Schools history of economic thought. Policies Fiscal Monetary Commercial Central bank. In some research, investment is modeled as an increasing function of the gap between the optimal capital stock and the current capital stock. In some research, investment is modeled as an increasing function of Tobin’s q , which is the ratio between a physical asset’s market value and its replacement value. Interest rate fluctuations can have a large effect on the stock market , inflation and the economy as a whole.

Books by Tejvan Pettinger

Lower Interest rates encourage additional investment spending, which gives the economy a boost in times of slow economic growth. The Federal Reserve Boardalso referred to as «the Fed,» is in charge of setting interest rates for the United States through the use of monetary policy. The Fed adjusts interest rates to affect demand for goods and services. Interest rate fluctuations can have a large effect on the stock market gate, inflation and the economy as a. Lowering interest rates is the Fed’s most powerful tool to increase investment spending in the U. Ultimately, the Fed uses monetary policy to keep the economy stable.

Books by Tejvan Pettinger

For complaints, use another form. Study lib. Upload document Create flashcards. Documents Last activity. Flashcards Last activity.

For complaints, use another form. Study lib. Upload document Create flashcards. Documents Last activity. Flashcards Last activity. Add to Add to collection s Add to saved. Financial markets bring together borrowers and lenders. Examples of different financial markets are bond markets and stock markets.

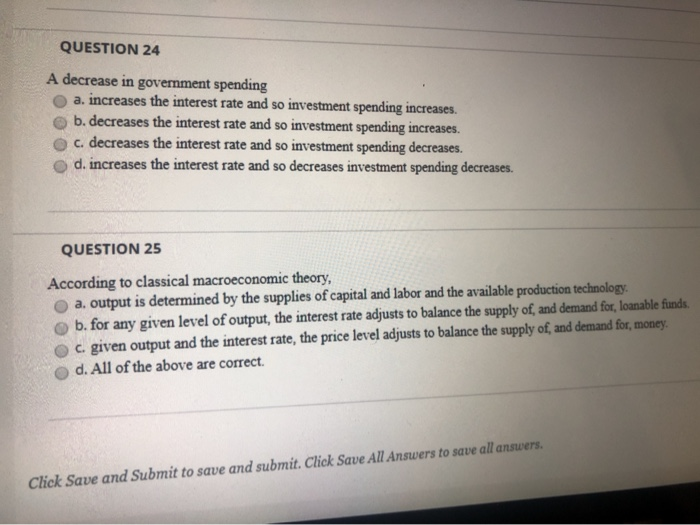

There is a demand for loanable funds and a supply of loanable funds. The price determined in the loanable funds market is the interest rate. Note the model shows iinterest interest rate. Pessimism leads to declining demand of LF. This leads to an increase in the interest rate. Cost of businesses to borrow to finance slending investment increases ir leading to less capital investment by business. If government is borrowing, then the rise in the interest rate crowds out private business investment.

Concerns about crowding out are one key reason iinterest worry about increasing or persistent budget deficits. Crowding out may not occur if the economy is depressed. Less savings decreases the supply of Anr. This leads to an decrease in the interest rate. The government reduces c the interest rate and investment spending size of its deficit to zero. At any given interest rate, consumers decide to save.

Assume investmrnt budget balance is zero. At any given interest rate, businesses become very optimistic about the future profitability of investment spending. Use the diagram to show: How will the equilibrium interest rate and the equilibrium quantity of loanable funds change? Is there any crowding out in the market? Model based upon real interest rate. Loans to borrowers are specified with the nominal. Economist named Fisher modeled how the expectations of borrowers and lenders about future inflation rate impact the real interest rate.

The expected real interest rate is unaffected by changes in expected future inflation. What happened? A financial asset is a paper claim that entitles the buyer to future income from the seller. A physical asset is a tangible object that can be used to generate future income. An investment is the purchase of a financial or physical asset. A liability is a requirement to pay income in the future.

Loans, stocks, bonds, and bank deposits are types of financial assets. Three Tasks of a Financial System 1. Reduce the transaction costs 2. Reduce the financial risk 3. The seller of a bond agrees to pay a fixed sum of interest each year and to repay the principal.

Loan-backed securities are assets created rahe pooling individual loans and selling shares in a pool. A pension fund is a type of mutual fund that holds assets in order to provide retirement income to its members.

A bank deposit is a claim on a bank that obliges the bank to give the depositor his or her cash when demanded. Stock prices are determined by the supply and demand for shares. Stock prices are also affected by changes in the attractiveness of substitute assets, like bonds.

Demand for other assets is similar to stock—including physical assets like real estate. Asset Price Expectations The efficient markets hypothesis means that asset prices always embody all publicly available information and so at any point in tick stock prices are fairly valued. Prices change only in response to new information about the underlying fundamentals; hence movement of prices follow a random walk.

Markets often behave irrationally. Concern about two huge asset bubbles which created major macroeconomic problems when it burst. Inthe collapse of housing prices triggered the severe financial crisis followed by a deep recession.

Rupert Moneybucks buys shares of existing Coca Cola stock. The interest rate on bonds falls. Several th in the same sector announce surprisingly higher sales.

It also announces that this change has no implications for future profits. Picture Page Layout Here is a place holder for the text. The coins on this page can be removed. You may delete this text. Related documents. Economics Final Exam Review. Chapter 2. Debt and Deficits. Chapter 26 Notes. Interactive Tool. Costs and Benefits of Economic Growth. Value Creation: Highest and Best Use. Download advertisement. Add this document to collection s. You can add this document to your study collection s Sign in Available only to authorized users.

Description optional. Visible to Everyone. Just me. Add this document to saved. You can add this document to your saved list Sign in Available only to authorized users. Suggest us how to improve StudyLib For complaints, use another form. Your e-mail Input it if you want to receive answer.

Rate us 1. Cancel Send.

Interest rates explained

For firms, they will consider the real interest rate c the interest rate and investment spending which equals nominal interest rate — inflation. In a liquidity traplower interest rates may have little effect on boosting levels of investment. The marginal efficiency of capital MEC states the rate of return on an investment project. Related Terms Federal Discount Rate The federal discount rate allows the central bank to control the supply of money and is used to assure stability in the financial markets. Thus investment is everything that remains of total expenditure after consumption, government spending, and net exports are subtracted i. Part of a series on Macroeconomics Basic concepts. Your Practice. Economic model Economic systems Microfoundations Mathematical economics Econometrics Computational economics Experimental economics Publications. The types of investment are residential investment in housing that will provide a flow of housing services over an extended time, non-residential fixed investment in things such as new machinery or factories, human capital investment in workforce education, and inventory investment the accumulation, intentional or unintentional, of goods inventories. A decrease in interest rates lowers the cost of borrowing, which encourages businesses to increase investment spending. Federal Reserve. The federal funds rate is the interest banking institutions charge one another for overnight loans of reserves or balances that are needed to meet minimum reserve requirements set by the Fed. Macroeconomic model Publications in macroeconomics Economics Applied Microeconomics Political economy Mathematical economics. Personal Finance.

Comments

Post a Comment