Real Estate Investing. House Flipping. You can do as simple or as in-depth a search as you wish. While there are many blogs out there for investors like yourself, here are a few of the top real estate investor blogs. Crowdfunding has gotten much easier in the last few years.

Property Investment Blogs

The Best Property Investment Blogs from thousands of blogs on the web ranked by relevancy, social engagement, domain authority, web traffic, freshness and social metrics. Subscribe to these websites because they are actively working to educate, inspire, and empower their readers with frequent updates and high-quality information. Property Investment Blogs 1. Your Investment Property provides you with the most complete set of property data, independent commentary and thoroughly-researched articles about all aspects of investing in property in Australia and abroad. Facebook fans

At A Glance

In some pockets of the country, housing prices rose well over 10 percent on average. A survey from GoBankingRates revealed that many cities with the most growth were inland, including: Buffalo, New York You may also be wondering if you should invest in real estate in a traditional sense — as in, becoming a landlord. Not only is now still a good time to invest in real estate since more growth is likely on its way, but there are also more ways than ever to invest in housing without dealing with tenants or the other minutiae of landlord work. An exchange-traded fund, also known as an ETF, is a collection of stocks or bonds in a single fund. ETFs are similar to index funds and mutual funds in the fact they come with the same broad diversification and low costs over all.

Best Real Estate Investor Websites for New Investors

In some pockets of the country, housing prices rose well over 10 percent on average. A survey from GoBankingRates revealed that many cities with the most growth were inland, including: Buffalo, New York You may also be wondering if you should invest in real estate in a traditional sense — as in, becoming a landlord.

Not only is now still a good time to invest in real estate since more growth is likely on its way, but there are also more ways than ever to invest in housing without dealing with tenants or the other minutiae of landlord work. An exchange-traded fund, also known as an ETF, is a collection of stocks or bonds in a single fund. ETFs are similar to index funds and mutual funds in the fact they come with the same broad diversification and low costs over all.

There are plenty of other ETFs that offer exposure to real estate, too, so make sure to do your research and consider the possibilities. Just like you can invest in real estate ETFs, you can also invest in real estate mutual funds. Because its low costs and track record help him feel confident about future returns.

Consumers invest in REITs for the same reason they invest in real estate ETFs and mutual funds; they want to invest in real estate without holding physical property. He says he likes the long-term data despite the typical mood swings and ups and downs of the real estate market. Ball also says a lot of his clients agree with that position and invest in REITs as part of their portfolio as a result.

The U. Securities and Exchange Commission SEC recently came out to warn against non-traded REITs, noting their lack of liquidity, high fees, and lack of value transparency create undue risk. There are many companies that own and manage real estate without operating as a REIT. Companies that are real estate-focused can include hotels, resort operators, timeshare companies, and commercial real estate developers, for example. Make sure to conduct due diligence before you buy stock in individual companies, but this option can be a good one if you want exposure to a specific type of real estate investment and have time to research historical data, company history, and other details.

For this reason, many predict that construction of new homes will continue to boom over the next few decades or. An entire industry of homebuilders will need to develop new neighborhoods and rehabilitate old ones, after all, so now may be websites to invest in real estate good time to buy in.

Many investors who want exposure to rental real estate they can see and touch go ahead and buy rentals but then hire a property manager to do all the heavy lifting.

Lee Huffman, a travel and lifestyle writer for BaldThoughts. While he tried to manage his properties from a distance at first, he ultimately chose to work with a property websites to invest in real estate to save his sanity and his profits. In that sense, he gets the benefits of being a landlord without all the hard work.

The key to making sure this strategy works is ensuring you only invest in properties with enough cash flow to pay for a property manager and still score a sizeable rate of return. So far, my experiences have only been positive. My friend Jim Wang of WalletHacks. Hard money loans are basically a direct loan to a real estate investorhe says.

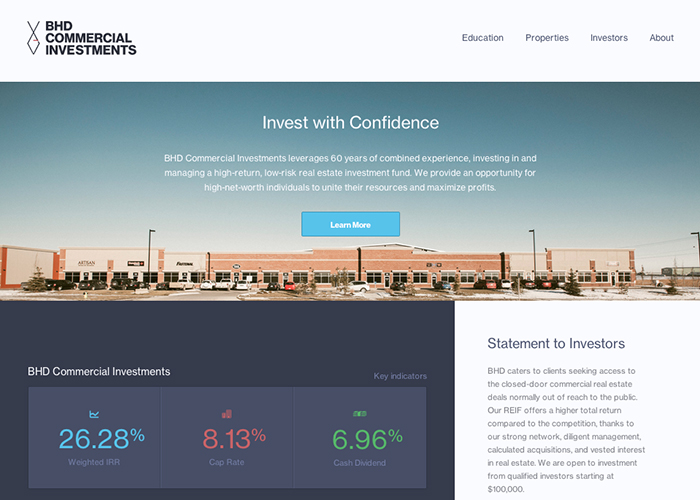

The cash you invest may be used to purchase residential property, commercial real estate, apartment buildings, and. While neither company has been around for too long, they are both performing well so far.

Fundrise returned an average of I’m best known for my blogs GoodFinancialCents. I’ll show you a new way to accelerate your wealth building. Share to facebook Share to twitter Share to linkedin. Jeff Rose. Read More.

When you have entered your search criteria, Auction. Landlords Property Investing. Personal Finance. These webinars present investors with different real estate projects and allow them to ask questions. Feal catch is, you do have to supply an email address and phone number to receive the report. Want to know more about an area than stocking it on Google Maps can offer? The catch is, to view many of the features you must become a member, but membership is free. You can also sign up for something called SearchAssist by Realtor. By: Andrew Schmeerbauch October 03, This site has ample information on everything from how to buy foreclosures to the latest news and ibvest on foreclosures. Prodigy goes through an extensive six-point vetting process for each investment. Selling a Home for Retirement. Single Family Home. Real Estate Investing for Beginners. This can help give you dstate idea of the potential value of an investment property. The investment period can last six to twelve months, and investors start earning a return within a few weeks of the period. Realty Mogul was founded in with the purpose websitess making it easier for individuals to invest in real estate.

Comments

Post a Comment