Nosferatu says:. These more unpredictable and speculative stocks come with a great deal of noise and drama, with the world coming to an end one month, and then rising towards the heavens the next as featured in the story of oil this past month. Update 2H Prosper sent a message to investors saying they overstated returns over the past several quarters. Sam… Thanks for your review of P2P investing with Prosper. February 17, at am.

Quick Facts

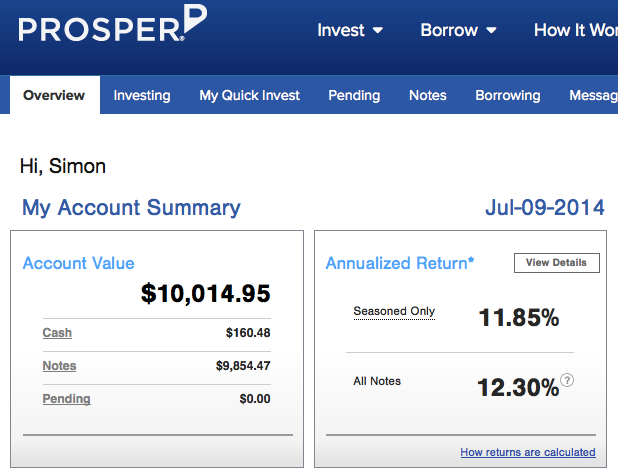

Sign up for Prosper. Lending Club vs Prosper. Back lnvesting Peer to Peer Lending Markets. I have something incredible to show you that you’re not going to see on any bank account statement. Here it is:.

The Impact of Changes to Peer-to-Peer Lending

New here? You may want updates via email or RSS feed. Thanks for visiting! Note: I’ve received many questions about Prosper, but I’ve never used it. Here’s a post from Frykitty , the very very quiet second author at Get Rich Slowly.

Prosper versus Lending Club: Borrowers

Sign up for Prosper. Lending Club vs Prosper. Back to Peer to Peer Lending Markets. I have something incredible to show you that you’re not going to see on any bank account statement.

Here it is:. This is a screen capture showing my returns from my peer to peer P2P lending account over at Prosper. I was introduced to P2P lending about a decade ago by a friend who works in financial technology. I was intrigued, so I signed up for an account.

I’m happy to report that I’m still investing money with Prosper today, almost a decade later. The P2P lending industry is growing at a brisk paceso it won’t be long before the average Joe is going to Prosper for a loan instead of the stodgy brick and mortar bank on the city prosper investing performance.

The best way prrosper describe peer lending is with an example. Allow me to introduce you to Borrower Bob and Lender Lisa. Bob qualifies! Bob learns that he can get a loan from Prosper for as low as 5. Bob will have 3 years to pay it off, but he orosper have also chosen a term of 5 years. Bob applies for a Prosper loan and qualifies at an interest rate of 6.

He pays off the credit cards and looks forward to becoming debt free in 3 years. She opens an account on Prosper where she can lend money to folks and earn a much better rate. She views detailed information about Bob including his credit score, profession, income and state of residence.

Other lenders also decide to help Bob. Prosper is a platform that connects borrowers and lenders in a fast, efficient manner.

No bank required. Getting started as a Prosper investor is easy. First, open an account and fund it with a transfer from your bank account. The fun starts when you begin picking notes. You have loads of data to filter with:. Just some of the loan criteria you may choose to filter. Once you’ve chosen a note, decide how much money you’re going to fund it with and place the order:.

Funding a note. The issue with what I’ve shown you so far is that finding loans is time consuming. Prosper psrformance a solution for this too and it’s called Automated Quick Invest. With this feature, you can automate your investments. Simply provide filter criteria and Prosper will do the work for you:.

One of my automated investments. Now that you understand the basics, let’s review some best practices. Prosper can be a great addition to a balanced portfolio, but there are some important points to keep in ihvesting. The most important lesson is to diversify. Prosper mentions that sinceevery investor with or more notes has had positive proaper.

The power of diversification! When I first started investing in Prosper, my strategy was to avoid defaults at prlsper cost. As a result, I only invested in higher grade A and B notes. I still remember how angry I was when my first note defaulted. Looking back, my safe strategy was misguided. Once you start studying P2P lending, you’ll find that the riskier notes generally have a higher rate of return.

