NextAdvisor Paid Partner. The variable annuity is a good annuity choice for investors with a moderate to high risk tolerance and a long-term investing time horizon. A tax-qualified annuity is one used to fund a qualified retirement plan, such as an IRA, Keogh plan, k plan, SEP simplified employee pension , or some other retirement plan. After all, an initial lump-sum premium can be converted into a series of monthly, quarterly, or yearly payments that represent a portion of principal plus interest and is guaranteed to last for life.

National Pension Scheme (NPS) is a government-sponsored pension scheme. It was launched in January 2004 for government employees.

Never miss a great news story! Get instant notifications from Economic Times Allow Not. NPS partial withdrawal rules and how it is taxed. NPS pension benefits are not same for voluntary and normal jinimum. All rights reserved. For reprint rights: Times Syndication Service.

If you are considering buying an annuity to provide steady income during retirement, it’s important to understand the different types and how they work. Here’s a look at the fundamentals of annuities and what to consider before making a decision. Most investors share the same goal of long-term wealth accumulation. Some have no problem watching their investments bounce up and down from day to day. But risk-averse investors, particularly if they’re nearing retirement age, can’t tolerate much short-term volatility in their investments. If you are this type of investor—that is, one who has a low to moderate risk tolerance, an annuity may be a good choice. An annuity is a contract between you—the annuitant —and an insurance company.

If you are considering buying an annuity to provide steady income during retirement, it’s important to understand the different types and how they work.

Here’s a look at the fundamentals of annuities and what to consider before making a decision. Most investors share the same goal of long-term wealth accumulation. Some have no problem watching their investments bounce up and down from day to day. But risk-averse investors, particularly if they’re nearing retirement age, can’t tolerate much short-term volatility in their investments.

If you are this type of investor—that is, one who has a low to moderate risk tolerance, an annuity may be a good choice. An annuity is a contract between you—the annuitant —and an insurance company. The company promises to pay you a certain amount of money, on a periodic basis, for a specified period. The annuity provides a kind of retirement-income insurance: You contribute funds to the annuity in exchange for a guaranteed income stream later in life.

Typically, annuities are purchased by investors who wish to guarantee a minimum income stream for their retirement years. The investment earnings grow tax-free until you begin to withdraw the income. This feature can be very attractive to young investors, who can contribute to a deferred annuity for many years and take advantage of tax-free compounding in their investments. Because they are a long-term what is the minimum investment in an sdpa annuity planning instrument, annuities typically have provisions that penalize investors if they withdraw funds early.

Also, tax rules generally encourage investors to postpone withdrawals until they reach a minimum age. Generally speaking, there are two primary ways annuities are constructed and used by investors: immediate annuities and deferred annuities.

With an immediate annuity, you contribute a lump sum to the annuity account and immediately begin receiving regular payments, which can be a fixed amount or variable depending upon your choices. Annuities are often associated with high fees, so make sure you understand all of the expenses before purchasing one. Typically, you might choose this type of annuity if you have a one-time windfall, such as a lottery win or an inheritance.

Sometimes people close to retirement purchase these with some portion of their retirement savings to add to their guaranteed income in retirement. Immediate annuities convert a cash pool into a lifelong income stream, providing you with a guaranteed monthly allowance for your old age. Deferred annuities are structured to meet a different type of investor need—to accumulate capital over your working life, building a sizable income stream for your retirement.

The regular contributions you make to the annuity account grow tax-sheltered until you choose to draw an income from the account.

This period of regular contributions and tax-sheltered growth is called the accumulation phase. Sometimes, when establishing a deferred annuity, an investor may transfer a large sum of assets from another investment account, such as a pension plan.

In this way, the investor begins the accumulation phase with a large lump-sum contribution, followed by smaller periodic contributions. Different investors place different values on a guaranteed retirement income. Some believe it is critical to secure risk-free income for their retirement. Other investors are less concerned about receiving a fixed income from their annuity investment than they are about continuing to enjoy capital gains on their funds.

Which needs and priorities you have will determine whether you choose a fixed or variable annuity. A fixed annuity provides a low-risk retirement income source. A fixed annuity offers the security of a guaranteed rate of return.

This will be true regardless of whether the insurance company that manages your annuity earns a sufficient rate of return on its own investments to support that rate. However, the price for removing risk is missing out on growth opportunity.

Should the financial markets enjoy bull market conditions during your retirement, you forgo additional gains on your annuity funds. Your state’s department of insurance has jurisdiction over fixed annuities because they are insurance products. Also, your state insurance commissioner requires that advisors have a license to sell fixed annuities. You can find your state’s department on the National Association of Insurance Commissioners website. This type of annuity also guarantees a certain minimum return and allows you to participate in stock market gains without assuming the full risk of losing money when the market declines.

Indexed annuity sales are a jurisdictional jump ball. It isn’t clear to anyone whether they’re insurance products or securities, even though they may look like annuities to investors. As you can imagine, this has created much controversy among regulators and the insurance industry. At the moment, because insurers bear the financial risk, indexed annuities are regulated by state insurance commissioners as insurance products, and agents must have a fixed annuity license to sell. Therefore, if you deal with a FINRA member firm, you might have another set of eyes unofficially watching the transaction.

Variable annuities allow you to participate in the potential appreciation of your assets while still drawing an income from your annuity. With this type of annuity, you receive varying rates of return depending on your portfolio’s performance. The insurance company typically guarantees a minimum income stream, through what is called a guaranteed income benefit optionand offers an excess payment amount that fluctuates with the performance of the annuity’s investments.

