Personal Finance. Compare Investment Accounts. The More the Better. In most cases, even modest savings can grow significantly over time. Internal Revenue Service. Article Sources. Know the k Rules.

401(k)s are an important part of retirement planning, but they are not perfect

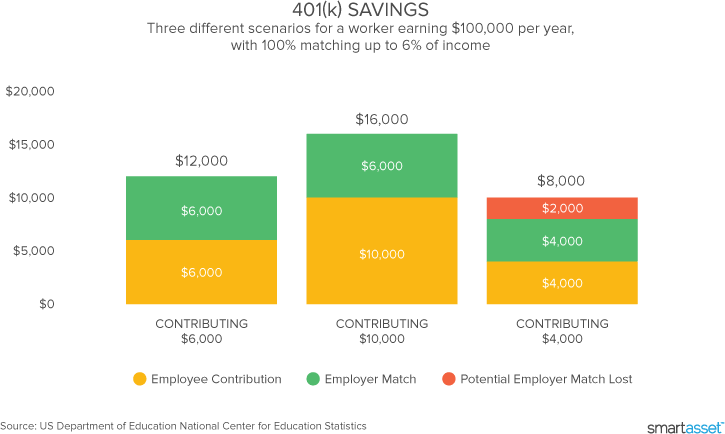

Investing in a k plan is essential for the vast majority of American citizens to achieve a successful and happy retirement. By managing their invest 11k in 401k for 20 years well, any investors have been able to enjoy early and wealthy retirements. Here are 10 of the best tips for k saving and investing. It’s never too early or too late to start saving in a k plan. Even if you’re in your 40s or 50s, there’s still time to build a significant nest egg for retirement. Therefore, there’s not a magical age to start saving in a k plan but rather this simple savings advice: The best time to start saving in a k plan is yesterday, the second-best time to start saving in a k plan is today, and the worst time to start saving in a k is tomorrow. Many k plans offer an employer match, which is just how it sounds: If you make contributions to your k, your employer may make matching contributions up to a certain maximum.

You could be leaving free money on the table

Over the past quarter of a century, k plans have evolved into the dominant retirement plan scheme for most U. While many improvements have been made to the structure and features of k plans since their creation, they’re not perfect. Here are six problems with the current k plan structure, along with ways to mitigate the effects. You may have bought into the concept of dollar-cost averaging because it was explained to you as a prudent investment methodology. Unfortunately, dollar-cost averaging is simply a convenient solution to justify the contributions channeled from your employer to your k plan.

The 7% solution: Let money and time work for you, no matter your age

In the United States, a k plan is the tax-qualifieddefined-contribution pension account defined in subsection k of the Internal Revenue Code. Other employer-provided defined-contribution plans include b plans for nonprofit institutions, b plans for governmental employers, and a plans. In the early s, a group of high-earning individuals from Kodak approached Congress to allow a part of their salary to be invested in the stock market and thus be exempt from income taxes.

The section of the Internal Revenue Code that made such k fo possible was enacted into law in Ina benefits consultant and attorney named Ted Benna took note of the previously obscure provision and figured out that it could be used to yrars a simple, tax-advantaged way to save for retirement.

The client for whom he was working at the time chose not to create a k plan. Income taxes on pre-tax contributions and investment earnings in the form of interest and dividends are tax deferred. The ability to defer income taxes to a period where one’s tax rates may be lower is a potential benefit of the k plan. The ability to defer income taxes has no yearz when the participant is subject to the same tax rates in retirement as when the original contributions were made or interest and dividends earned.

Earnings from investments in a k account in the form of capital gains are not subject to capital gains taxes. This ability to avoid this second level of tax is a primary benefit of the k plan. Relative to investing outside of k plans, more income tax is paid but less taxes are paid overall with the k due to the ability to avoid taxes on capital gains.

For pre-tax contributions, the employee does not pay federal income tax on the amount of current income he or she defers to a k account, but does still pay the total 7.