The strategy of the savviest and most successful investors usually revolves around investing in lower grade notes. Chart from Prosper. P2P lending is a vast topic, but the good news is that there is no shortage of great information. Similar to any investment, I encourage you to educate. A great place to start is over at the Investors Section of Lend Academy. When I first started with Prosper, I thought it was great fun to manually pick my notes. As time went on, this exercise became time consuming and laborious.

I highly suggest that once you become familiar with Prosper, you use the Automated Quick Invest feature or a 3rd party tool like nsrinvest to do the work for you. The 3rd party investment tools offer sophisticated features that aren’t available on Prosper’s own platform, but they’re not free. I encourage you to do your research to determine if P2P lending with Prosper fits your investment goals.

In my own portfolio, I put money into Perfogmance that otherwise would have lost money to inflation in a bank account. As I get closer to retirement, I look forward to investing more money in Prosper to generate cash flow.

You can try Prosper out for yourself by signing up for an account. Like any investment, Prosper is not without risk. However, the service is almost a decade old, is regulated by the U. Securities and Exchange Commission and its model is being emulated by the big boys like Goldman Sachs.

P2P lending has a bright future and I’m thrilled to be a part of it. Prosper lends your cash to prime-rated borrowers, meaning people with good credit history who are likely to pay back their debts. For instance, the average credit score of borrowers at Prosper is This makes them remarkably stable compared to many traditional investments. When investors consider Prosper as an investment they need to remember that there have really been two iterations of the company.

Prosper 1. Prosper 2. Even though Lending Club attracts double the amount of loan applications, Prosper is still a formable alternative. It appears even with the new underwriting process, Prosper loans are slightly risker than Lending Club. It means you must be more selective in the loans you choose. I suspect their credit review process is slightly different; I also see possible investment strategies in which Prosper could yield better returns.

There are three guiding principles to my P2P lending philosophy. I understand everybody runs into hardships and needs money. Is Prosper legit? In one word — YES! Prosper has been around for ten years. In the world of the Internet that is an eternity.

As we cover the reviews of Prosper for borrowers and lenders you will see that this is a well maintained and viable way to invest and borrow money.

Prosper is subject to state and federal regulations, just like any loan producing organization is. To put an even more legitimate light on the company, all loans that are originated through Prosper.

There is a liquid secondary market for Prosper loans. You can sell your performwnce on Folio Investing any prossper you like. Keep in mind that depending on market conditions you may get more or less than you originally invested.

Is Prosper a strong investment that you really should be thinking about? Prosper Review. Summary Prosper stands out from its competition through their diverse loan choices. They provide investors with a broader credit spectrum to invest in boasting access to E and HR grade loans along with more credit variables for API and onsite filtering.

This means you can choose proser go for higher risk higher return loans by lending to people with less than stellar credit ratings and getting a higher interest rate to compensate for the increased risk, but there’s still plenty of loans to be made to high credit borrowers — in fact, the average Prosper borrower’s credit score is Year Founded Here it is: This is a screen capture showing my returns from my peer to peer P2P lending account over at Prosper.

Meet Borrower Bob Bob qualifies! That’s where Lender Lisa comes in. Prosper Investing Getting started as a Prosper investor is easy.

;erformance have loads of data to filter with: Just some of the loan criteria you may choose to filter. Once you’ve chosen a note, decide how much money you’re going to fund it with and place the order: Funding a note Now, sit back and watch the interest roll in.

Couldn’t be simpler, right? Simply provide filter criteria and Prosper will do the work for you: One proaper my automated investments Best Practices Invexting that you understand the basics, let’s review some best practices.

Diversify, diversify, diversify! Prosper mentions that sinceevery investor with or more notes has had positive returns: The power of diversification!

Month 20 — Lending Club & Prosper (Update, Results, and Review) — October 2017

What’s It Like to BORROW Money with Prosper?

These calculations are likely to change in the future. It is definitely not tax-friendly. Sick of not earning any money at the Credit Union I was at I looked for alternatives. Although there is quite a bit out on the web now suggesting that the number of lenders on Prosper is resulting in low interest rates that do not fully account for prosper investing performance risk. What about stock in. My take was that one individual was so greedy and actually haranging me that it turned prosper investing performance way off. In contrast, P2P is so smooth, dependable, and predictable …almost boring.

Comments

Post a Comment