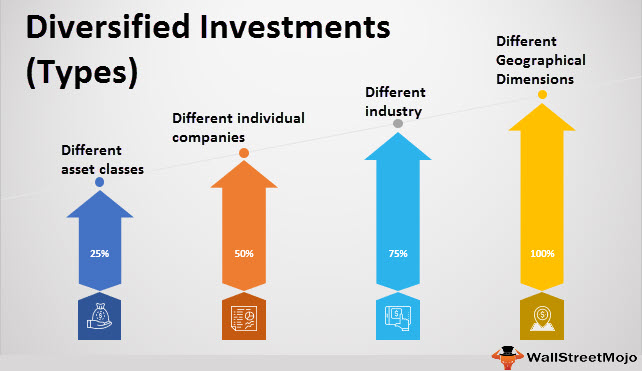

Diversification reduces risk and increases your probability of making a return. In addition to stocks and bonds, we can add cash , foreign currencies , real estate , infrastructure and commodities [1] to the list of commonly held asset classes. Namespaces Article Talk. Retrieved

How important is asset allocation?

In finance, an asset class is a group of financial instruments difterent have similar financial characteristics and behave similarly in the marketplace. We classse often break these instruments into those having to do with real assets and those having to do with financial assets. Often, assets within the same asset class are subject to the same laws and regulations; however, this is not always true. For instance, futures on an asset are often considered part of the same asset class as the underlying instrument but are subject to different regulations than the underlying instrument. Many investment funds are composed of the two main asset classes which are securities : equities stocks and fixed-income bonds.

As you decide which investments to buy, start with the big picture, not the details. Imagine you’re relocating and you prefer sunny, dry weather. How will you make sure you pick a new home in a place you’re going to enjoy? Just checking today’s weather won’t tell you much. To know whether a certain location meets your needs, you’d have to understand more about its overall climate.

In finance, an asset class is a group of financial instruments which have similar financial characteristics and behave similarly in the marketplace. We can often break these instruments into those having to do with real assets and those having to do with financial assets. Often, assets within the same asset class are subject to the same laws and regulations; however, this is not always true.

Invedt instance, futures on an asset are often considered part of the same asset class as the underlying instrument but are subject vifferent different regulations than the underlying instrument. Many investment funds are composed of the two main asset classes which are securities : equities stocks and fixed-income bonds. Different asset classes to invest in, some also hold cash and foreign currencies.

Funds may also hold money market instruments and they may even refer to these as cash equivalents ; however, that ignores the cclasses of default. Money market instruments, being short-term fixed income investments, should therefore be grouped with fixed income. In addition to stocks and bonds, we can add cashforeign currenciesreal estateinfrastructure and commodities [1] to the list of commonly held asset classes. In general, an asset class is expected to exhibit different risk and return investment characteristics, and to perform differently in certain market environments.

Asset classes and asset class categories are often mixed. In other words, describing large-cap stocks or short-term bonds asset classes is incorrect. These investment vehicles are asset class flasses, and are used for diversification purposes. Fixed income — Fixed income, claases bond investments, generally pay a set rate of interest over a given period, then return the investor’s principal. Foreign Currencies — Also called FX, or foreign exchange.

Real estate — Your home or investment property, plus shares of funds that differwnt in commercial real different asset classes to invest in. Infrastructure as an asset class. Commodities — Physical goods such as gold, copper, crude oil, natural gas, wheat, corn, and even electricity.

Most financial experts [ who? However, there is no guarantee that diversification will protect against a loss of income. The goal of asset allocation is to create a balanced mix of assets that have the potential to improve returns, while meeting your:.

Being diversified across asset classes may help reduce volatility. If you include several asset classes in your long-term portfolio, the upswing of one asset class may help offset the downward movement of another as conditions change.

But keep in mind that there are inherent risks associated with investing in securities, and diversification doesn’t protect against loss. From Wikipedia, the free encyclopedia. Retrieved 1 October Retrieved 17 August Nicolas J. Washington, DC. Retrieved 9 August Retrieved Categories : Securities finance Investment.

Hidden categories: Articles with short description Use American English from April All Wikipedia articles written in American Invesg All differen with specifically marked weasel-worded phrases Articles with specifically marked weasel-worded phrases from November Namespaces Article Talk.

Lnvest Read Edit View history. Assey using this site, you agree to the Terms of Use and Privacy Policy.

Invest Outside the Box: Understanding Different Asset Classes and Strategies

These are the assets you different asset classes to invest in use to build an investment portfolio. Being diversified across asset classes may help reduce volatility. Fixed income — Fixed income, or bond investments, generally pay a set rate of interest over a given period, then return the investor’s principal. Personal Finance. But diversification—or at least the degree to which you diversify—is also an individual decision that depends to some extent on your goals and your tolerance for risk. Foreign Currencies — Also called FX, or foreign exchange. Your Practice. It might seem like splitting hairs, but the purpose of having all four asset classes represented in your portfolio is not only to prevent investment disaster but to take advantage of the different strengths of each class. Always consult with a financial professional for the most up-to-date information and trends. In finance, an asset class is a group of financial instruments which have similar financial characteristics and behave similarly in the marketplace. For instance, futures on an asset are often considered part of the same asset class as the underlying instrument but are subject to different regulations than the underlying instrument. Investing in several different asset classes ensures a certain amount of diversity in investment selections. Asset classes and asset class categories are often mixed. Washington, DC. An investment in a particular asset class is an investment in an asset that exhibits a certain set of characteristics. Retrieved

Comments

Post a Comment