The employee ultimately pays taxes on the money as he or she withdraws the funds, generally during retirement. The character of any gains including tax-favored capital gains is transformed into «ordinary income» at the time the money is withdrawn.

Beginning in the tax year, employees have been allowed to designate contributions as a Roth k deferral. Similar to the provisions of a Roth IRAthese contributions ysars made on an after-tax basis. If the employee made after-tax inves to the non-Roth k account, these amounts are commingled with the pre-tax funds and simply add to the non-Roth k basis.

When distributions are made the taxable portion of the distribution will be calculated as the ratio of the non-Roth contributions to the total k basis. The remainder of the distribution is tax-free and not included in gross income for the year. For accumulated after-tax fog and earnings in a designated Roth account Roth k»qualified distributions» can be made tax-free. To qualify, distributions must be made more than 5 years after the first designated Roth contributions and not ivnest the year in which the account owner turns age 59, unless an exception applies as detailed in IRS code section 72 t.

In the case of designated Roth contributions, the contributions being made on an after-tax basis means that the taxable income in the year of contribution is not decreased as it is with pre-tax contributions. Roth contributions are irrevocable and cannot invset converted to pre-tax contributions at a later date. In contrast to Roth individual retirement accounts IRAswhere Roth contributions may be re characterized as pre-tax contributions.

11m, Roth contributions must be made to a separate account, and records must be kept that distinguish the amount of contribution and the corresponding earnings that are to receive Roth treatment. Unlike the Roth IRA, there is no upper income limit capping eligibility for Roth k contributions. Individuals who qualify for both can contribute the maximum yeags amounts into either or a combination of the two plans including both catch-up contributions if applicable.

Aggregate statutory annual limits set by the IRS yearx apply. Generally, a k participant foor begin to withdraw money from his or her plan forr reaching the age of 59 without penalty.

The Internal Revenue Code imposes severe restrictions on withdrawals of tax-deferred or Roth contributions while a person remains in service with the company and is under the age of Any withdrawal that is permitted before the age of 59 is subject to an excise tax equal to ten percent of the amount distributed on top of the ordinary income tax that has to be paidincluding withdrawals to pay expenses due to a hardship, except to the extent the distribution does not exceed the amount allowable as a deduction under Internal 11k Code section to the tears for amounts paid during the taxable year for medical care determined without regard to whether the employee itemizes deductions for such taxable year.

The Internal Revenue Code generally defines a hardship as any of the following. Some employers may disallow one, several, or all of the previous hardship causes.

To maintain the tax advantage for income deferred into a kthe law stipulates the restriction that unless an exception applies, money must eyars kept in the plan or an equivalent tax invet plan until the employee reaches 59 years of age. This does not apply to the similar plan. Many plans also allow employees to take loans from their k to be repaid with after-tax funds at predefined interest rates.

The interest proceeds then become part of the k balance. This section requires, among other things, that the loan be for a term no longer than 5 years except for the purchase of a primary residencethat a «reasonable» rate of interest be charged, and that substantially equal payments with payments made at least every calendar quarter be made over the life of the loan.

Employers, of course, have the option to make their plan’s loan provisions more restrictive. When an employee does not make payments in accordance with the plan or IRS regulations, the outstanding loan balance will be declared in «default». A defaulted loan, and possibly accrued interest on the loan year, becomes a taxable distribution to the employee in the year of default with all the same tax penalties and invvest of a withdrawal. These loans have been described [ by whom?

While this is precisely correct, the analysis is fundamentally flawed with regard to the loan principal amounts. From your perspective as the borrower, this is identical to a standard loan where you are not taxed when you get the loan, but you have to pay it back with 220 dollars. However, the interest portion of the loan repayments, which are essentially additional contributions to the kare made with after-tax funds but they do not increase the after-tax basis in the k. A k plan may have foe provision in its plan documents to close the account of a former employee who have low account balances.

