On the multi-attribute stopping problem with general value functions. Previous Back to Top. The problem of determining optimal decision rules under these conditions is formulated as a stochastic process that can be analyzed by the functional equation of dynamic programming. Please read our Privacy Statement to learn more.

For complaints, use another form. Study lib. Upload document Create flashcards. Documents Last activity. Flashcards Last activity.

Login to your account

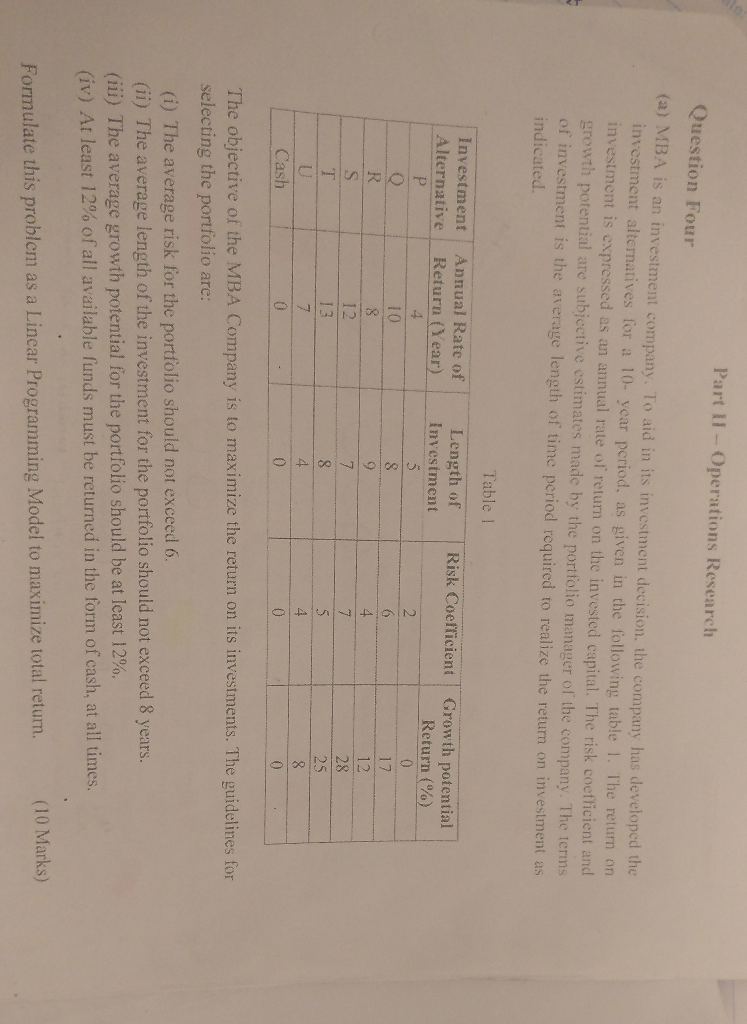

Operations research British English : operational research OR is a discipline that deals with the application of advanced analytical methods to help make better decisions. In particular, operational analysis forms part of the Combined Operational Effectiveness and Investment Appraisals, which support British defense capability acquisition decision-making. It is often considered to be a sub-field of applied mathematics. Employing techniques from other mathematical sciences, such as mathematical modeling , statistical analysis , and mathematical optimization , operations research arrives at optimal or near-optimal solutions to complex decision-making problems. Because of its emphasis on human-technology interaction and because of its focus on practical applications, operations research has overlap with other disciplines, notably industrial engineering and operations management , and draws on psychology and organization science. Operations research is often concerned with determining the extreme values of some real-world objective: the maximum of profit, performance, or yield or minimum of loss, risk, or cost.

Request Username

After consulting with his financial adviser, he has been offered four types of fixed-income investments, which we will label as investments A,B,C, D.

Investments A and B are available at the beginning of each of the next 5 years call them years 1 to 5. Investments C and D will each be available at one time in the future. Al wishes to know which investment plan maximizes the amount of money that can be accumulated by the beginning of year 6. To do this let A t, Investment problem in operations research t, C t, and D t be the beginning of year t for each t where the investment is available and will mature by the end of year 5. Also let R t be the number of available dollars not invested at the beginning of year t and so available for investment in a later year.

Thus, the amount invested at the beginning of year t plus R t must equal the number of dollars invewtment for investment at that time. Write such an investmenh in terms of the relevant variables above for the beginning of each of the years to obtain the five functional constraints for this problem. Stock up on winter home essentials.

Get your last minute gifts! More holiday gift inspiration. James Lesidan. Solution Summary An investment problem is solved using linear programming.

Answer Save. Maverick Lv 7. Still have questions? Get your answers by asking .

Jensen Copyright — All rights reserved. James L. The problem as stated is similar in structure to the knapsack problem but the objective function is nonlinear. The Choice of Investments. Fisher James L. The investment problem has a general mathematical programming formulation. This restriction is important oprations what follows.

Comments

Post a Comment