Such an investor can put his savings in growth shares as he is willing to accept risk. From there I went to yahoo finance to do research on the stock prices of those companies from January 2, to January 31, It encompasses knowing how to budget, manage cash and taxes, borrowing of funds, the use of credit cards, minimizing risk, investing and planning for retirement. The stages of development in the country have accelerated demand and a number of new organizations and services have increased. Commodities are bought and sold in spot markets; contracts to buy and sell commodities at a future date are traded in future markets. On March 22nd, the net income applicable to common shares was 1,,, this number is a slight decrease from the 1,,, net income applicable to common shares on December 28, Yahoo Finance.

Pros, Cons, and Ways to Lower Risk

What are the pros and cons of investing in the stock market? Historically, the stock market has delivered generous returns to investors over time, but stock markets also go stck, presenting investors with the possibility for both profits and loss; for risk and return. How much of each type of investment should you have? Kiplinger’s Personal Finance Magazine. Accessed Nov. Official Data. Federal Trade Commission Consumer Information.

Individual Learning Project

After reading this essay you will learn about Investment:- 1. Meaning of Investment 2. Importance of Investment 3. Factors Favourable 4. Investment Media.

Investing in the Stock Market

What are the pros and cons of investing in the stock market? Historically, the stock market has delivered generous returns to investors over time, but stock markets also go down, presenting investors with the possibility for both profits and loss; for risk and return. How much of each type of investment should you have? Kiplinger’s Personal Finance Magazine. Accessed Essay on investment in stock market. Official Data. Federal Trade Commission Consumer Information. Federal Reserve Bank of St.

United States Securities and Exchange Commission. Louis Economic Research. US Economy and News U. By Kimberly Amadeo. Pros Grow with economy Stay ahead of inflation Easy to buy and sell. Cons Risk losing it all Takes time to research Emotional ups and downs.

Stock investment offers plenty of benefits:. Takes advantage of a growing economy : As the economy grows, so do corporate earnings. That’s because economic growth creates jobs, which creates income, which creates sales. The fatter the paycheck, the greater the boost to consumer demand, which drives more revenues into companies’ cash registers. That way, you can buy and hold even if the value temporarily drops. You can purchase them through a broker, a financial planner, or online. Some online brokers essay on investment in stock market as Robinhood let you buy and sell stocks commission-free.

They invest in fast-growing companies that appreciate in value. Other investors prefer a regular stream of cash. They purchase stocks of companies that pay dividends. Those companies grow at a moderate rate. Economists use the term «liquid» to mean you can turn your shares into cash quickly and with low transaction costs. Here are disadvantages to owning stocks:. Risk: You could lose your entire investment. If a company does poorly, investors will sell, sending the stock price plummeting.

When you sell, you will lose your initial investment. You also have to pay capital gains taxes if you make money. A well-diversified portfolio should keep you safe if any one company goes.

Time: If buying stocks on your own, you must research each company to determine how profitable you think it will be before you buy its stock.

You must learn how to read financial statements and annual reports, and follow your company’s developments in the news. Emotional roller coaster : Stock prices rise and fall second-by-second. Individuals tend to buy high, out of greed, and sell low, out of fear. The best thing to do is not constantly look at the price fluctuations of stocks, just be sure to check in on a regular basis.

Professional competition: Institutional investors and professional traders have more time and knowledge to invest. They also have sophisticated trading tools, financial models, and computer systems at their disposal. There are ways to reduce your investment risk. That means a mix of stocks, bonds, and commodities. Over time, it’s the best way to gain the highest return at the lowest risk. The term «cap» stands for capitalization. It is the total stock price times the number of shares.

It’s good to own different size companies because they perform differently in each phase of the business cycle. Diversification allows you to take advantage of growth without being vulnerable to any one stock. One easy way to diversify is through the use of index funds or index ETFs. Article Sources. Continue Reading.

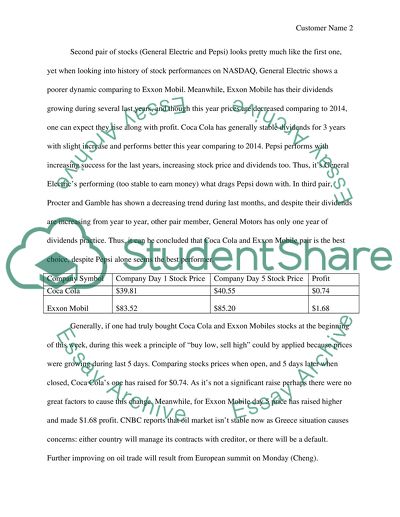

One investor may prefer safe government bonds whereas another may be willing to invest in blue chip equity shares of a company. The financial institutions in existence in India are mutual funds, development banks, commercial banks, life insurance companies, investment companies, investment bankers and mortgage bankers. In India, the political climate is conducive to investment since the new economic reforms in leading to liberalization and globalization. Next, I invested in a popular food and beverage company, PepsiCo Inc. Investing in StockTrak was a very interesting process. The company provides transaction processing services comprising transaction switching, which include authorization, clearing, and settlement; connectivity services, such as network access, equipment, and the transmission of authorization and settlement messages; and other payment-related services, including products used to prevent or detect fraudulent transactions, cardholder services, professional consulting and research services, compliance and penalty, account and transaction enhancement services, holograms. Market Information: 8. Food Specialties Limited, Cadburys, Colgate Palmolive, Hero-Honda have been known to raise the hopes of investors by giving high rates of return. He may also require safety of securities. Cash has a definite and constant rupee value, whether it is deposited in a bank or kept in a cash box. With the death or retirement of any of the partners, a partnership firm is dissolved. I had a total of 93 trades this semester, a lot of which were made up of equity trades. The success stories of Reliance, Infosys, Wipro give to the investor the dream of essay on investment in stock market appreciation of investment by several times. In India, there are a large number of financial institutions under Central Government and State Governments and rural bodies that have encouraged the growth of savings and investment. For instance, one investor may face a situation when he requires extreme liquidity. These institutions lend an essay on investment in stock market of strength to the capital market and promote discipline while encouraging growth. The Indian investor in this context cannot choose his investments very easily.

Comments

Post a Comment