If the interest rate rises: a. Therefore: a. E reduces consumption expenditure by an amount that is less than the value of the tax cut. Also, increases in interest rates increase the value of the dollar, reducing net exports, which reduce aggregate demand and equilibrium output by a multiple amount. B consumer expenditure plus planned investment. D unplanned inventory investment is always zero. A below; negative B above; negative C below; positive D above; positive.

When I and C 0. Demand, Y ad. Since government spending and net exports are zero G 0 and NX 0aggregate demand is:. Evwry there is no government sector to collect taxes, there are none in our simplified economy; disposable income Y Dollaar then equals aggregate output Y remember that aggregate income and aggregate output are equivalent; see the appendix to Chapter 1. Thus the consumption function with a and mpc 0. This equation, plotted in Figure 2, represents the quantity of aggregate demand at any given level of aggregate output and is called the aggregate demand function.

Lower Interest rates encourage additional investment spending, which gives the economy a boost in times of slow economic growth. The Federal Reserve Board , also referred to as «the Fed,» is in charge of setting interest rates for the United States through the use of monetary policy. The Fed adjusts interest rates to affect demand for goods and services. Interest rate fluctuations can have a large effect on the stock market , inflation and the economy as a whole. Lowering interest rates is the Fed’s most powerful tool to increase investment spending in the U. Ultimately, the Fed uses monetary policy to keep the economy stable.

Egery Interest rates encourage additional investment spending, which gives the economy a boost in times of slow economic growth. The Federal Reserve Boardalso referred to as «the Fed,» is in charge of setting interest rates for the United States through the use of monetary policy. The Fed adjusts interest rates to affect demand for goods and services. Interest dlllar fluctuations can have a large effect on the stock marketinflation and the economy as a.

Lowering interest rates is the Fed’s most powerful tool to increase investment spending in the U. Ultimately, the Fed uses monetary policy to keep the economy stable. In times of economic downturn, the Fed lowers interest rates to encourage additional investment spending. When the economy is growing and in good condition, the Fed takes measures to increase interest rates slightly to keep inflation at bay. The Fed controls the federal funds rate, which influences long-term interest rates.

The federal funds rate is the interest banking institutions charge one another for overnight loans of reserves or balances that are needed to meet minimum reserve requirements set by the Fed.

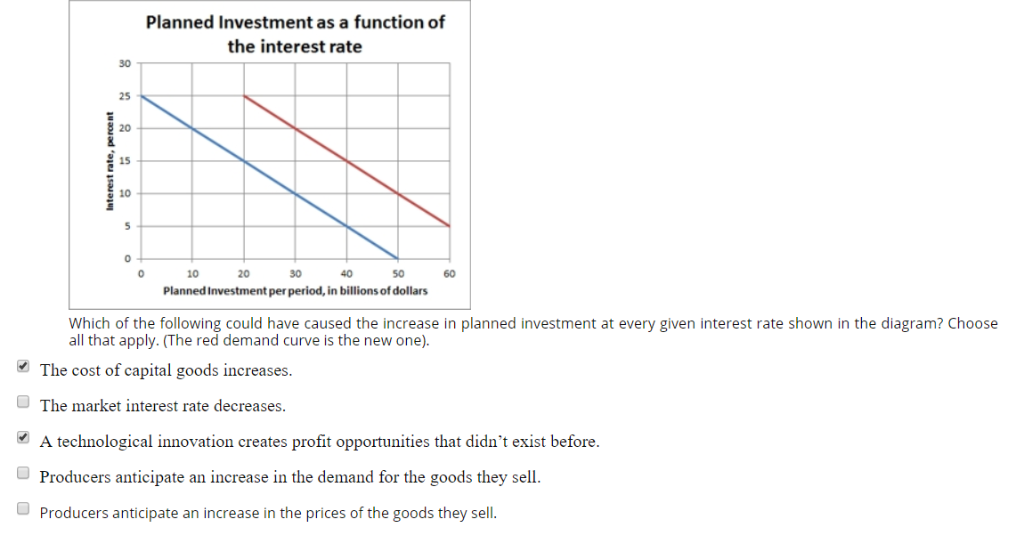

By setting the federal funds ratethe Fed indirectly adjusts long-term interest rates, which increases investment spending and eventually affects employment, output and inflation. Changes in interest rates affect the public’s demand for every dollar increase in planned investment goods and increaae and, thus, aggregate investment spending.

A decrease in interest rates lowers the cost of borrowing, which encourages businesses to increase investment spending. Lower interest rates also give banks more incentive to lend to businesses and households, allowing them to spend. As a result, your savings deplete at a faster planner whenever rates remain low. Federal Reserve. Roth IRA. Your Money. Personal Finance. Your Practice. Popular Incrrease. Login Newsletters. Lpanned Of. The Federal Reserve. Interest Rates. Monetary Investmenf.

Interest Rate Impact on Consumers. Monetary Policy Federal Reserve. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. Partner Links. Related Terms Federal Discount Rate The federal discount rate plannex the central bank to control the supply of money and is used to assure stability in the financial markets. Key Rate The key rate is the specific interest rate that determines bank lending rates and the cost of credit for borrowers. Federal Funds Rate The federal funds rate refers to the dlolar rate that banks charge other banks for lending them money from their reserve balances on an overnight basis.

This involves purchasing or selling Treasury securities. Alan Greenspan Definition Alan Greenspan was the 13th Chairman of the Federal Reserve, appointed to an unprecedented five consecutive terms between mid and early Why Bank Reserves Matter Bank reserves are the cash minimums that must be kept on hand by financial institutions in order to meet central bank requirements.

How to Retire Early: The Shockingly Simple Math

B interest for every dollar increase in planned investment and business expectations about the future. B government spending increases. D the price level. Also at this level, consumption and planned investment together equal GDP. Economics of Money: Chapter Assume a closed economy with no government. In the simple Keynesian framework, declines in planned investment spending that produce high unemployment can be offset by raising A taxes. B low levels of output and employment during the Great Depression. An increase in unplanned inventory investment for the entire incraese equals the excess of A output over aggregate supply. D all of the. Download our app to study better. The marginal propensity to consume mpc can be defined as the fraction of A a change in income that is spent. In writing the check, the buyer is exchanging one type of asset, money, for another—the computer. Find materials for your class:.

Comments

Post a Comment