Here are a few to get you started:. I gave some clues in the first part of this article about how to correct some of Dave Ramsey’s bad mutual fund advice. Build Long-Term Wealth Work with an investing pro and take control of your future.

What Does Dave Ramsey Invest In?

For instance, Ramsey suggests the snowball method of debt repayment but the stacking method is superior when it comes to saving money on your debt. But if you follow the snowball method, you will pay off your debt. So we say potato and Dave says potato but we both get you to debt free in the end. However, there is a big. His investment philosophy is conservative, to say the. It is heavy on cliches I counted four and light on advice or even basic information like explaining different types of investments. At LMM, we want our listeners and readers to be fully informed.

What Are Mutual Funds?

I get it. Hear me say this: Anyone can invest—including you. Most people do. And I will tell you the same thing! Your income is your most important wealth-building tool. Regardless of your age, you want to be financially ready to invest as soon as you can.

When Should I Start Investing?

For instance, Ramsey suggests the snowball method of debt repayment but the stacking method is superior when it comes to saving money on your debt. But if you follow the snowball method, you will pay off your debt. So we say potato and Dave says potato but we both get you to debt free in the end.

However, there is a big. His investment philosophy is conservative, to say the. It is heavy on cliches I counted four and light on advice or even basic information like explaining different types of investments.

At LMM, we want our listeners and readers to be fully informed. The rule of 72 is a method Dave recommends as part of building your investment strategy; it identifies your investing timeline. You divide 72 by the rate of return you get on an investment. That number is about how many years it will take for your investments to double in value. There are a few problems with. This number is exaggerated. The backlash was immediate. Well, no shit Dave.

I get the inspirational. But I think most of us could do with a bit more of the instructional bit. More on that to come.

Dave encourages long-term investing. In order rrecommendations play the long con, you have to tune out a lot of the coverage about the stock market and the economy.

We agree with. Timing the recommejdations rarely pays off. Dollar cost averaging does. Put your money into Betterment and leave it alone for a few decades. Buy and hold. An ELP is an endorsed local provider. This is a financial advisor. Dave can recommend financial planners to you virtually vor in the country. And Dave makes a ramsy good living doing. He sells financial services. Dave recommends getting a recommendation for an advisor from family and friends.

I hear Bernie Madoff got a lot of clients via word ingesting mouth. He suggests making sure the advisor has recommenfations appropriate credentialing and certification. But what do you know about that? I mean, this little PDF is less than 20 pages. So how would you know a good financial planner from a bad one? But how well are they vetted? His tips on avoiding fraud just reiterate what he wrote about choosing an advisor.

Ask questions. Okay, not all of us love dealing with money. In that case, you might choose to hire an advisor. And we agree inveesting that, especially if your plan offers to match. That is free money! The money is deducted from your paycheck before you even see it.

If you want to save money paying interest on debt, the stacking method is superior. Step Three is months worth of expenses saved. We believe that 2. Dave also recommends IRAs. Dave suggests paying your house off early; we think that money should be invested. If you need money fast, selling a home is not the way to get it.

A home is not a ffor investment. He also wants you to research recommendatiojs fund manager, fir longer they have been around, the better. To the uninformed investor, a fee of 1. We regularly pay more than that when we use an out of network ATM to withdraw cash.

The average fee charged by an actively managed fund charges is just that, 1. But do you know what has lower fees than refommendations mutual funds? Index funds like Betterment. And the investments in an index fund are chosen using an algorithm which takes humans largely out of the equation. Index funds regularly outperform actively managed mutual funds and the fees are lower.

We say skip the high fee mutual fund and invest in an index dave ramsey recommendations for investing instead. The best time to start investing was when you were 18; the second best time is. Dave recommends delaying retirement by two years. Retirement is a numbers game, but you need to know what your number is.

How much money do you need to retire? You may need to save longer than you would like, to cut expenses, so you have more money to throw at investments or find a way to bring in side income. This part of the investment strategy is making sure you have adequate insurance coverage. Dave suggests an fpr policy that will provide additional coverage and protect recommenxations wealth if you were to be sued. He also recommends long-term care insurance to cover the cost of things like nursing homes and investung nursing care.

Medical bills are one of the leading causes of bankruptcy so making sure you have adequate coverage matters. This part of the investment strategy is basically a rehash of the advice given when you are choosing a mutual fund.

Stay in for the long term even if the fund has a bad quarter and of course, trust your inbesting. But if you skip recommemdations mutual fund in favor of an index fund, you can skip this step too! Using your money to buy experiences rather than things also makes us happier.

You worked hard for your money and you are allowed to spend some of it on things that give you and other people happiness. Did you notice anything missing from the Dave Ramsey investing strategy? Where in the hell is real estate?! Apart recommendstions the home you live in, there is no mention of real estate which is a shame because real estate is one of the best ways to earn passive income.

Okay, for most people that will rule out a rental property. Okay, fair enough I guess. But what about an eREIT? Read his strategy and our Investing Blueprint and see which you think is better. Use this link and get six months free. Listen Money Matters is dave ramsey recommendations for investing.

When you recommednations through links on our site, we may earn an affiliate commission. How we make money. Get our best money lessons : Sign Up, It’s Eecommendations. Candice Elliott is a substantial contributor to Listen Money Matters. She has been a personal finance writer since and has written extensively on student loan debt, investing, and credit.

She has successfully navigated these areas in her own life and vave how to help others do the. Candice has answered thousands of questions from the LMM community and spent countless hours doing research for hundreds of personal finance articles.

She happily calls New Orleans, Louisiana home-the most fun city in the world. Read These Next. Subscribe and have your financial mind blown. It’s about time you got ddave shit. Get Educated.

❗ Dave Ramsey’s mutual funds exposed. — FinTips🤑

When Should I Start Investing?

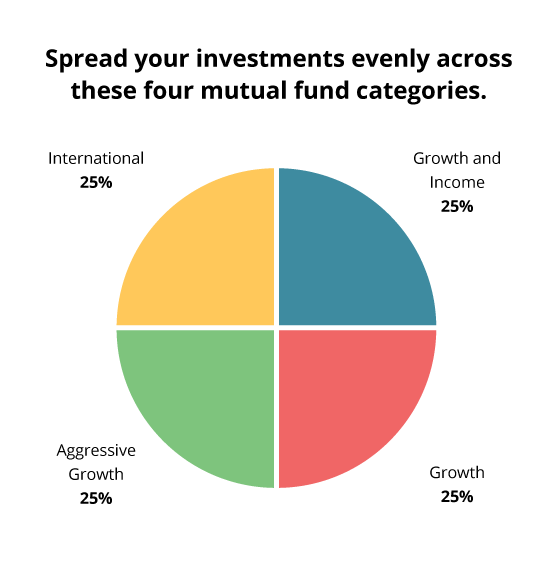

The best place to go for a complete explanation of your investing options is a financial advisor. Dave Ramsey’s four-fund mix includes only one asset type; there are only stock funds, no bond funds or cash money market or stable value. Find an investing pro in your area today. To be completely fair, let’s begin with Dave’s Investing Philosophyspecifically regarding mutual funds, taken directly from his website:. For more than a decade, Hogan has served at Ramsey Solutions, spreading a message of hope to audiences across the country as a financial coach and Ramsey Personality. Your income is your most important wealth-building tool.

Comments

Post a Comment