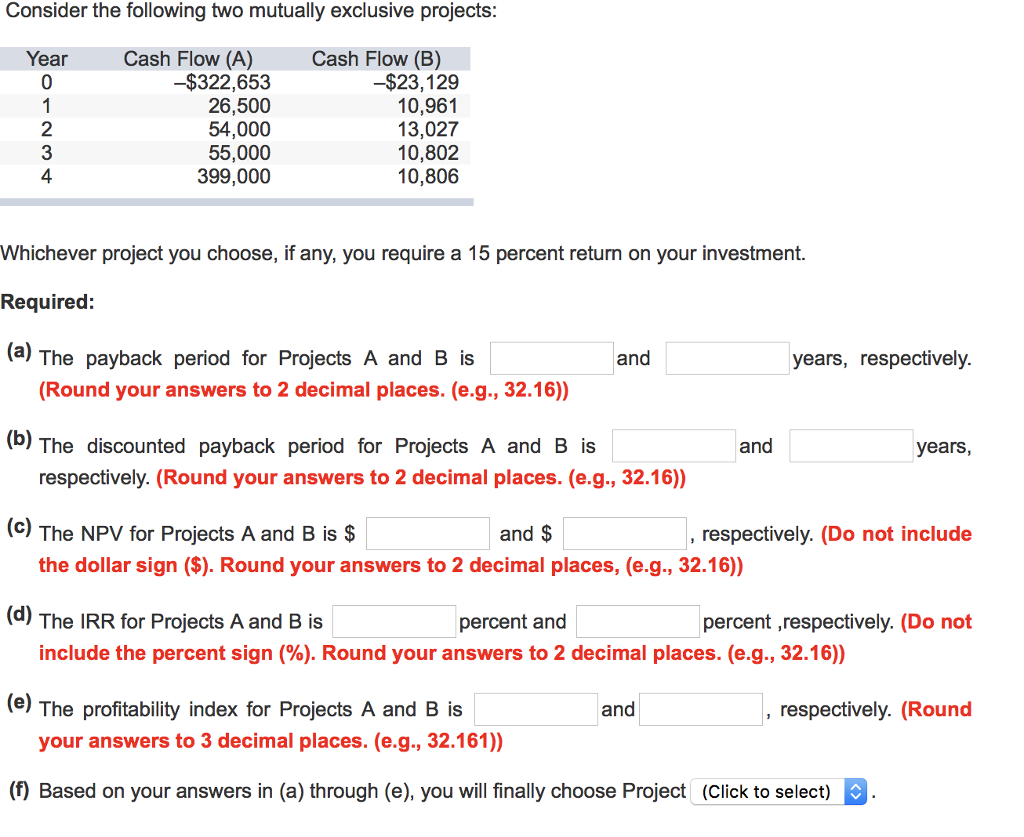

Every percentage increase in profit each year means huge increases in your ultimate wealth over time. Another example is illustrated in the chart. The first thing we need to do is strip out inflation. The reality is, investors are interested in increasing their purchasing power. When we do that and look through the data, we see the rate of return varies by asset types :. Instead, it is merely a store of value that maintains its purchasing power.

Here are the best investments in 2019:

Bill Bernanke thinks the total real return on this investment will be only 7 percent. What does Bill believe the inflation rate will be over the next year? Why didn’t Bill ask his big brother Ben for the answer, since Ben is still running the show. Here is an Example: An investment offers a total return of 14 percent over the coming year. Bill Bernanke thinks the total real return on this investment will be only 8.

Warren Buffett Explains How To Make A 50% Return Per Year

If the interest rate of the security is not as high as inflation, investors lose purchasing power. Another example is illustrated in the chart. That Why does this matter? Prices tend to rise over time. Also, the lack of liquidity might be a problem if you ever needed to access cash quickly. Rental housing can be a great investment if you have the willingness to manage your own properties. Liquidity: Quarterly payouts, especially if the dividends are paid in cash, are relatively liquid. With a CD, the financial institution pays you interest at regular intervals. Investment-grade short-term bond funds often reward investors with higher returns than government and municipal bond funds. How to pick the best plan. However, like other mutual funds, the fund itself is not government-backed and is subject to risks like interest rate fluctuations and inflation. Past performance is not indicative of future results. You’ll double your money in years. As with other dividend stocks, look for REITs that have a history of steadily raising their dividend over time, rather than selecting the REIT that has the highest current yield.

Comments

Post a Comment