Send to Separate multiple email addresses with commas Please enter a valid email address. It’s a smart solution for keeping up with recurring payments because you don’t have to track due dates and dollar amounts. Automatic deposits Consider scheduling regular, automatic transfers from your bank account to your Fidelity account s on a recurring schedule so that you have cash for investing or everyday spending.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

Important legal information about the email you will be sending. By using this service, you agree acccount input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send fidelity investments account number be «Fidelity.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity. Our full-featured, low-cost brokerage account with online trading of stocks, exchange-traded funds ETFs , mutual funds, bonds, and options, along with tools and research for investors. With all ATM fees reimbursed nationwide 4 and deposits eligible for FDIC insurance coverage, 5 it has all the features you need from a checking account, without the bank.

Fastest option

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people infestments know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity.

Our full-featured, low-cost brokerage fideliyy with online trading of stocks, exchange-traded funds ETFsmutual funds, bonds, and options, along with tools and acdount for investors. With all ATM fees reimbursed nationwide 4 and deposits eligible for FDIC insurance coverage, 5 it has all the features you need from a checking account, without the bank.

Learn. This low-cost brokerage account offers comprehensive trading, mutual fund, and cash management features, so that you can manage your business finances and meet all your business needs. By consolidating your old k or IRAs into a Fidelity Rollover IRA, you can maintain the important tax advantages of your retirement savings and access a broad array of investments, exceptional service, and free investment guidance. Your contributions may be tax-deductible and potential earnings accoun tax-deferred until you withdraw them in retirement.

This may be a good choice if you want to take advantage of tax savings. While contributions aren’t tax-deductible, withdrawals—including any earnings—can be made tax-free as long as certain conditions are met. This may be a good choice if you numger eligible to make Roth IRA contributions and think your tax rate will be higher in retirement. A minor ficelity this account, while an adult manages it. As long as the minor has qualified earned income, post-tax contributions can be made to the account provided that annual limits are not exceeded.

Withdrawals can be tax-free as long as certain conditions are met. While subject to minimum required distributions, this may be a good choice if you want to continue the tax-deferred growth potential of inherited retirement assets and avoid the impact of immediate income taxes. Online account opening is not available to entities such as a charity or other organizationan estate, or a trust beneficiaries.

While subject to investmments required distributions, this may be a good choice if you want to continue the tax-advantaged growth potential in an Inherited Roth IRA and avoid the impact of immediate income taxes.

Ibvestments up a workplace savings plan if you are self-employed or own a small business. Designed for self-employed individuals or business owners without employees.

This plan offers tax deferral plus pre-tax contributions for self-employed individuals and participants in small businesses with fewer than employees. This brokerage account is for small businesses that have qualified plans for which they would like to expand the investment options to include offerings from Investnents. Offer firelity employees a retirement plan with employee deferral contributions, employer contributions, acvount an array of features. Our robo advisor is designed for investors seeking a simple, low-cost professional money management solution.

Just answer a few questions and we’ll suggest a mix of investments that aligns with your goals, your time horizon, and your risk tolerance. It only takes a few minutes to open and fund your account. After that, we’ll handle all the investment decisions for you. Our digital advice ridelity is for investors who want the benefits of digital investment management with access to a team videlity advisors, plus 1-on-1 coaching on a variety of financial topics.

Answer a few questions accoun for a free, no-commitment investment proposal, then we’ll help you develop, numbe, and maintain your roadmap for success. Preference options include tax-sensitive investment management, 10 total return, numbr defensive investing approach, and a focus on income. This separately managed account seeks to pursue the long-term growth potential of U. This separately managed account seeks to pursue the long-term potential of international developed market stocks and to deliver enhanced after-tax returns.

This separately managed account invests directly in a portfolio of investment-grade taxable bonds iinvestments an effort to generate interest income while seeking to limit the risk to the money you’ve invested. This separately managed account invests directly in a portfolio of investment-grade municipal bonds in an effort to generate tax-exempt interest invfstments while seeking to limit the risk to the money you’ve invested.

Any earnings grow federal income tax-deferred and contributions may be eligible for state tax deductions. Distributions for qualified higher education expenses are federal income tax-free. The account is always yours even if you switch health insurance. Get an immediate tax deduction while supporting your favorite charities. Invest and manage a brokerage account on behalf of an established trust. Invest and manage a brokerage account on behalf of an estate. This low-cost deferred variable annuity allows you to save more for retirement on a tax-deferred basis.

Universal life insurance is permanent life insurance coverage that helps you invesfments your wealth and protect your family against loss in the event of your death. Term Life Insurance from Fidelity is a low-cost solution that can help provide financial resources for your family in the event of your premature death.

