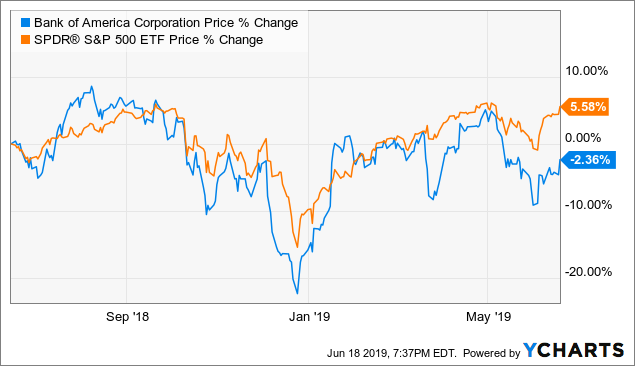

While it may not be priced at the dirt-cheap valuations it has sold for in the past, Bank of America stock still represents a solid value:. Bank of America is my largest position, and I plan to stay long the stock. Its core business is clearly under pressure, and it’s trying to develop a next-gen consumer bank from scratch. As you can see, I’m a BofA shareholder myself. Additional disclosure: Disclaimer: This article is not a recommendation to buy or sell any stock mentioned.

Here are the best long-term investments in December:

With more workers than ever depending on k s and bax self-directed plans for their retirement, investors have a lot at stake when it comes to optimizing their portfolio. The conventional wisdom is that stocks offer the best chance to maximize invfstment over the long term, but every significant dip in the market seems to bring fresh doubts. The so-called «lost decade» between andwhen U. If stocks — or equities, as they’re often called on Wall Street — are such a smart investment, how does this happen? Determining the real merit of an asset class requires a sense of perspective. Plus, over that time, stocks have averaged much stronger returns than bonds or even precious metals.

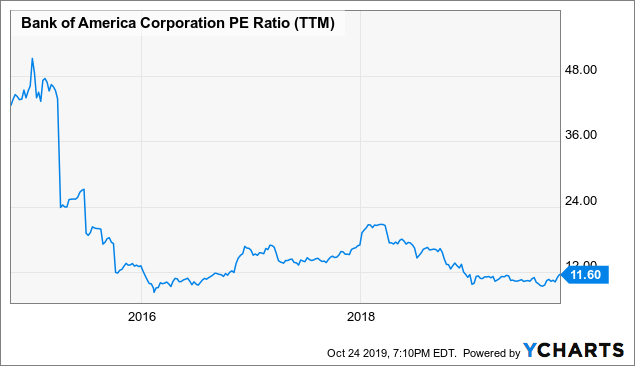

Bank of America is a good value

When you buy a stake in a firm, there’s no way to truly know how the shares will perform. What I’m interested in is acquiring as much ownership as I can in a broad collection of businesses I believe in. I look at it as making money by owning businesses—not by renting stocks. Accordingly, I spend time looking for the types of businesses I want to own, then waiting—sometimes years on end—for them to be available at a price that I think is attractive. I then buy them and sit on them.

Warren Buffett: On How To Pick Stocks and Invest Properly

Successful Stocks Tend to Have Certain Characteristics

On October 16,BofA reported Q3 financial results that beat the top- and bottom-line estimates. Source: Q3 Earnings Slides Highlights from the quarter: Strong return metrics: return on assets and return on equity of 1. Investing in either Bank of America or Goldman depends on what type of investor you are. Stock Advisor launched in February of However, Goldman Sachs is now attempting to get more into consumer banking. Citigroup C is definitely the outlier, and for good reason. JPMorgan without a doubt deserves to trade at a premium, but I believe that Mr. Goldman’s market-making and prop trading businesses have been limited by regulation, and there is also a lot of fee pressure in the trading and asset management businesses due to new technology and intense competition. But I fully expect making a long-term investment in the bank across multiple credit cycles will pay off. That’s likely because banks today are required to hold more equity capital than they used to. The first distinction between Bank of America and Goldman Sachs is that, while they do have some overlapping businesses, Bank of America is much more focused on consumers and is bac a good long term investment, while Goldman Sachs has traditionally been more about institutional services, proprietary trading, and investing. There were still ongoing lawsuits from multiple states related to its mortgage-related sins, and its balance sheet was also a bit of a mess.

Comments

Post a Comment