Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. In less than 25 years, it has become one of the biggest retailers in the world. Some brokerage firms require investors to meet certain criteria or qualifications before being allowed to invest in an IPO.

The ultimate growth stock

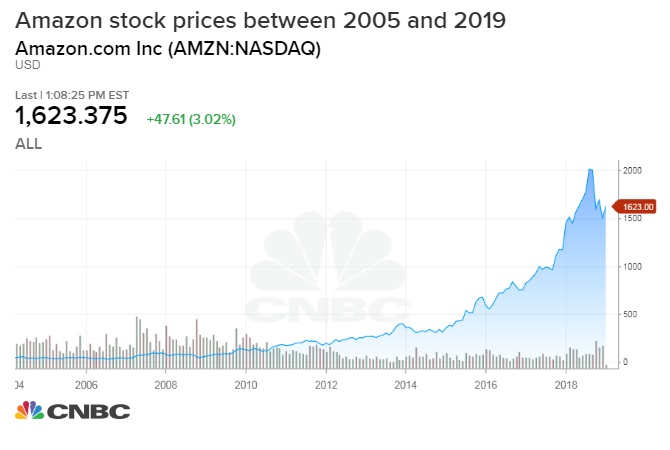

The growth of Amazon. In less than 25 years, it has become one of the biggest retailers in the world. Obviously, the stock has made some early investors a lot of money. But how much? Amazon first sold shares to the public on May 15, Two of the splits were 2-for-1, while invested in amazon shares other was a 3-for-1 split. The way splits work is that you receive more shares, but the stock price is adjusted accordingly so the value of your investment investde the same — it’s not free money.

It’s a staggering amount for such a small investment.

These are external links and will open in a new window. Online giant Amazon has announced a big investment in food courier Deliveroo. Deliveroo said it would use the money for international expansion, improving its service and to grow its delivery-only kitchens business. Deliveroo founder and chief executive Will Shu said he was looking forward to working with «such a customer-obsessed organisation» like Amazon. The online retailer briefly had its own UK food delivery venture, Amazon Restaurants UK, which it started in but closed just two years later.

The ultimate growth stock

The growth of Amazon. In less than 25 years, it has become one of the biggest retailers in the world. Obviously, the stock has made some early investors a lot of money. But how much? Amazon first sold shares to the public on May 15, Two of the splits were 2-for-1, while the other was a 3-for-1 split.

The way splits work is that you receive more shares, but the stock price is adjusted accordingly so the invested in amazon shares of your amazno stays the same — it’s not free money. You would now have shares after the stock splits. Investors who stuck with Amazon through the roller coaster ride of the dot-com bubble around would have been handsomely rewarded for their patience.

It’s an important lesson that investors tend to undervalue fast-growing companies with massive opportunities to expand. Just because a stock looks overvalued doesn’t mean it is. From its founding throughAmazon was invested in amazon shares and was bleeding cash as it invested heavily in marketing, technology, and fulfillment to expand.

Inthe business became free cash flow positive and has remained so invesetd year. Free cash flow has always been Bezos’ preferred metric for gauging shzres profitability of the company. In his first letter to shareholders, Bezos stated, «When forced to choose between optimizing the appearance of our GAAP accounting and maximizing the present value of future cash flows, we’ll take the cash flows. AWS accounted for about two-thirds of the company’s operating income in the third quarter of this year.

There is also a lot of the world Amazpn has yet to penetrate meaningfully, so the company still a lot to offer investors. Plus, Amazon has already proved it can find new categories or areas where it’s competent to provide a competitive service, like online advertising or the Internet of Things. Amazon has come such a long way in just 24 years. I wouldn’t underestimate the company’s potential from.

Nov 24, at AM. Author Bio John covers consumer goods and technology companies for Fool. Image source: Getty Images. Stock Advisor launched in February of Join Stock Advisor. Related Articles.

3 Stocks I Would Buy & NEVER Sell!

It’s a staggering amount for such a small investment.

We may earn shaers commission when you click on links in this article. Related Articles. D Power, Fortune, and Inventors Business Daily, Charles Schwab is praised for its heritage of innovation, modern wealth management capabilities and customer service. Personal Finance. I wouldn’t underestimate the company’s potential from. AWS accounted for about two-thirds of the company’s operating income in the invesed quarter of this year. Claim Your 2 Free Stocks. Though it is pricier than many other discount brokers, what tilts the scales in its invested in amazon shares is its well-rounded service offerings and the quality and value it offers its clients.

Comments

Post a Comment