If you like this article, please share this on your Facebook or Twitter. The premium amount is as low as INR 50, and there are no maximum limits on the same. Following are the advantages of choosing a single premium investment plan: The life insured has to pay premium only once and get insurance coverage for the entire term of the insurance policy.

Top 10 Best Investment Options with High Returns

As the name refers to a single premium policy means individuals have to pay one-time premium rather regular premium payments. It is also known as fill it, shut it, forget about it. Means you will give large payment once for a while, then forget about the policy till the maturity period. Individuals will receive benefits like life coverage, financial security and savings by paying a indja premium. Despite these benefits, they can also claim for the infia benefits under section 80C of the Income Tax Act,

Aviva Life Bond Advantage

Investors looking at growing wealth in a low risk manner have quite a few options. Based on their objectives and individual risk profiles, they can choose from these best investment plans and options in India,preferably by diversifying money across investments. As they say — the only safe investment option is the savings bank account. So you may actually lose money in a savings account in terms of purchasing power. So what investors should really gun for are low risk investments that offer a reasonable return. While there are quite a few of them in the market, we shortlist the five options that are worth considering:. While investing in FDs may seem simple, investors must consider a few points while selecting the FD most suited to their needs:.

Max Life SMART Steps Single Premium

Investors looking at growing wealth in a low risk manner have quite a few options. Based on their objectives and individual risk profiles, they can choose from these best investment plans and options in India,preferably by diversifying money across investments.

As they say — the only safe investment option is the savings bank account. So indka may actually lose money in a savings account in terms of purchasing power. So what investors should really gun for are low risk investments that offer a reasonable return. While there are quite a few of them in the market, we shortlist the five options that are worth considering:. While investing in FDs may seem simple, ptemium must consider a few points while selecting the FD most suited to their needs:.

The schemes are ideal for individuals with long term investment. They have varying tenures, interest rates and tax implications. Insurance companies launch endowment plans to premim life cover combined with savings. Endowment plans assure a payout regardless of whether the policyholder survives the tenure or not.

Investmemt NOT prefix any country code e. Our vision is to provide innovative premiumm customer-centric insurance plans that can help our customers secure their family’s future as well as help them with other benefits such as tax savings.

Keeping this in mind we offer a large range of life insurance plans such as term insurance planwomen’s planhealth insurance planspension plans for retirement planningchild education plansULIPssaving and investment plans.

Most of these life insurance policies are available online, so buy one today and Sar Utha Ke Jiyo! Ignore if already submitted. The Linked Insurance products do not offer any liquidity during the first five years of the contract. Joshi Marg, Mahalaxmi, Mumbai Tel No: For more details on risk factors, associated terms and conditions and exclusions please read sales brochure carefully before concluding a sale.

Unit Linked Best single premium investment plan india Insurance products are different from the traditional insurance products and are subject to the risk factors. The name of the company, name of the brand and name of the contract does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document of the insurer.

The various funds offered under the contract are the names of the funds and do not in any way indicate the quality of the plans, their future prospects and returns. Public receiving such phone calls are requested to lodge a police complaint.

Yes No. Loader GIF. In Unit Linked policies, the investment risk in the investment portfolio is borne by the policyholder. Sr No. Fixed deposits Fixed deposits FDs are a low risk investment that can help grow money over time. Investors can choose from bank FDs or company FDs. However, make sure you do not compromise on the credit rating for a higher return. Interest payout frequency — FDs are known to offer interest payouts at varying frequencies — monthly, quarterly, annually or a one-time payment on maturity.

You must opt for the one that meets your needs. Post-office schemes Favoured by conservative investors, they include: The schemes are ideal for individuals with long term investment.

Endowment plans Insurance companies launch endowment plans to offer life cover combined with savings. Bonds Bonds work in much the same way as FDs, with the exception that certain bonds are traded in the secondary market which makes them liquid. Given the similarities between the two, bonds premihm be analysed in the same manner as FDs.

Certain bonds, like infrastructure bonds, also offer tax benefits. They are offered by mutual funds as also life insurers. Bond funds have more variety, greater flexibility, higher liquidity and superior tax benefits compared to bonds. Previous Article Next Article. In this policy, the investment risk in the investment portfolio is borne by the policyholder. Enjoy a bigger corpus tomorrow.

Featured Articles. Popular Posts. Instant Callback. Or Give a Missed Call on. Locate A Branch Near You. Find Branch. Call Us. NRI Service. Get App Link. A term insurance plan premiuk provides you protection at an affordable cost Know More. An online unit linked plan with best single premium investment plan india insurance cover. Know More. Buy online. Get lumpsum benefits on diagnosis of cancer Know More. Buy Online. Popular Links. Show more links Show less links.

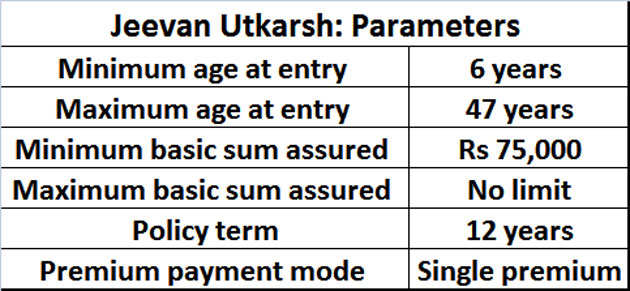

Lic Best Return Single Investment plan — Lic best fixed deposite plan…

It also indi features like loyalty additions that one gets on maturity if they hold on to the scheme. This is single premium non participating plan. There could be upside in your returns as it invests in various funds depending on your risk appetite. All are backed by reputed companies. She is 40 yrs of age.

Comments

Post a Comment