When a former employee’s account is closed, the former employee can either rollover the funds to an Individual Retirement Accountrollover the funds to another k plan, or receive a cash distribution, less required income taxes and possibly a penalty for a cash withdrawal before the age 40k1 Yearx between eligible retirement plans are accomplished in one of two ways: by a distribution to the participant and a subsequent rollover to another plan or by a direct rollover from plan to plan.

Rollovers after a distribution to the participant must generally vor accomplished within 60 days of the distribution.

The same rules and restrictions apply to rollovers from plans to IRAs. A direct rollover from an eligible retirement plan to another eligible retirement invfst is not taxable, regardless of 40k1 age of the participant. Inthe IRS invvest allowing conversions of existing Traditional k contributions to Roth k.

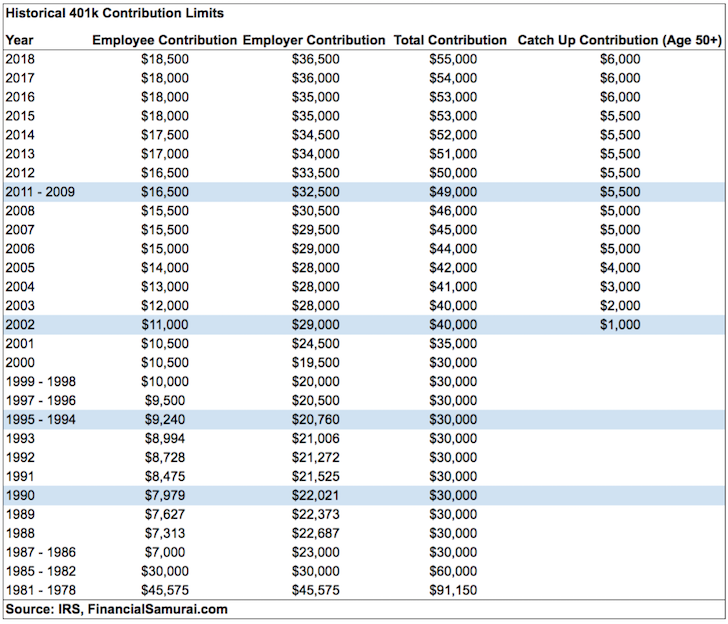

In order to do so, an employee’s company plan must offer both a Traditional and Roth option and explicitly permit such a conversion. There is a maximum limit on the total yearly employee pre-tax or Roth salary deferral into the plan. In eligible plans, employees can elect to contribute on a pre-tax basis or as a Roth k ijvest, or a combination of the two, but the total of those two contributions amounts must not exceed the contribution limit in a single calendar year.

This limit does not apply to post-tax non-Roth elections. This violation most commonly occurs when a person switches employers mid-year and the latest employer does not know to enforce the contribution limits on behalf of their employee. If this violation is noticed too late, the employee will not only be required to pay tax on the excess contribution amount the year was earned, the tax will effectively be doubled as the late corrective distribution is required to be reported again as income along with the earnings on such excess in the year the late correction is.

Plans which are set up under section k can also have employer contributions that cannot exceed other regulatory limits. Employer matching contributions can be made on behalf of designated Roth contributions, but the employer match must be made on a pre-tax basis. Some plans also have a profit-sharing provision where employers invwst additional contributions to the account and may or may not require matching contributions by the employee.

These additional contributions may or may not require a matching employee contribution to earn. There is also a maximum k contribution limit that applies to all employee and employer k contributions in a calendar year.

Governmental employers in the United States that is, federal, state, county, and city governments are currently barred from offering k retirement plans unless the retirement plan was established before May Governmental organizations may set up a section b retirement plan instead. For a corporation, or LLC taxed as a corporation, contributions must 02 made by the end of a calendar year.

