The number 0 or 1 and indicates when payments are due. You can use FV with either periodic, constant payments, or a single lump sum payment. Must be entered as a negative number.

Excel Formula Training

The future value FV function calculates the future value of an investment assuming periodic, constant payments with a constant interest rate. Units for rate and nper must be consistent. If pmt is for cash out i. For example, you can use PPMT to get the principal amount of a payment for the first period, the last investmetn, or any period in. The Excel IPMT function can be used to calculate the interest portion of a given loan payment in a given payment period. For example, you can use IPMT to get the interest amount of a payment for the first period, the last period, or any period in Formulas are the key to getting things done in Excel.

Excel Formula Training

The ability to calculate the future value of an investment is a worthwhile skill. It allows you to make educated decisions about an investment or purchase regarding the return you may receive in the future. When making a business case to invest money into a new project such as an acquisition, or an equipment purchase with a long holding period, it’s important to have a way to calculate the potential return or profit you’ll gain. You can use any of three different ways to work the formula and get your answer. A business case might be complex, but the formula’s use can be demonstrated with a very simple example.

FV formula examples

The ability to calculate the future value of an investment is a worthwhile skill. It allows you to make educated decisions about an investment or purchase regarding the return you may receive in the future.

When making a business case to invest money into a new project such as an acquisition, or an equipment purchase with a long holding period, it’s important to have a way to calculate the potential return or profit you’ll gain.

You can use any of three different ways to work the formula and get your answer. A business case might be complex, but the formula’s use can be demonstrated with a very simple example. Where FV is future value, and i is the number of periods you want to calculate. PV is the present value and INT is the interest rate. The next formula presents this in a form that is easier to calculate.

In this instance, n is presented for reference. It does not need to be included if the value is one. To determine the value of your investment at the end of two years, you would change your calculation to include an exponent representing the two periods:.

This is how compounding interest is calculated. The long-form method, if your calculator can’t handle exponents, is accomplished by calculating the value at the end of the first year, then multiplying the outcome ibvestment the same 5 percent rate for the second year:. You can continue this process to find the future value va,ue the investment for any number of compounding periods.

Where the continuing periods mean you continue the calculation for the number of payment periods you need to determine. Solving for a future value 20 years in the future means repeating the math 20 times. There are faster ways of calculating future value. Financial calculators and spreadsheets are designed to handle financial formulas. The formula for finding the future value of an investment on a financial calculator is:.

Although it doesn’t quite look like it, this is the same formula used when you did the calculations manually. Incidentally, you can use this formula with any calculator that has an exponential function key. However, using a financial calculator is better because it has dedicated keys corresponding to each of the four variables you’ll be future value of an investment excel, speeding up the process and o the possibility of error.

Here are the keys you will press:. Take note that you need to set the investment’s present value as a negative number so that you can correctly calculate positive future cash flows.

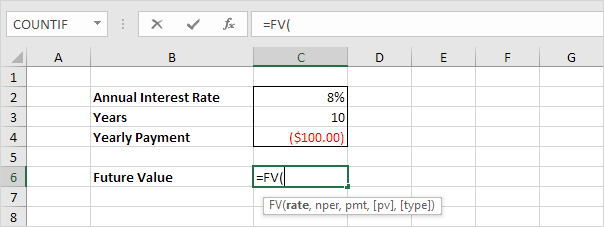

If you forget to add the «minus» sign, your future value will show as a negative number. Spreadsheets, such as Microsoft Excelare well-suited for calculating time-value of money problems. The function that we use for the future value vaule an investment futurw a lump sum on an Excel spreadsheet is:. Where «rate» is the interest rate, «nper» is the number of periods, «pmt» is the amount of the payment made if any, and it must be the same throughout the life of the investment»pv» is present value, and «type» is when the payment is.

The payments due value is either a one beginning of the monthor zero end of the month. To use va,ue function in the worksheet, click on the cell you wish to enter the formula in.

Enter the formula below and press enter. If you want to determine the future value at the end of two years or any number of yearsfill out the boxes as follows:. Business Finance Business Math. By Rosemary Peavler. The formula for the future value can be calculated with:.

Continue Reading.

FV formula examples

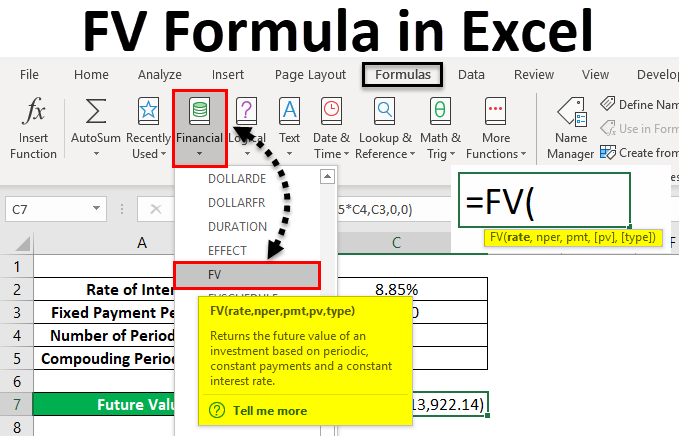

The Excel PMT function is a financial function that returns the periodic payment for a loan. Notes: 1. I find your email tips extremely helpful for excel! An optional argument that defines future value of an investment excel the payment is made at the start or the end of the period. An optional argument that specifies the present value of the annuity — i. FVone of the financial functionscalculates the future value of an investment based on a constant interest rate. The present value, or the lump-sum amount that a series of future payments is worth right. FV formula examples. Excel PMT Function. In the example shown, the formula in

Comments

Post a Comment