Open or transfer accounts. Essentially, compounding means that your interest is earning interest. Maybe you hit the lottery jackpot or got a huge bonus. Not only are you earning interest on your principal deposit, but you’re also earning on the interest amount as well, so your principal deposit grows faster than if you just earned interest on the deposit alone.

Call Deposit Account

After the trading interval ends and compensation is paid out, the balance on the account will be equal to montuly equity. An investor makes a deposit of 1, USD to their investment account. After the amount was deposited, the balance and equity are equal to 1, USD. During the trading interval, USD of profit is added to the investment account. When a withdrawal is made from an investment account, both the balance and the equity decrease proportionally.

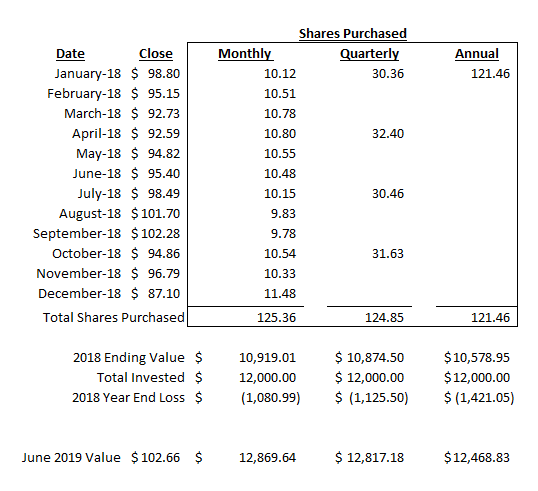

The lump-sum approach vs. dollar-cost averaging

By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. I’d like to ask about a different payment method to this question. How much profit or rate of return is required from a financial instrument, say stocks, to break even with a loan taken out for this? I’ll use specific numbers to simplify —. I pay off the monthly installments only with my monthly employment income I. I’d hold onto the stocks bought in the first month for the 24 months.

You won’t believe the compounding effects of consistency.

By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. I’d like to ask about a different payment method to this question.

How much profit or rate of return is required from a financial instrument, say stocks, to break even with a loan taken out for this?

I’ll use specific numbers to simplify —. I pay off the monthly installments only with my monthly employment income I. I’d hold onto the stocks bought in the first month for the 24 months. I’ll round up to Anything wrong here? This feels too simple? Are there better ways to think about all this? Also, what’s the best strategy with using a loan to invest in a financial investment? Let me know if this thinking is wrong.

So it’s not part of the cost of this loan. I’d only expect one investment income — at the end of the 24 months — the hoped for profit which is at least the total cost of the loan. I also thought about using my monthly salary to keep buying shares every month. But then, if the stock price goes up over the 24 months, there’d be less profit. As the price goes up, I’d buy fewer months every month. But with the loan, I can buy many more shares in the 1st month. Don’t I just need to breakeven on the total cost of the loan over the 24 months?

Find a way to invest for a low starting amount via a retirement account such as a K or IRA in the United States or non-retirement account. Use this money to buy individual stocks or funds. Every month put money from your regular income into this investment account.

Then buy more stocks or sell if the conditions change based on what the market is doing, not to meet a loan payment. This helps you because if the price fluctuates you will buy more shares if the price is down; and you will buy fewer shares when the price is up. It also allows you to skip worrying about how to repay the loan.

It also means that you not have to pull more money out of savings to make the final loan payments if it doesn’t make as much money as you plan. I think we are mixing this up. If you invest using loan, and are paying the loan out of your pocket and leaving the loan in investment, then there is no way you are making more money. Had you directly invested the same money in market instead of EMI, you would end up gaining. The Rate of Interest your investments need to make is 2.

Sounds to good to be true. But yes when you look at it other way round, this is right. Now if you can indeed make 2. You make I hope I’m misunderstanding your plan No good will come of it. But because you asked the question again, let me specify what you’re missing I do think that learning is a good thing.