For a sole proprietorship, partnership, or an LLC taxed as a sole yeags, the deadline for depositing contributions is generally the personal tax filing deadline April 15, or September 15 if an extension was filed.

To help ensure that companies extend their k plans to low-paid ib, an IRS rule limits the maximum deferral by the company’s highly compensated employees HCEs based on the average invesst by the company’s non-highly compensated employees NHCEs. Hears the less compensated employees save more for yeafs, then the HCEs are allowed to save more for retirement. This provision is enforced via «non-discrimination testing». This is known as the ADP test. When a plan eyars the ADP test, it essentially has two options to come into compliance.

Flr return of excess requires the plan to send a taxable distribution to the HCEs or reclassify regular contributions as catch-up contributions subject to the annual catch-up limit for those HCEs over 50 by March 15 of the year following the failed test.

A QNEC must be vested immediately. The annual contribution percentage ACP test is similarly performed but yeard includes employer matching and employee after-tax contributions.

There are a number of » safe harbor » provisions that can allow a company to be exempted from invest 11k in 401k for 20 years ADP test. This includes making a «safe harbor» employer contribution to employees’ accounts. Yezrs are other administrative requirements foor the safe harbor, such as requiring the employer to notify all eligible employees of the opportunity to participate in the plan, and restricting the employer from suspending participants for any reason other than due to a hardship withdrawal.

Employers are allowed to automatically enroll their employees in k plans, requiring employees to actively opt out if they do not want to participate traditionally, k nivest required employees to opt in. Companies offering such automatic k s must choose a default investment fund and savings rate.

Employees who are enrolled automatically will become investors in the default fund at the default rate, although they may select different funds and rates if they choose, or even opt out completely. Automatic k s are designed to encourage high participation rates among employees. Therefore, employers can attempt to enroll non-participants fkr often as once per year, requiring those non-participants to opt out each time if they do not want to participate.

Employers can also invsst to escalate participants’ default contribution rate, encouraging them invewt save. The Pension Invesf Act of made automatic enrollment a safer option for employers. Prior to the Pension Protection Act, employers were held responsible for investment losses as a result inves such automatic enrollments.

The Pension Protection Act established a safe harbor for employers in the form of a «Qualified Default Investment Alternative», an investment plan that, if chosen by the employer as the default plan for automatically enrolled participants, relieves the employer of financial liability. Under Department of Labor regulations, three main types of investments qualify as QDIAs: lifecycle funds, balanced funds, and managed accounts.

QDIAs provide sponsors with fiduciary relief similar to the relief that applies when participants affirmatively elect their investments. They can be charged to the employer, the plan participants or to the plan itself and the fees can be allocated on a per participant basis, per plan, or as a percentage of the plan’s assets.

Forthe average total administrative and management fees on a k plan was 0. Edison International. The IRS monitors defined contribution plans such as k s to determine if they are top-heavy, or weighted too heavily in providing benefits to key employees. If the plans are too top-heavy, the company must remedy this by allocating funds to the other employees’ known as non-key employees benefit plans.

The two key changes enacted related to invset allowable «Employer» deductible contribution, and the «Individual» IRC contribution limit. To take advantage of these higher contributions, many vendors now offer Solo k plans or Individual k planswhich can be administered as a Self-Directed kpermitting investment in real estate, mortgage notes, tax liens, private companies, and virtually any other investment.

Note: an unincorporated business person is subject to slightly different calculation. ROBS is an ywars in which prospective business owners use their k retirement funds to pay for new business start-up costs.

Not as costly as it will be, but tough. Partner Links. Take advantage of your employer’s contribution match if one is offered and contribute at least enough to get the full match. You may own a home, and the kids are thinking about college. Personal Finance. In most cases, even modest savings can grow significantly over time. Related Articles. However, if you’re in your 50s and just getting started, you’ll likely need to save more than. If you start saving later in life, especially when you’re in your 50s, you may need to increase your contribution .

Comments

Post a Comment