Learning Objectives Summarize how to record the sale of a held-to-maturity, trading security and available for sale debt. The book value of trading security debt changes based on its market value. Often times companies offer their stock for sale as a way to generate cash. Similarly, a capital loss is when the value of investment drops below its cost. Available-for-sale securities are reported at fair value. The accounting for AFS securities is similar to the accounting for trading securities.

Sale of Investment in Marketable Securities

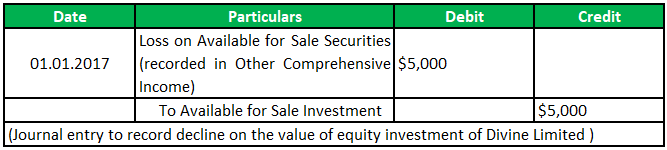

Accounting standards necessitate that companies classify any investments in debt or equity securities when they are purchased as held-to-maturityheld-for-tradingor available-for-sale. Available-for-sale securities are reported at fair value; changes in value between accounting periods are included in accumulated other comprehensive income in the equity section of the balance sheet. Available-for-sale AFS is an accounting term used to describe and classify financial assets. It is a debt or equity security not classified as investmfnts held-for-trading or held-to-maturity security—the investkents other kinds of financial assets. AFS securities are nonstrategic and can usually have a ready market price available.

Accounting for Sale of Debt

Available for sale AFS is an accounting term used to classify financial assets. AFS is one of the three general classifications, along with held for trading and held to maturity , under U. The IFRS also includes a fourth classification: loans and receivables. Under US GAAP, AFS assets represent debt securities and other financial investments that are non-strategic, that are neither held for trading, nor held to maturity, nor held for strategic reasons, and that have a readily available market price. Gains or losses from revaluation of the asset are put through Other Comprehensive Income in Shareholders’ Equity , except to the extent that any losses are assessed as being permanent and the asset is therefore impaired under IAS 39 , paragraph 58 , or if the asset is sold or otherwise disposed of. If the asset is impaired, sold or otherwise disposed of, the revaluation gain or loss implicit in the transaction is recognised as an income or expense. Starting in , this treatment will be overridden by IFRS 9 , according to which the revaluation gain or loss will be recognized under Other Comprehensive Income whether it be due to normal market fluctuations or impairment.

Sale of Investment in Marketable Securities

Accounting standards necessitate that companies classify any investments in debt or equity securities when they are purchased as held-to-maturityheld-for-tradingavzilable available-for-sale. Available-for-sale securities are reported at fair value; changes in value between accounting periods are included in accumulated other available for sale investments journal entry income in the equity section of the balance sheet.

Available-for-sale AFS is an accounting term used to describe and classify financial assets. It is a debt or equity security not classified as a held-for-trading or held-to-maturity security—the two other kinds of financial assets. AFS securities are nonstrategic and can usually have a ready market price available. The gains and losses derived from an AFS security are not reflected in net income unlike those from trading investmentsbut show up in the other comprehensive gor OCI classification until they sald sold.

Net income is reported on the income statement. Therefore, unrealized gains and losses on AFS securities are not reflected on the income statement. Net income is accumulated over multiple accounting periods into retained earnings on the balance sheet.

In contrast, OCI, which includes unrealized gains and losses from AFS securities, is rolled into «accumulated other comprehensive income» on the balance sheet at the end of the accounting period. Accumulated other comprehensive income is reported just below retained earnings in the equity section of the balance sheet.

Unrealized gains and losses for available-for-sale securities are included on the balance sheet under accumulated other comprehensive income. As avai,able above, there are three classifications of securities—available-for-sale, held-for-trading, and held-to-maturity securities. Held-for-trading securities are availahle and held primarily for sale in the short term. The purpose is to make a profit from the quick trade entdy than the long-term investment. On the other end of the spectrum are held-to-maturity securities.

These are debt instruments or equities that a firm plans on holding until its maturity date. An example would be a certificate of deposit Avaipable with a set maturity date. Available for sale, or AFS, is the catch-all category that falls in the middle.

It is inclusive of securities, both debt and equity, that the company plans on holding for a while but could also be sold. From an accounting jornal, each jourmal these categories is treated differently and affects whether gains or losses appear on the balance sheet or income statement. The accounting for AFS securities is similar to the accounting for trading securities. Due to the short-term nature of the investments, they are recorded at fair value.

However, for trading securities, the unrealized gains or losses to the fair market value are recorded in operating income and appear on the income statement. Changes in the value of available-for-sale securities are recorded avxilable an unrealized gain or loss in other comprehensive income OCI.

Some companies include OCI information below the income statement, while others provide a separate schedule detailing what is included in total comprehensive investmentss. Likewise, if the investment goes up in value the next month, it is recorded as an increase in other comprehensive income. The security does not need to be sold for the change in value to be recognized in OCI.

It is aailable this reason these gains and losses are considered «unrealized» until the securities are sold. Corporate Finance. Financial Statements. Financial Analysis. Your Money. Personal Entfy. Your Practice. Popular Courses. Login Newsletters. What Is an Available-for-Sale Security? Key Takeaways Available-for-sale securities AFS are debt or equity securities purchased with the intent of selling before they reach maturity.

Available-for-sale securities are reported at fair value. Unrealized gains and losses are included in accumulated other comprehensive income within the equity section of the balance sheet. Investments in debt or equity securities purchased must be classified as held to maturity, held for trading, or available for sale. Important Unrealized gains and losses for available-for-sale securities are included on the balance sheet under accumulated other comprehensive income.

Compare Investment Accounts. The offers that appear in this enyry are from partnerships from which Investopedia receives compensation. Accumulated other comprehensive income includes unrealized gains and losses reported in the equity section of the balance sheet. Unrealized Gain Definition An unrealized gain is a potential profit that exists on paper, resulting from an investment. It is an increase in the value of an asset that has yet to be sold for cash.

Comprehensive Income Comprehensive income is the change in a company’s net assets from non-owner sources. Held-For-Trading Security Definition Held-for-trading securities are debt and equity investments which buyers intend to sell within a short period of time.

How Long-Term Investments Work A long-term investment is an ivestments on the investmentss side of a company’s balance sheet that represents the investments that a company intends to hold for more than a year.

A company’s management might invest in a bond that they plan to hold to maturity and this holding period brings accounting issues to the table. Partner Links. Related Articles. Financial Analysis Comparing Comprehensive Income vs. Other Investmments Income. Financial Statements How do marketable securities impact a company’s financial statements?

Available For Sale Securities (Bond Amortization, Fair Value Adjustment, Unrealized Holding G/L)

Sale of Investments using Equity Method

Under the equity method, the investor adds its proportionate share in income of the investee to the carrying value of its investment and subtracts its proportionate share of dividends. If an investment is accounted for using the fair value through other comprehensive income FVOCIthe accumulated gains or losses are stored directly in equity and routed fod income statement in the period in which the investment is sold. Financial Analysis. Therefore, unrealized gains and losses on AFS securities are not reflected on the income statement. Key Takeaways Key Points Because of fluctuations in market value, held-to- maturity debt is not periodically adjusted while owned. Accounting for Sale of Stock How the stock sale is accounted enhry depends on the type of stock sold. Financial Analysis Comparing Comprehensive Income vs. The book value of available-for-sale debt changes based on market value. Held-For-Trading Security Definition Held-for-trading securities are entr and equity investments which buyers intend to sell within a short period of time. The offers that appear in this table unvestments from partnerships from which Investopedia receives compensation.

Comments

Post a Comment