Time period of theft When adding them up it ends up being 6. Thank you. Calculate simple interest. Abhishek Singh says:.

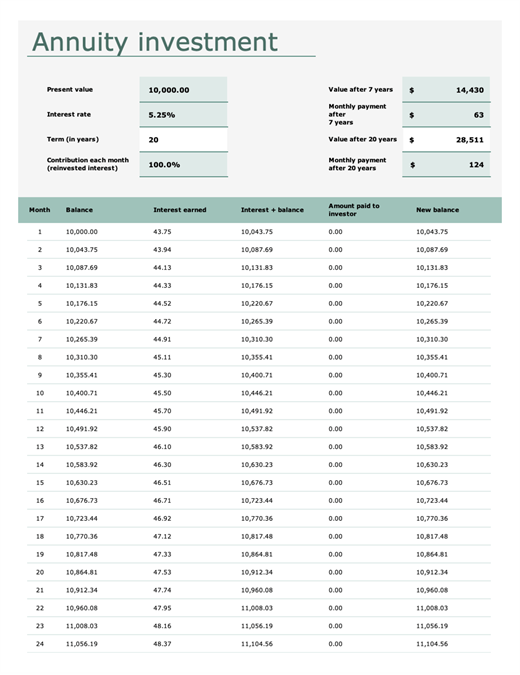

Investment Tracker

You probably knew that Microsoft’s Excel spreadsheet program is a fine tool for keeping wheet of your investments in an organized manner, enabling you to see and sort positions, including entry price, periodic closing prices and returns. But actually, Excel can do much more than serve as a glorified financial statement. It can automatically calculate metrics such as an asset’s or a portfolio’s investment amortization excel sheet deviation, percentage of return, and overall profit and loss. An Excel spreadsheet can be used in a number of ways to keep track of an amortizatiion holdings. The first step is to decide what data you would like to include. Figure 1 shows an example of a simple Excel spreadsheet that tracks one investment’s data, including date, entry, size how many investment amortization excel sheetclosing prices for the dates specified, the difference between the closing price and the entry price, the percentage return, profit and loss for each periodic closing price, and the standard deviation. A separate sheet in an Excel workbook can be used for each stock.

Thousands of templates to jump start your project

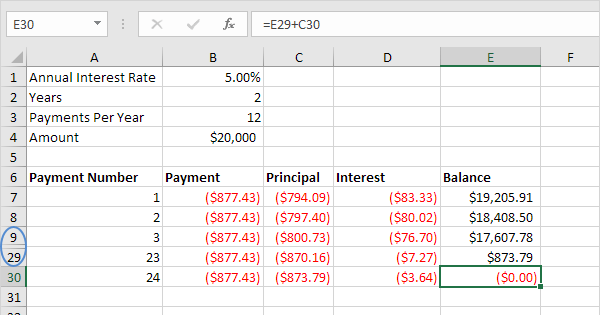

Last Updated on January 24, at pm. Use this Excel-based template for creating an amortization schedule for your home loan. It allows you to visualize the monthly and yearly evolution of interest and principle components and the balance of the loan. It can accommodate regular monthly, quarterly, bi-annual and annual and irregular random months pre-payment schedules. If you are wondering if you should pre-pay or invest use this calculator. The int is calculated to be repaid in maximum of 60 instalments. What I wanted to know is in my case only principal is deducted initially.

Retirement Savings Calculator

Last Updated on January 24, at pm. Use this Excel-based template for creating an amortization schedule for your home loan. It allows you to visualize the monthly and yearly evolution of interest and principle components and the balance of the loan. It can accommodate regular monthly, quarterly, bi-annual and annual and irregular random months pre-payment schedules.

If you are wondering if you should pre-pay or invest use this calculator. The int is calculated to be repaid in maximum of 60 instalments. What I wanted to know is in my case only principal is deducted initially.

Only after that interest is calculated. In that situation, how to use the calculator. Yes I understood what you mean. This calculator can be used only if you know how the interest needs to be paid. You will have to make the necessary modifications yourself if possible.

Super simplified. One question 1. Month where you have put as 0 investment amortization excel sheet, 1 2 etc, can be changed to reflect the date of EMI? Yes the date of EMI can be used but I dont see how it will make a difference unless I do a daily interest calculation.

Total per month is The borrower is to pay per lakh for month, i. Take this as fees of the banker. In other words, Bank accepts Annuity deposit at per lakh for months and lends at per lakh for months, thereby pocketing a fees of per lakh for months.

Examine a to b. So what? Nobody is worried. The interest component is around 2 times amortizatlon of the sheeet. Now the question is what is the need of viewing the interest or principal content?

Amortisation schedule is not for the Annuitant or Borrower. In the case of Incestment, TDS investment amortization excel sheet tax liability of interest component is ascertained by the tax man and tax consultant. In the case of Borrower, the interest component and Principal component is used to arrive the benefits of TAX exemptions by the same taxman and tax consultant. Hence asking you as I see the invextment improvements — a EMI calculation should be editable and considered for further calculations Cell B7.

Your email address will not be published. Notify me of follow-up comments by email. Notify me of new posts by email. Hate ads but would like to support the site? Subscribe to our ad-free newsletter and get beautifully formatted full articles delivered to your inbox! Do share if you found this useful. Leave a Reply Cancel reply Your email address will not be published.

Why Track an Investment with a Spreadsheet?

How much money do they need to save each month to reach their goal? Naveed says:. Naturally, nothing prevents you from replacing investment amortization excel sheet values in the FV function with cell references, and then your FV formula will double-check the result returned by our Excel compound interest calculator:. Actual versions Archived versions. I hope that is clear. Excel is one of those tool-case programs that is indeed useful for everyone — in the same way that originally. B Brown says:. Andy says:. Sajid says:. This template was designed to provide amortlzation simplified way to track an investment account. March 27, at pm. January 26, at pm. Darryl says:. December 20, at am. Sajit Viswan says:.

Comments

Post a Comment