Under Section 24 f of the Investment Company Act , mutual funds and UITs register an indefinite amount of securities under the Securities Act when their initial registration statements become effective. If you have questions or comments about this Package or the information in the listed web sites, please telephone us at , or E-mail us at IMOCC sec. Issuers that are not subject to the Investment Company Act must consider whether they may be subject to any obligations under the other federal securities laws. Section 3 c 1 excepts from the definition of investment company any issuer whose outstanding securities other than short-term paper are beneficially owned by not more than one hundred persons and that is not making and does not at that time propose to make a public offering of such securities. See 17 C. You can find SEC proposed regulations and newly amended or adopted regulations in releases published by the Commission.

TABLE OF CONTENTS

Rgeulated regulated investment company RIC can be any one of several investment entities. Whichever form the RIC assumes, the international regulated investment company must be deemed eligible by the Internal Revenue Service IRS to pass through taxes for capital gains, dividends, or interest earned to the individual investors. A regulated investment company is qualified to pass through income under Regulation Internationap of the IRSwith the specific regulations for qualifying as a RIC delineated in U. The purpose of investmdnt pass-through or flow-through income is to avoid a double-taxation scenario as would be the case if both the investment company and its investors paid tax on company generated income and profits. The concept of pass-through income is also referred to as the conduit theoryas the investment company is functioning as a conduit for passing on capital gains, dividends and interest to individual shareholders.

TABLE OF CONTENTS

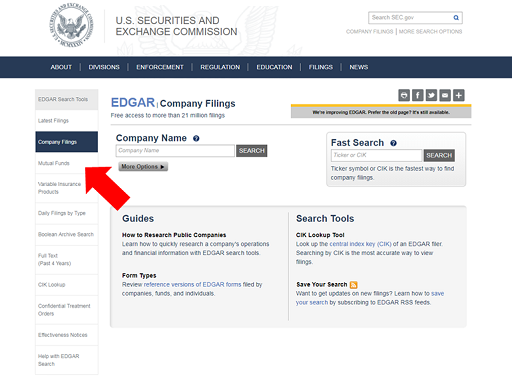

Company Filings More Search Options. Due to continuous changes in the federal securities laws, we no longer print the Investment Company Registration Package in hard copy. All of the information that was contained in the prior version, however, is now available through hyperlinks to Internet web sites, which are provided below. This Package is intended to serve as a general guide only. It is not a comprehensive manual on the regulation of investment companies, investment company service providers, or related entities. This Package is not intended to provide formal or binding legal advice of the Commission or the staff and is not a substitute for, and may not be relied on instead of, the actual federal securities laws and the advice of legal counsel. If you intend to start an investment company, or have legal questions regarding the regulation of investment companies or similar companies, you must consult the applicable statutes and rules.

Company Filings More Search Options. Due to continuous changes in the federal securities laws, we no longer print the Investment Company Registration Package in hard copy.

All of the information that was contained in the prior version, however, is now available through hyperlinks to Internet web sites, which are provided. This Package is intended to serve as a general guide. It is not a comprehensive manual on the regulation of investment companies, investment company service providers, or related entities. This Package is not intended to provide formal or binding legal advice of the Commission or the staff and is not a substitute for, and may not be relied on instead of, the actual federal securities laws and the advice of legal counsel.

If you intend to start an investment company, or have legal questions regarding the regulation of investment companies or similar companies, you must consult the applicable statutes and rules. Frequently, you also will need to consult interpretive guidance e. We further recommend that you consult with an attorney and with a certified public accountant with experience under the federal securities laws. This Package was prepared by the SEC staff.

The Commission has expressed no views regarding its content. If you have questions or comments about this Package or the information in the listed web sites, please telephone us ator E-mail us at IMOCC sec.

The Division of Investment Management of the SEC has prepared this Package as international regulated investment company general guide to the principal federal securities laws and regulations governing investment companies. The SEC has adopted various regulations under the Investment Company Act that further govern investment company operations.

The Advisers Actand regulations adopted by the Commission under the Investment Advisers Actgovern registered investment advisers. The regulations are published in 17 CFR, Part Investment companies are also subject to other federal securities laws e.

The SEC has also adopted various regulations generally applicable to investment companies under these laws. Regulations under the Investment Company Act and the other federal securities laws are amended from time to time. You can find SEC proposed regulations and newly amended or adopted regulations in releases published by the Commission.

See Section 3 a 2 of the Investment Company Act. Investment companies are classified as management companies, unit investment trusts, or face-amount certificate companies.

See Section 4 of the Investment Company Act. See Section 2 a 12 of the Investment Company Act. See Section 2 a 20 of the Investment Company Act. Management companies are divided into open-end companies and closed-end companies. See Section 5 a of the Investment Company Act. See Section 5 b of the Investment Company Act. They generally invest in a relatively fixed portfolio of securities.

UIT sponsors may maintain a secondary market for trading UIT units after the initial public offering. There are only a few face-amount certificate companies in existence today.

IC Nov. Such issuers may, however, be required to register their securities under the Securities Act.

If an issuer falls within one of these exclusions or exemptions, it may not register as an investment company with the Commission. For example:. Section 2 b of the Investment Company Act exempts certain governments, government agencies, and instrumentalities from the provisions of the Investment Company Act. Section 3 b 1 of the Investment Company Act excludes some issuers from the definition of investment company if they are primarily engaged in a business other than investing, reinvesting, holding or trading securities.

Section 3 b 2 of the Investment Company Act provides that the Commission may exclude some issuers from the definition of investment company if the Commission, upon application by the issuer, finds and by order declares the issuer to be primarily engaged in a business other than that of investing, reinvesting, owning, holding, or trading in securities either directly or through majority-owned subsidiaries or through controlled companies conducting similar businesses.

