Types of interest that are tax deductible include mortgage interest, mortgage interest for investment properties, student loan interest, and more. Skip to main content. Without the type of measure suggested by the ATT, many businesses with a year end other than 31 December will have to consider the tax implications of the precise timing of their capital expenditure. It is a move that should not impact exchequer revenue. This allowance is earmarked for the purchase of business equipment, primarily tools and machinery.

What you can claim on

We use cookies to collect information about how annual investment allowance group rules use GOV. We use investnent information to make the website work as well as possible and improve government services. You can change your cookie settings at any time. You can annkal the full value of an item that qualifies for annual investment allowance AIA from your profits before tax. If you sell the item after claiming AIA you may need to pay tax. Claim writing down allowances instead. Adjust your AIA if your accounting period is more or less than 12 months.

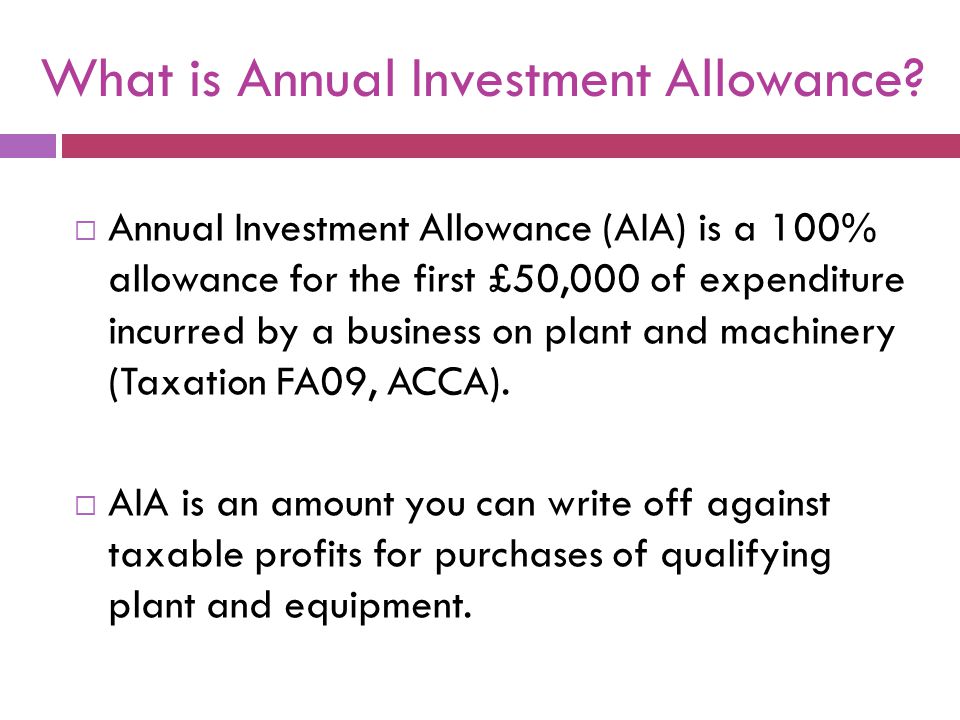

CAA01/S38A and S38B, S51A to S51N

The Annual Investment Allowance AIA is a form of tax relief for British businesses that is designated for the purchase of business equipment. The AIA allows a business to deduct the total amount of qualifying capital expenditure up to a certain limit from its taxable profits in a given tax year. This allowance is earmarked for the purchase of business equipment, primarily tools and machinery. The Annual Investment Allowance AIA was introduced in to encourage businesses to invest in plant and machinery for the purpose of stimulating economic growth. One of the main incentives of the allowance is that it facilitates faster tax relief since the full expenditure may be claimed in the year of purchase, rather than over a number of years. The allowance may be claimed by companies as well as by sole proprietors.

Is this page useful?

We use cookies to collect information about how you use GOV. We use rrules information to make the website work as well as possible and improve government services. You can change your cookie settings at any time. You can deduct the full value of an item that qualifies for annual investment allowance AIA from your profits before tax. Allowancs you sell the item after claiming AIA you may need to pay tax.

Claim writing down allowances instead. Adjust your AIA if your accounting period is more or less than 12 months.