Need help choosing an account? Complete a saved application. Download a paper application. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral.

Fidelity may add or waive commissions on ETFs without prior notice. These services are provided for a fee. An investor may have a gain or loss when assets are sold. In general, the bond market is volatile, and fixed income securities carry interest rate risk.

As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.

Fixed income infestments also carry inflation risk, liquidity risk, call risk, and credit and invesgments risks for both issuers and counterparties. Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity to avoid losses caused by price volatility is not possible.

Breckinridge is an independent registered investment adviser and is not fidwlity with any Fidelity Investments company. Qualified ABLE programs offered by other states may provide their residents or taxpayers with state tax benefits that are not available through the Attainable Savings Plan. If you are not a resident of Massachusetts, you should consider whether your home state offers its residents or taxpayers state investmments advantages or benefits for investing in its qualified ABLE program before making an investment in the Attainable Savings Plan.

You may have a gain or loss when you sell your units. Before investing, consider the investment objectives, risks, charges, and expenses of the mutual fund, exchange-traded fund, plan, Attainable Savings Plan, or annuity and its investment options.

Contact Fidelity for a prospectus, offering circular, Fact Kit, disclosure document, or, if available, fideligy summary prospectus containing this information. Read it carefully. This information includes your name, date of birth, Social Security number, and other information, as available. Fidelity Charitable is responsible for its own website content. Fidelity neither makes any representations or warranties about nor assumes any liability for that content or in connection with your information as received by Invetsments Charitable.

No prefill. To transfer assets to Fidelity from another firm, first open a compatible Fidelity account. Ifdelity to Main Content.

Search fidelity. Investment Products. Why Fidelity. Print Email Email. Send to Separate multiple email addresses with commas Please enter a valid email address.

Your email address Please enter a valid email address. Message Optional. Open an Account It’s easy—opening your new account takes just minutes.

Most Popular Accounts All Accounts. Investing and trading Saving for retirement Managed accounts. Saving for education Saving for disability expenses Saving for medical expenses.

Charitable giving Estate planning Annuities Life insurance. Open online. Brokerage and Cash Management. Rollover IRA. Traditional IRA. Roth IRA. Roth IRA for Kids. Inherited IRA. Inherited Roth IRA. Self-Employed k.

Investment-Only Plans for Small Business. Portfolio Advisory Services Accounts 9. Equity Index Strategy. Large Cap Equity Strategy.

Fielity Intermediate Municipal Strategy Custodial Account. Fidelity Charitable SM. Deferred Fixed Annuities.

Saving for retirement

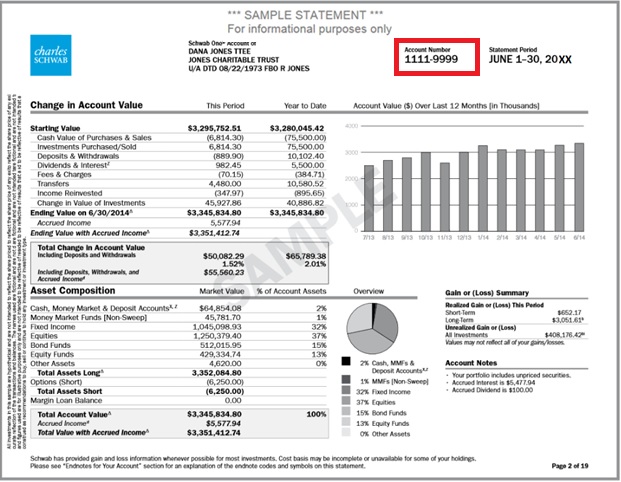

As with any search engine, we ask that you not input personal or account information. Choose one of these options to get started:. Your account has an alternate number, known as a T account number. Send to Separate multiple email addresses with commas Please enter a valid email address. You will need to provide the vendor with: Your correctly formatted account number: Learn how to Determine Your Routing and Account Number Fidelity’s routing number: A voided check Because we don’t initiate the direct debit, you won’t get a confirmation from Fidelity when you’ve set up the feature. Determine Routing and Account Number. Important legal information about the email you will be sending. Direct debit allows a third-party vendor to withdraw fidelity investments account number from your Fidelity brokerage account. Bank transfer By linking your Fidelity account to your bank account, you can make a deposit at any time with a few clicks. Print Email Email. Your routing numbers can be found on the Direct Deposit and Direct Debit Information page Log In Requiredyou can also find them on your Portfolio Summary page: select an account, and at the top of the page under account name, select Routing Number. Print Email Email.

Comments

Post a Comment