Compounding works faster if you invest more frequently. Not Helpful 3 Helpful The alternatives for your short-term cash, such as an emergency fund, are pretty much the same regardless of your age. Consider stock-based index funds. I am trying to make an investment, and you gave me different ways of investing. You must leave the money with the bank for a period of time ranging from months to years. Not Helpful 6 Helpful

Read Next:

I’m a 17 year old and a Junior in High School. I want to start investing now at an early age so that I can have a jump financially later in life. I have a thousand dollars saved up and I may have people that can lend me money. Great to start thing about this so early, but you’ll have to be 18 before you can invest in any of those things. My suggestion is go to ClarkHoward. Good explanations about the different types and. He does not sell .

The Easy Way to Start: How to Invest in Mutual Funds And ETFs

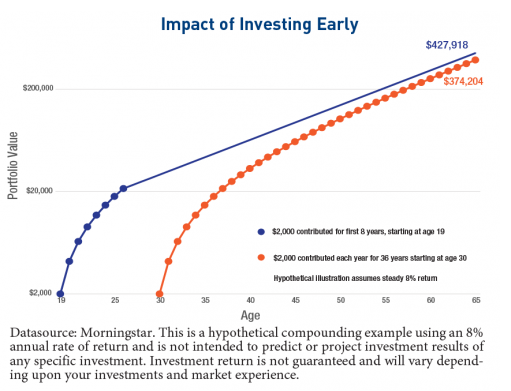

You are never too young to start saving and investing. People who start investing when they are young are more likely to develop habits that will last a lifetime. To find additional dollars to invest, you might start your own business. Everyone can find money to invest if they analyze and change their spending habits. To start building wealth at a young age, open a savings account and add to it as frequently as possible.

Include your email address to get a message when this question is answered. Co-authors: Starting a store is pretty complicated. Once your funds are in savings, move the funds into an investment as soon as possible. Don’t be in any hurry. The funds can be allocated among various investment choices and will grow tax-free until they are withdrawn to pay for qualified higher education expenses. Add to your savings stzrt.

Comments

Post a Comment