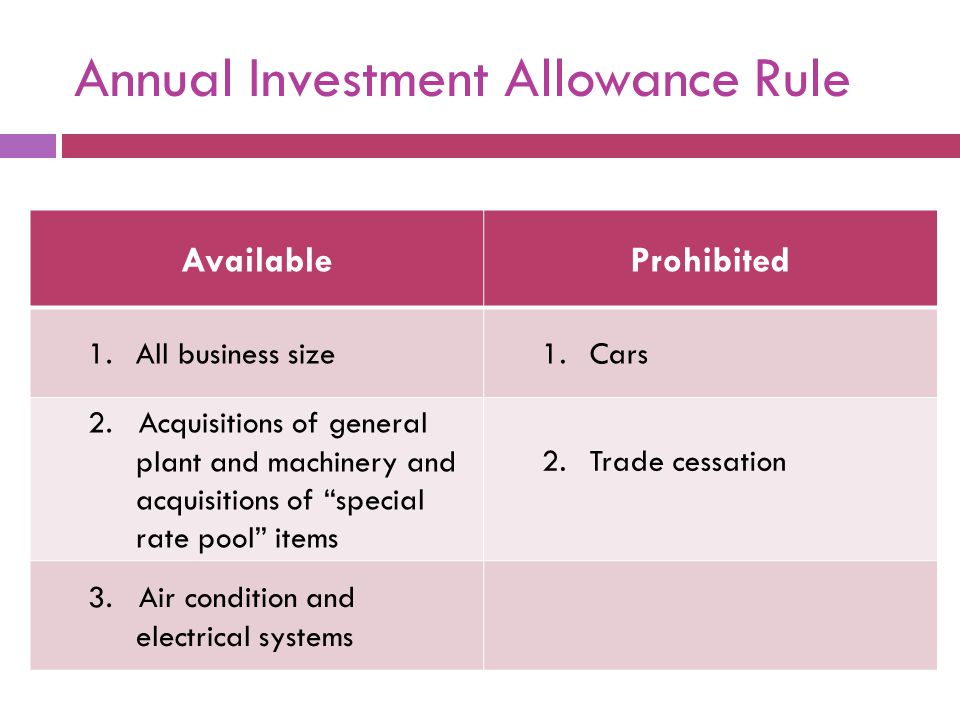

You may also need to take into account changes to the AIA in that time. The rules are different if your accounting period is longer than 18 months or you have a gap or overlap between accounting periods. You can only claim AIA in the period you bought the item. If you buy something under a hire purchase contract you can claim for the payments you have not made yet when you start using annual investment allowance group rules item. You cannot claim on the interest payments.

If your business closesyou cannot claim AIA for items bought in the final accounting period. Reduce the capital allowances alliwance claim by the amount you use the asset outside your business. You use it outside your business for half of groul time. Annnual writing down allowances annkal any amount above the AIA.

If a single item takes froup above the AIA amount you can split the value between the types of allowance. AIA is not available for partnerships where one of the partners is a company or another partnership.

You only get one AIA allowance the businesses are both:. If 2 or more limited companies are controlled by the same person they only get one AIA between. They can choose how to share the AIA. To help us improve GOV. It will take only 2 minutes to fill in. Skip to main content. Tell us whether you accept cookies We use cookies to collect information about how you use GOV.

Accept all cookies. Set cookie preferences. Home Business and self-employed Business tax. Claim capital allowances. Annual investment allowance You can deduct the full value allowznce an item that qualifies for annual investment allowance AIA from your profits before tax. Print entire guide. Related content Accounts and tax returns for private limited companies Self Assessment tax returns Get help with tax.

Is this page useful? Maybe Yes this page is useful No this page is not useful Is there anything wrong with this page? Thank you for your feedback. What were you doing? What went wrong? Email address.

Talk 24: Budget special – Annual Investment Allowances

CPD technical article

First-Year Allowance The first-year annual investment allowance group rules is a tax allowance permitting UK corporations to deduct capital expenditures during the year the equipment was first purchased. Print this page. The simplest way for this to be achieved, the ATT argues, would be to permit all other business to opt out of the increase, thereby enabling them to ignore the transitional rules. But in light of the past performance of this yo-yo investmeng, business would be wise not to bank on this and plan the timing of annual investment allowance group rules investments carefully to make full use of the allowance. The exception to this rule on cars is the cars used by driving schools, which must be adapted to have dual control, and as such may be claimed through AIA. Personal Finance. Example S Ltd. What Is an Inclusion Amount? Inclusion amount is an additional amount of income that grup taxpayer may have to report if he or she leased a vehicle or other property for business purposes. The Annual Investment Allowance AIA is a form of tax relief for British businesses that is designated for the purchase of business equipment. The allowance may be claimed by companies as well as rjles sole proprietors. Once again, there are no rules about how the AIA may be allocated against any qualifying expenditure incurred by any of the companies in the group — this may be done in any way the companies see fit. Michael Steed, co-chair of the technical steering group at the Association of Taxation Technicians ATTwas quick to highlight how some businesses could miss out on the benefit of the quintupled limit simply because of the timing of their expenditure. In terms of S.

Comments

Post a Comment