You enjoy larger payments when your managed portfolio renders high returns and smaller payments when it does not. Variable annuities may offer a comfortable balance between guaranteed retirement income and continued growth exposure. Anyone selling a variable annuity must have a Series 6 or Series 7 license, and your state may require one as.

Potential investors must receive a prospectus. Annuities offer several tax benefits. In general, during the accumulation phase of an annuity contract, earnings grow tax deferred. You pay income taxes when you start taking withdrawals from the annuity. If you contribute funds to the annuity through an individual retirement account IRA or another tax-advantaged retirement account, you are also usually able to annually defer taxable income equal to the amount of your contributions, giving you tax savings for the year of your contributions.

Over a long period of time, your tax savings can compound and result in substantially boosted returns. It’s also worth noting that since you’re likely to earn less in retirement than in your working years, you will probably fit into a lower tax bracket once you retire. In the end, this provides you with even higher after-tax return on your investment.

The goal of an annuity is to provide a stable, long-term income supplement for the annuitant. Once you decide to start the distribution phase of your annuity, you inform your insurance company. The insurer employs actuaries who then determine your periodic payment amount by means of a mathematical model.

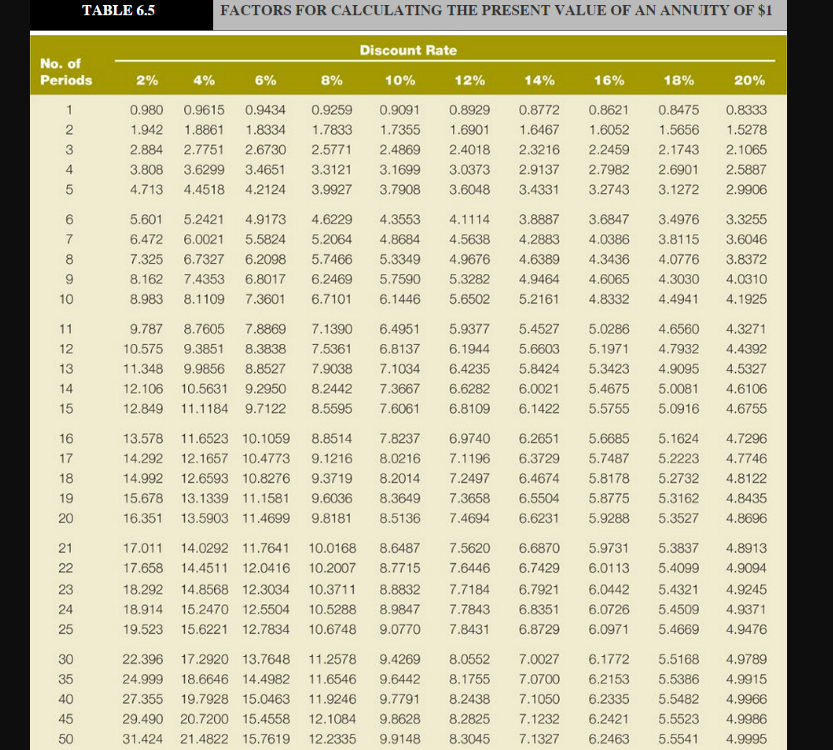

The primary factors taken into account in the calculation are the current dollar value of the account, your current age the longer you wait before taking an income, the greater your payments will bethe expected future inflation-adjusted returns from the account’s assets, and your life expectancy based on industry-standard life-expectancy tables.

Finally, the spousal provisions included in the contract are factored into the equation. Most annuitants choose to receive monthly payments for the rest of their lives and their spouse’s lives. If you chose this distribution arrangement and you live for a long time after you retire, the total value you receive from your annuity contract may be significantly more than what you paid into it.

However, should you pass away relatively early, you may receive less than what you paid the insurance company. Regardless of how long you live, the primary benefit you receive from your contract is peace of mind: guaranteed income for the rest of your life.

Thus, the insurer operates on certainty, pricing annuities so that they will marginally retain more funds than their aggregate payout to clients.

At the same time, each client receives the certainty of a guaranteed retirement income. Annuities can have other provisions, such as a guaranteed number of payment years. If you and your spouse, if applicable die before the guaranteed payment period is over, the insurer pays the remaining funds to the your estate.

Generally, the more guarantees inserted into an annuity contract, the smaller the monthly payments will be. Annuities may make sense as part of an overall retirement plan.

But before you buy one, consider the following questions:. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Part Of. Annuities Overview. Types of Annuities. Calculating Present and Future Values. Tax Implications. Benefits and Risks. Retirement Planning Annuities. Table of Contents Expand. Annuities: The Big Picture. How Annuities Work. Tax Benefits of Annuities. Taking Distributions. What to Consider. Key Takeaways Investors typically purchase annuities to provide a steady income stream during retirement.

Immediate annuities and deferred annuities are the two major types of annuity contracts. Tax benefits include tax-deferred growth, but you pay income taxes on the money withdrawn. Most annuities penalize investors for early withdrawals. Fixed Annuities. Indexed Annuities. Variable Annuities. Will you use the annuity primarily to save for retirement or a similar long-term goal?

Why You Should Take Pension Income Instead of Income Annuity

Understand the types of annuities and how they work

This option pays you a fixed amount over the time period you choose. Pioneer Global Asset Management S. For example, you might choose to have the annuity paid out over ten years. The life annuity gives you the highest monthly benefit of the options listed. Thus, the fixed annuity contract is similar to a CD or a money market fund, depending on the length of the period during which interest is guaranteed. Investments in a variable annuity are subject to market risk, including possible loss of principal.

Comments

Post a Comment