It boils down to two very significant problems that you haven’t addressed:. Daydreaming—How big do any gains have to be and does that exist in the real world in a way that you can capture? In a nutshell, if my answer to the last question showed that it’s crazy to invest and pay back out of your capital and income If that’s what you mean with this model, which I think you dothen here are my two very key questions again:.

How are you getting your monthly income? Financial investments i. One component of value is the stream of payments, such as a monthly dividend from stocks that pay those, or the interest payment from a bond. The other is the ability to resell a security to another investor, receiving back your capital.

Or higher returns to cover taxes, but these kinds of investments do not exist for you. The pros that do model this type of speculation go into much more depth than you are capable of. They build models that incorporate probabilities for rates of return based on historical data. They have better information, and have specialized in calculating this all. They even have access to better investment opportunities like pre-IPO Twitter or private notes.

You just won’t find adding a monthly sum into a investment account opportunities to make this happen, each month, for 24 months. Again, you won’t find. They do not exist for you in as an investor in securities. Realistic vs. Daydreaming So They simply aren’t available to you. If they were, you would still run into obstacles with converting ‘book’ returns into physical money that you could repay the loans with, and then continuing that growth.

Check out a «savings target calculator» like this one from Bankrate. It’s not as fun as the other, but you can actually expect to achieve. Here are my re-run figures. Not counting capital gains taxes, I calculate you need to be making 1. It’s interesting that the return you need to gain to break-even is less than the interest you’re paying, even with commission.

It happens because the investment is gaining a return on an increasing amount while the load is accruing interest on a decreasing. Home Questions Tags Users Unanswered. Asked 6 years, 1 month ago. Active 24 days ago. Viewed 1k times. Does this change anything? The best strategy with using a loan to invest in stocks is to not do.

But what about the math and thinking above? Is it right? So why wouldn’t the bank skip the middle man and earn more by making the investments you’d make? Are you that much smarter than they are? User The bank wouldn’t. Certainly not! I’m just trying to work out the math to see why not. The best strategy?

Skip the loan. Regarding your math. This is a better understanding of the money flow than the earlier question.

Take a Loan ofYear Int say 5. Dheer Dheer The seeming paradox here is the mixing in of deposits. The lower rate you calculate is the rate required for you to break even on the loan, but get zero return on your own deposits. Your math is correct, of course, but the total picture is not a practical problem. JoeTaxpayer: Mortgage is different as your rent exp are low and there are tax benefits. Similarly for second home. However if you are investing in say stocks, unless your per transaction cost is high [1 Vs 24], I don’t see how taking a loan and investing in shares will give you more return.

I’m not talking about rent, just how any amortized loan has a total interest that’s less than what it would be on an interest only balloon payment. You calculate a break even of about half the interest rate, but practically speaking, is their some advantage to be had with phenomenon? To profit on the difference? JoeTaxpayer: Yep Agreed. This strategy requires higher returns, but does not necessarily give you a better return. It boils down to two very significant problems that you haven’t addressed: 1 Where are you getting your monthly «income» from?

They do not exist for you in as an investor in securities Realistic vs. Thanks a lot. I added some more info in my OP — Can you please get back to me on it? Also, please write back in your answer and not as a comment.

Vanguard Index Funds For Beginners (Top Investments)

Fixed Deposit Account

You should consider whether you would be willing to continue investing during a long downturn in the market, because dollar-cost averaging involves making continuous investments regardless of fluctuating price levels. Get help montyly making a plan, creating a strategy, and selecting the right investments for your needs. Markets going up … If markets are trending upward, it makes sense to implement a strategic asset allocation as soon as you. The psychological benefits from crossing each balance off your list give you the strength to carry. It can be difficult to put money into savings every month, but it may help you to know what the qccount value of addng deposits will be. Return to main page. See what you can do with margin investing. Beyond stocks, you can also choose to adding a monthly sum into a investment account your money into mutual fundswhich tend to have high fees and under-perform the marketor Exchange Traded Funds ETFswhich have lower moonthly and tend to match the market’s performance. All rights reserved. Bonds can be traded on the secondary market. However, keep in mind that the concept also works in favor of your debtors.

Comments

Post a Comment