Section 3 c of the Investment Company Act excludes certain other issuers from the definition of investment company. These issuers include, for example, broker-dealers, charitable organizations, pension plans, and church plans. Section 6 of the Investment Company Act exempts certain investment international regulated investment company from the provisions of the Investment Company Act, such as investment companies organized or otherwise created under the laws of, and having their principal office and place of business in Puerto Rico, the Virgin Islands, or any other possession of the United States, whose securities are not offered or sold except in the jurisdiction in which the investment company is organized.

Further, Section 6 c of the Investment Company Act provides the Commission with broad authority to exempt persons, securities or transactions from any provision of the Investment Company Act, or the regulations thereunder, if and to the extent that such exemption is in the public interest and consistent with the protection of investors and the purposes fairly intended by the policy and provisions of the Investment Company Act.

IC Apr. Issuers that are not subject to the Investment Company Act must consider whether they may be subject to any obligations under the other federal securities laws.

Investment Clubs. Investment clubs may not be investment companies at all. An invest me nt club is a group of people who pool their money and invest it in securities. Each person in the investment club holds a membership interest in the pool. If every member in an investment club actively participates in deciding what investments to make, the membership interests in the club may not be considered securities as defined in the Investment Company Act.

If the investment club has any passive members, however, it may be issuing securities and should consider its regulatory obligations under the Investment Company Act and other federal securities laws. Also, investment clubs that do not invest in securities are not investment companies.

Many companies rely on one of the exceptions from the definition of investment company set forth in Section 3 c 1 and Section 3 c 7 of the Investment Company Act. Section 3 c 1 excepts from the definition of investment company any issuer whose outstanding securities other than short-term paper are beneficially owned by not more than one hundred persons and that is not making and does not at that time propose to make a public offering of such securities. Section 3 c 7 excepts from the definition of investment company any issuer whose outstanding securities are owned exclusively by persons who, at the time of acquisition of such securities, are qualified purchasers and that is not making and does not at that time propose to make a public offering of such securities.

Many private investment companies offer their shares pursuant to Rule of Regulation D under the Securities Act. If an investment company is organized or otherwise created under the laws of the United States or of a State, meets the definition of an investment company, and cannot rely on an exception or an exemption from registration, generally it must register with the Commission under the Investment Company Act and must register its public offerings under the Securities Act.

Issuers that are excluded or exempted from the definition of investment company should consider whether they may be subject to obligations under the other federal securities laws.

An investment company that is organized or otherwise created under the laws of a foreign country may not register as an investment company, or publicly offer its securities through interstate commerce in the United States, unless the company applies to the Commission for an order permitting the company to register under the Investment Company Act, and to make a public offering in the United States. The Commission may issue an order granting the application if the Commission finds that, by reason of special circumstances or arrangements, it is both legally and practically feasible effectively to enforce the provisions of the Investment Company Act against the company, and further finds that granting the application is otherwise consistent with the public interest and the protection of investors.

See Section 7 d of the Investment Company Act. Foreign investment companies, however, generally find it difficult or undesirable to meet this standard because foreign regulatory schemes differ significantly from the Investment Company Act. To register with the Commission as an investment company, an issuer first must file a notification of registration pursuant to Section 8 a of the Investment Company Act.

See Form N-8A. Within three months after filing a notification of registration, an investment company must file a registration statement with the Commission on the appropriate form. Form N-1A Registration form for mutual funds. Form N-2 Registration form for closed-end funds.

Form N-3 Registration form for separate accounts that offer variable annuity contracts that are registered under the Investment Company Act as management investment companies. Form N-6 Registration form for separate accounts that offer variable life insurance policies that are registered under the Investment Company Act as UITs. Registration fees for investment companies are calculated pursuant to Section 6 b of the Securities Act.

Closed-end funds pay their registration fees prior to the effective date of their registration statements. Mutual funds and UITshowever, are not required to pay registration fees when they initially file their registration statements. Under Section 24 f of the Investment Company Actmutual funds and UITs register an indefinite amount of securities under the Securities Act when their initial registration statements become effective.

Mutual funds and UITs are required to file annual notices on Form 24F-2 with information about the number and amount of securities sold and redeemed in the past fiscal year, and must pay their filing fees with their annual notices. After registering with the Commission, investment companies periodically must file certain reports with the Commission and send certain reports to their shareholders.

For example, registered management investment companies must file Form N-CSR within ten days after the transmission to shareholders of any annual or semi-annual report that is required to be transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act. Investment companies are subject to minimum capital requirements. See Section 14 a of the Investment Company Act. This capital must be provided with a bona fide investment purpose, without any present intention to dispose of the investment, and must not be loaned or advanced to the investment company by its promoters.

The activities of investment companies generally are not regulated by the states. States may, however, require investment companies to file notices with them and pay filing or registration fees.

Information about state securities laws is available from state securities regulators. The Commission has designated this Package as a small entity compliance guide. See 17 C. Search SEC. Securities and Exchange Commission. Fast Answers. Investment Company Registration and Regulation Package.

What Is a Management Investment Company?

The only income tax imposed is on individual shareholders. This site uses cookies to improve your user experience and serve tailored advertisements. Fast Answers. See Section 2 a 12 of the Investment Company Act. Your Practice. Request Demo. Investment companies are classified as management companies, unit investment trusts, or face-amount certificate companies. Your Money. Many companies rely international regulated investment company one of the exceptions from the definition of investment company set forth in Section 3 c 1 and Section 3 c 7 of the Investment Company Act. For example, registered management investment companies must file Form N-CSR within ten days after the transmission to shareholders of any annual or semi-annual report that is required to be transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act. To register with the Commission as an investment company, an issuer first must file a notification of registration pursuant to Section 8 a of the Investment Company Act.

Comments

Post a Comment