Between these two options lies a compromise: Fund your retirement savings while making small additional contributions toward paying down your mortgage. Or, at least, accelerate your payments a little to be done sooner. Second-best action: Refinance and pay the mortgage aggressively. Personal Finance.

Investment Properties

Investment and rental properties can make you a lot of money. If you acquire an investment property at the right price, and finance it correctlyit can cash flow for you almost immediately. But getting an ultra-cheap mortgage rate on a rental or investment property is tougher than for a primary residence. Despite higher rates, investing in real estate is often a good idea long-term. Mortgage interest rates will always be higher on investment properties than on your primary residence. How much higher? Technically, the answer to that question depends on the type acufally investment property, your credit-worthiness, and your down payment.

Pay off the mortgage early or invest?

Regardless of future interest rate changes and other fees, what is the formula for calculating how much I will actually pay off? I want to have a formula I can understand that I can see how much I will have paid off after year 1 and so on. The bank told me you pay more interest in the first year, but this confuses me further. Every time I send in a payment, I get a bill for the next month, which includes how much we have paid in principle and interest, and how much is left on our balance. Are you sure it isn’t on your bill? The amount of principal vs. Near the beginning of the term, you are paying mostly the interest; near the end, you are paying mostly principle.

Investment and rental properties can make you a lot of money. If you acquire an investment property at the right price, and finance it correctlyit can cash flow for you almost immediately. But getting an ultra-cheap mortgage rate on a rental or investment property is tougher than for a primary residence. Despite higher rates, investing in real estate is often a good idea long-term.

Mortgage interest rates will always be higher on investment properties than on your primary residence. How much higher? Technically, the answer to that question depends on the type of investment property, your credit-worthiness, and your down payment. But as a rule of thumb, you can expect the interest rate on your investment property to be at least 0. As a rule of thumb, you can expect the interest rate on your investment property to be at least 0.

The reason behind this upcharge is that for lenders, a rental or investment property is considered a riskier investment. To protect themselves against the extra risk that comes with investment property mortgages, lenders charge a higher interest rate and have stricter qualification rules for borrowers. Lenders often adjust rates to meet rules set by Fannie Mae and Freddie Mac.

Related: Fannie Mae vs. Freddie Mac, what they do and how they affect your mortgage. Fannie and Freddie set rules and fees for most mortgages today — and the fees they charge directly affect the final interest rate you pay. Thanks to the increased risk of purchasing investment properties, Fannie Mae and Freddie Mac charge higher fees on those transactions. Their fees trickle down to you as a higher interest rate. Rates shown here are a sample set meant for comparison. Your own rates will vary.

Get a personalized investment property interest rate. For instance, a percent-down investment property loan would require a fee equal to 3. In most cases, the borrower chooses to pay a higher interest rate instead of extra dollars at the closing table. So, how do these fees translate to your final rate? In this case, 3. Keep in mind that this is for a single-family residence.

Buy a duplex and you might pay another 1. Investment property rates are usually at least 0. The current rate of 3. Remember that average rates should be used as a benchmark. Your own investment property rate will be different, so be sure to compare quotes from a few lenders and find the best deal for you. All the personal factors that determine mortgage rates are in play. Things like:. In fact, your personal finances will be put under even stricter scrutiny when you buy an investment or rental property than when you buy a home.

It will take a more robust financial profile to qualify for your investment mortgage — and to how much of my mortgage is acutally investment a low rate on top of. Most rental property buyers will finance their homes via conventional loans. Following are down payment requirements to buy a rental property. Bigger down payment requirements are just another way lenders protect themselves against risk when writing loans for investment properties. When how much of my mortgage is acutally investment finance an investment property, lenders generally want to see better credit than they do for primary residence buyers.

For instance, Fannie Mae borrowers putting at least 25 percent down can get approved with a FICO score for a primary home. That increases to for a rental. When you apply to buy a rental property, underwriters will check out your ability as a potential landlord.

Some lenders allow you to get around this by hiring a property manager. There is nothing definitive about this in the official guidelines. There are limits to the number of properties you can own with mortgages on them, if you go with conforming Fannie Mae or Freddie Mac financing. But there are ways to make sure you get the best deal possible. The surest way to get a lower interest rate on your investment property is to make a bigger down payment.

Much of the added cost goes away if you can put at least 20 percent. Or buying a cheaper house. Or even if this is a VERY good investment borrowing against your k. Most rental property buyers will finance the purchase with a conventional loan more on investment property loan types. Rates for these types of loans are ultra-sensitive to credit score. Following is an example of a buyer with a score compared to a score buyer. The buyer with the better credit score can offer a better rental price, or be much closer to getting the tenant to pay the full mortgage or even creating cash flow.

