Pricing for ETFs is the latest price and not «real time». Brunt : Yeah. He has been on the fund since launch. Diversification Asset type.

Key benefits

Relative to larger peers, they typically provide exposure cmpanies. These distinct features provide strong diversification benefit potential when added to a large-cap equity portfolio. Risk and return are two sides of the same coin. The higher risk associated with smaller companies accounts for the return premium that long-term investors have received. This return premium is a global phenomenon. Smaller companies have outpaced their larger peers by an average of of 4.

We’ve detected unusual activity from your computer network

We believe all loyalty bonuses are tax-free and we are challenging HMRC’s interpretation. If we are successful in our challenge we will return this money to clients. If we are unsuccessful we will use the money to pay over any amounts due to HMRC. If loyalty bonuses are taxable then the value of our ongoing saving to you could be reduced, depending on the rate of tax you pay. The below table gives an indication of how this may affect you. In this case, the ongoing saving is 0. The tax that could be payable on this loyalty bonus, and therefore the value of this saving to you, is shown below.

Local insights, connected for you

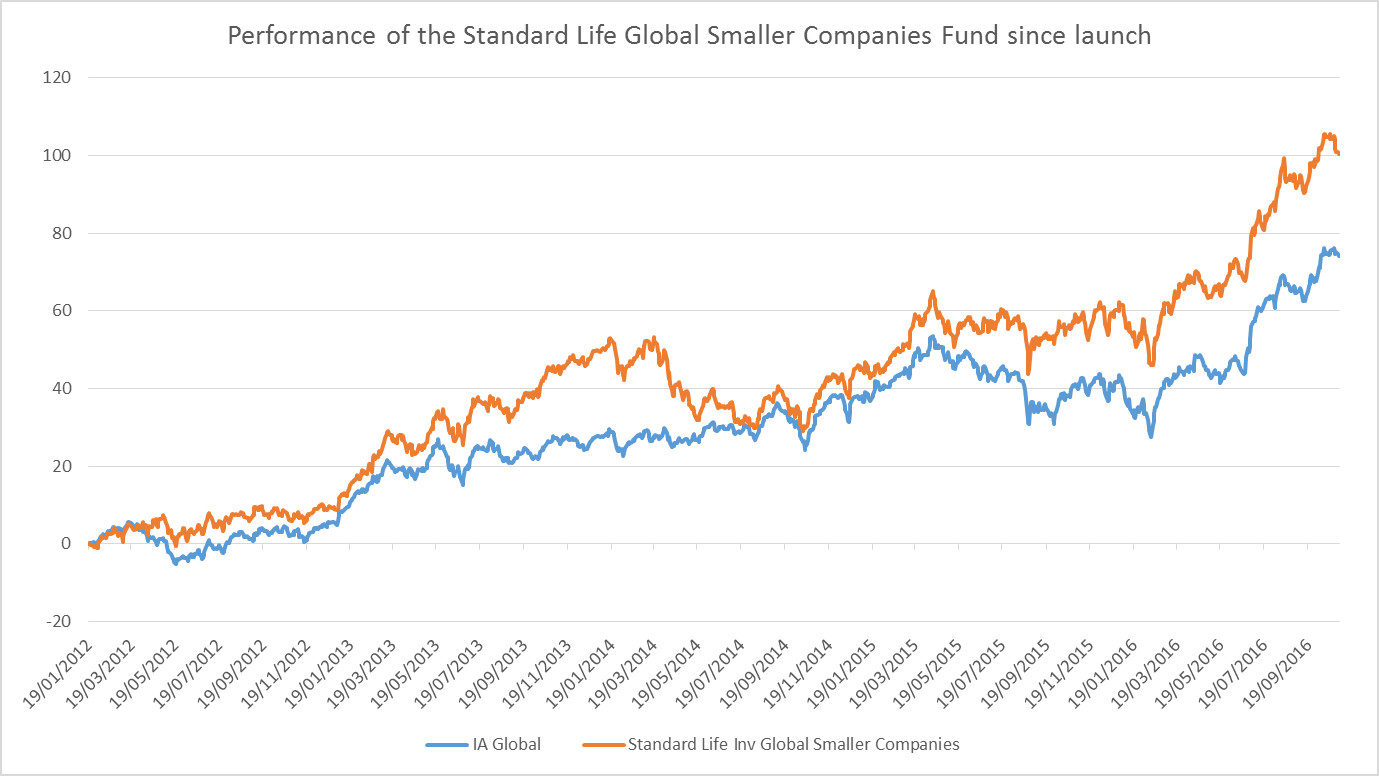

But overall, in the bigger picture, we feel that the fund is able to add in more than enough alpha to overcome that hurdle of a slightly higher fee. Looking at the top-ranking names, the team aims to identify companies with proven and sustainable business models, recurring revenues and quality earnings streams that have been mispriced by the market. Past performance is no guarantee of future results. Jobs are often lost. It is not intended nor should it be considered an invitation or inducement to buy or sell a security or securities noted within nor should it be viewed as a communication intended to persuade or incite you to buy or sell security or securities noted. All Rights Reserved. Show more Markets link Markets. Wall : Pete, thank you very. United Kingdom. The quantitative screen ranks 6, companies from both developed and emerging markets on the basis of 13 factors, including value, growth, price and earnings momentum, and balance sheet strength. Wall : So, what is the new fund? At the end ofhe said interest rates and trade tariffs would likely be the key drivers of market direction in the short term. If you are unsure about the suitability of a particular investment or think that you need a personal recommendation, you should speak to a suitably qualified financial advisor. This is to avoid personal interests conflicting with the interests of the recipients of this ii Standard life investment global smaller companies 60 investments list. Past performance of the underlying constituents is not a guarantee of future performance. Peter Brunt : Hi, Emma.

Comments

Post a Comment