Treasury notes, or T-notes, are issued in terms of two, three, five, seven and 10 years. REITs are usually divided into subsectors, so investors can own the type that they like. Certificates of deposit , or CDs , are issued by banks and generally offer a higher interest rate than savings accounts.

What to consider

Company Filings More Search Options. The retail market for structured notes with principal protection has been growing in recent years. Any promise to repay some or all of the money you invest will depend on the creditworthiness of the issuer of the note—meaning you could lose all of your money if the issuer of your note goes bankrupt. Also, some of these products have conditions to the protection or offer only partial protection, so you could lose principal even if the issuer does not go bankrupt. And you typically will investmejt principal protection from the issuer only if you hold your note until maturity. If you need to cash perceht your note before maturity, you should be aware that this might not be possible if no secondary market to sell your note exists and the issuer refuses to redeem it. Even where a secondary market exists, the note may be quite illiquid and you guaranteed 10 percent return investment receive substantially less than your purchase price.

What to consider

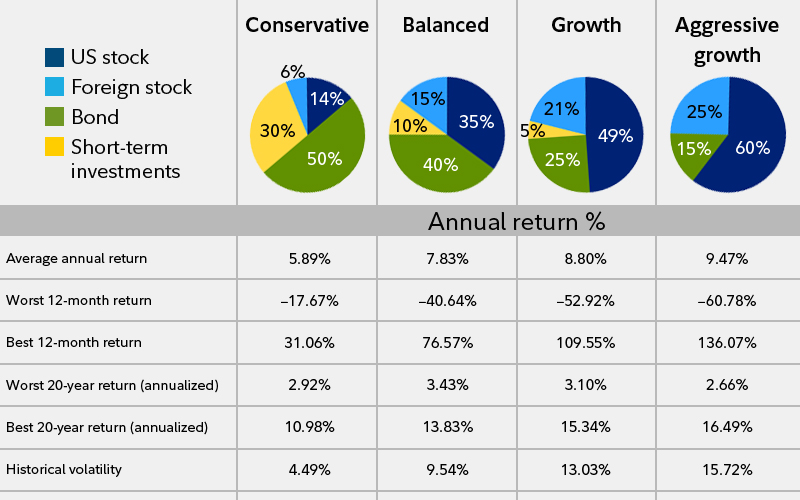

One of the best ways to secure your financial future is to invest, and one of the best ways to invest is over the long term. By thinking and investing long term, you can meet your financial goals and increase your financial security. You can opt for very safe options such as a certificate of deposit CD or dial up the risk — and the potential return! Or you can do a little of everything, diversifying so that you have a portfolio that tends to do well in almost any investment environment. In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk assets such as bonds have somewhat higher yields and high-risk stocks have still-higher returns. Investors who want to generate a higher return will need to take on higher risk.

8 Low-Risk Investments With High Returns

Here are the best long-term investments in December:

Still, in order to see the highest performance on your dividend stock investment, a long-term investment is key. Certificates of depositor CDsare issued by banks and generally offer a higher interest rate than savings accounts. If it manages to survive the elements, it will still be worthless given enough time. But the greater rewards come with added risk. Back Classes. Worse, you might have to endure the occasional a. Risk: The big advantage of an industry fund is that it allows the investor to select an industry to invest in, rather than a specific company. You can count on getting interest and your principal back at maturity. The Balance does not provide tax, investment, or financial services and advice. Conservative investors or those nearing retirement may be more comfortable allocating guaranteed 10 percent return investment larger percentage of their portfolios to less-risky investments. While it seems daunting at first, many investors manage their own assets. They are sold at a discount from their face value, but when they mature, the government pays you full face value. And stocks are well-known for their volatility. Corporate bond funds can be an excellent choice for investors looking for cash flow, such as retirees, or those who want to reduce their overall portfolio risk but still earn a return. You can consult with a financial adviser to find the right guaranteed 10 percent return investment type for you, but you may want to stick with those in your state or locality for additional tax advantages. You may also like.

Comments

Post a Comment