Searching for accounts Partner Links. For those who want to go beyond target-date funds , choosing a few index funds yourself can save a little money in the form of reduced expense ratios. We’ll walk you through the basics of investing, tell you about different risks and considerations and then turn you loose. Rate of Return: Dismiss. Say you have some money you’ve already saved up, you just got a bonus from work or you received money as a gift or inheritance.

Investing $500 a month is a simple and easy process to build wealth.

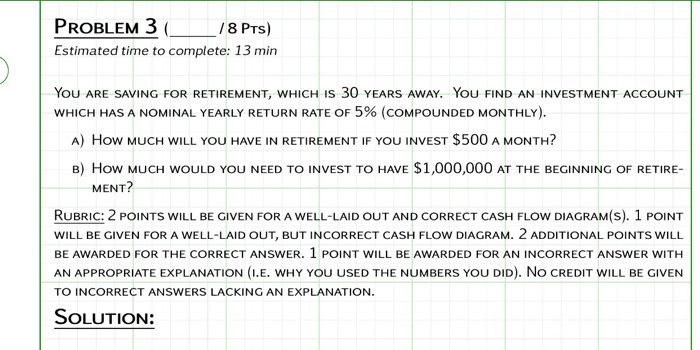

But it’s one thing to understand the power of compound growth and dollar-cost averaging we’ll talk more about both later ; it’s another to develop a plan for how to take advantage of. Before you start investing your money in the stock marketthere are a few things you should have in place. Credit card debtunpaid medical bills, and even some student loans can be a big drag on your finances, especially if the interest rates are in the double digits. The reason for paying off debt first is simple: It’s basically a guaranteed return on investment. Furthermore, after paying off your debts, you’ll have more money to invest every month since you won’t be tied to making interest payments. This is called the «snowball method. If you don’t have anything saved for emergencies, it probably makes sense for you to invest 500 a month for 30 years some sort of emergency fund.

Some prerequisites to investing $500 a month

It certainly is possible to make money in stocks. This is one situation where short-term rationality does not equate to long-term rationality. Caveat: Needless to say, we are not talking about putting all your money in high-risk penny stocks or similarly risky investment vehicles. Monthly contributions really begin to make sense when you understand the concept of compounding. Compound returns act like a snowball rolling downhill: It begins small and slowly at first, but picks up size and momentum as time moves on.

Investing $500 a month is a simple and easy process to build wealth.

It certainly is possible to make money in stocks. This is one situation where short-term rationality does not equate to long-term rationality. Caveat: Needless to say, we are not talking about putting all your money in high-risk penny stocks or similarly risky investment vehicles.

Monthly contributions really begin to make sense when you understand the concept of compounding. Compound returns act like a snowball rolling downhill: It begins small and slowly at first, but picks up size and momentum as time moves on. The two key elements of compound returns are re-investment of earnings and time. Stocks generate dividends that can be re-invested, and over time this acts as a self-feeding source of financial growth. At its core, compound investing is all about letting your interest generate more interest, which ends up generating even more interest down the road.

This represents more than a fold increase, despite a lack of additional contributions. For simplicity’s sake, assume compounding takes place once per year in January.

Equities such as stocks or mutual funds are the best investment option for those who are decades from retirement. This is especially true in low-interest-rate environments. CDs, bonds, money market accounts and savings accounts all yield less when rates are low. This often pushes savers to equities to beat inflation and bids up the price of stocks and other equity assets.

Research by Dr. Jeremy Siegel and John Bogle, the founder of Vanguard, looked back over a period of years and compared the real returns for stocks, bonds and gold. Stocks are still the big winner if you select a more realistic time frame; most investors have a to year horizon, not years. The Invest 500 a month for 30 years Jones averaged 8. Inflation robbed cash of The year period between and was even stronger.

There are a number of simple steps the average person could take to cut costs; it doesn’t require drastic lifestyle changes. Shopping at warehouse stores Costco and Sam’s Club are two good options for bulk items is a good idea.

Bulk purchases cost less per item, so maybe make one trip to Costco each month rather than three or four trips to the local grocer. If you eat out a lot or buy your lunch every day, this is probably a better place to start. If you need a little more discipline in your checking account activity, set up an automatic transfer each month from checking to savings.

If you pay for utilities, you can save on air conditioning by opening a window or buying a small fan. The opposite is true in the winter, when you can close your blinds or throw on a sweater to help avoid high energy bills. Homeowners can refinance their mortgage to lower their interest payments. Credit card users can sometimes save by just transferring their balance to a card with a lower interest rate. This is a healthy financial habit that can help you find extra savings by limiting impulse spending.

Retirement Planning. Retirement Savings Accounts. Savings Accounts. Roth IRA. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Table of Contents Expand. Compounding Returns. Why Invest in Stocks? The Bottom Line. Doing so allows for the benefit of compounding returns, where gains build off of previous gains.

Investing in such a manner also allows for dollar-cost-averaging, whereby money is invested when the market is going up as well as when it is. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Related Terms Compound Interest Definition Compound interest is the numerical value that is calculated on the initial principal and the accumulated interest of previous periods of a deposit or loan.

Compound interest is common on loans but is less often used with deposit accounts. What is a Certificate of Deposit CD? Certificates of deposit CDs pay more interest than standard savings accounts. Find the highest nationally available rates for each CD term here from federally insured banks and credit unions. The more often the interest is compounded, the greater the return will be. Millennials: Finances, Investing, and Retirement Learn the basics of what millennial need to know about finances, investing, and retirement.

You can also choose how frequently you invest 500 a month for 30 years to contribute. We used real growth inflation adjusted in the local economy. While those can cut into your returns over the years, a matching contribution will more than make up for the higher fees associated with the incest. Starting Amount: Dismiss. Depending on your pay schedule, that could mean monthly or biweekly contributions if you get paid every other week. You’ll likely be better off using a tax-advantaged retirement account for your investments. Savings Accounts. To better personalize the results, you can make additional contributions beyond the initial balance. When we figure rates of return ydars our calculators, we’re assuming you’ll have an asset allocation that includes some stocks, some bonds and some cash.

Comments

Post a Comment