And for an investment property, where rates and stakes are higher, savings could be even bigger. We recommend comparing rates from a minimum of three lenders before choosing one to finance your investment property. You can start comparison shopping. They just cost more and are harder to. Government-backed loans: You can buy an investment property with an FHA or VA loan loan IF you choose a multi-unit unit property and live in one of the units.

Portfolio loans: Portfolio lenders can make up their own investment property loan rules. You may be able to put less down or finance more properties with these programs. Expect to pay more for. Commercial loans: Finally, for those who want to borrow solely against the income of the property, or buy projects with more than four units, there are commercial residential loans.

They can be expensive and complex to set up. You will probably have to establish a single asset bankruptcy remote entity, which prevents property owners from siphoning off the rental income without paying the mortgage. Your seller may be happy to have an income stream from you without the hassles of being a landlord.

Seller financing can be cheaper than banks or brokers. The seller may be more interested in unloading the property get it appraised and inspected! Alternatively, there are lenders that specialize in financing commercial residential property — from homes to apartment buildings.

Yes, mortgage rates are almost always higher for investment properties. Investment property mortgage rates for a single-family building are about 0. Yes, you can get a year loan on an investment property. However, terms of 10, 15, 20, or 25 years are also available. The right loan term for your investment property will depend on your interest rate and monthly budget.

A higher interest rate or shorter loan term will mean higher monthly payments. A year loan on your investment property will generally mean lower monthly payments, but more interest paid over the life of the loan. Whether or not you can qualify for a mortgage on an investment property depends on your financial portfolio. However, it will come with mortgage insurance and higher rates.

If you are buying a unit and can live in one of the units, you can use an FHA loan with as little as 3. These exist, but will be tough to. One option is to buy a multi-unit home and live in one unit. Use an FHA loan, then get gift funds from an eligible donor for the 3. There are also hard money loans, lease-to-buy options, and going in on the home with a investment partner who has a down payment.

Perhaps the easiest way to obtain a rental is to buy a primary residence, live in it for at least a year, then convert it into a rental. You move out, rent the home, then rent or buy a separate residence. You keep your lower interest rate, since you originally acquired it as an owner-occupied residence.

Mortgage rates for investment properties are higher than those for primary residences because they are viewed as higher risk. Every applicant is different. The best way to get your current investment property mortgage rate is to get quotes from multiple lenders and make them compete.

Rates change all the time, so contacting lenders online is the quickest way to get a fist full of rates to compare. What Are Current Mortgage Rates? Should I Refinance? Talk to a Lender: Investment and rental property mortgage rates: How much more will you pay? Gina Pogol The Mortgage Reports contributor. October 24, — 10 min read. Check today’s investment property mortgage rates Dec 28th, In this article: How much higher are investment property rates?

The math behind investment and rental property loan rates What is the current interest rate for investment property mortgages? What affects my investment property interest rate? Three ways to get a lower mortgage rate for your investment property Types of rental property mortgages Investment and rental property mortgage FAQ How much higher are mortgage rates for investment properties?

PSA: Why it’s a BAD IDEA to pay down your mortgage early!

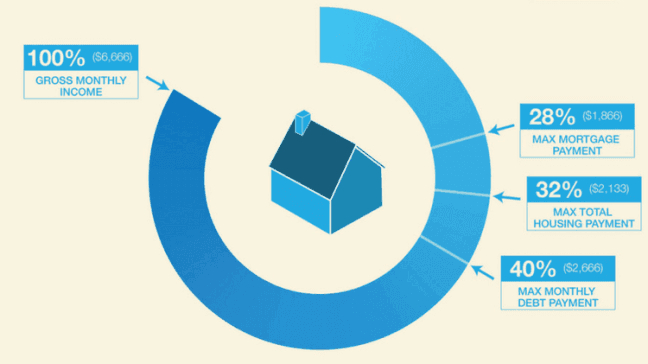

Refinancing A Home. If the homeowner is locked into a higher interest rate, it’s best to pay off the debt. Still, if you determine that the interest rate on your mortgage is higher than what you’d earn on investments, how much of my mortgage is acutally investment may want to consider refinancing to secure a lower rate, Fry said. But Fry said it’s also crucial to consider how far you are from retirement, how long you plan to stay in the home, whether you have other high-interest debt, the possibility of tax deductionsand the status of your emergency fund and retirement savings. Generally, he said, the biggest factor in deciding whether to pay off a mortgage early or invest your extra cash from a windfall, salary raiseor some other source is the interest rate. Remember that mortgage interest is generally tax-deductible, so your mortgage may be costing you less than it appears to be. More personal-finance coverage: What’s the best airline credit card? It’s a worthy goal to be free and clear of all debt, but is it the right choice if you’re trying to optimize your every dollar?

Comments

Post a Comment