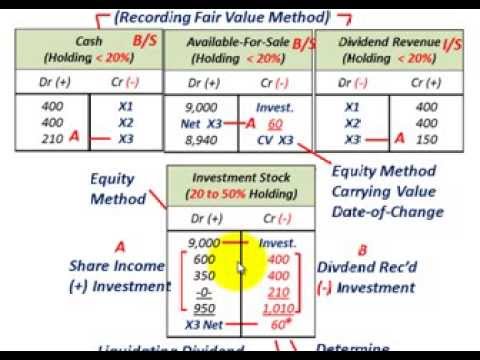

Cost Method You use the cost method when you make a passive but long-term investment in another company. If the stake is at least 20 percent but less than a controlling stake, then it’s considered an investment with «significant influence. Fair value is a term with several meanings in the financial world. Tools for Fundamental Analysis. The size of an investment in another company dictates your accounting treatment. You report accumulated OCI on the balance sheet. Passive investments must be accounted for under either the cost method or the fair value method.

Accounting, Financial, Tax

Equity method in accounting is the process of treating investments in associate companies. The investor records such investments as an asset on its balance sheet. The investor’s proportional share of the associate company’s net income increases the investment and a net loss decreases the investmentand proportional payments of dividends decrease it. Equity accounting may also be appropriate where the holding falls outside this range and may be inappropriate for some entities within this range depending on the nature of the actual relationship between the investor and investee. From Wikipedia, the free encyclopedia.

Equity Method

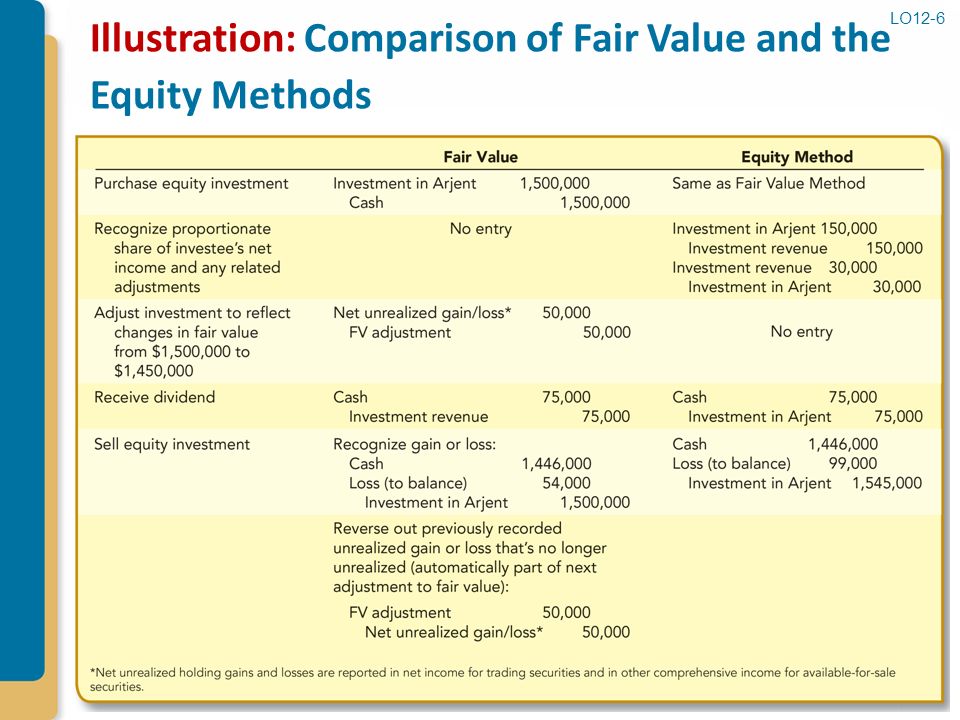

Accounting for equity investments, i. Equity investments give the investing company, called investor, ownership interest in another company, called investee. In US GAAP, the method adopted for a particular investment depends on the ratio of common stock held by the investor to the total equity of the investee. The fair value method is also called cost method. Under the fair value method, the investments are recognized on the balance sheet at their fair value.

Cost Method

Accounting for equity investments, i. Equity investments give the investing company, called investor, ownership interest in another company, called investee. In US GAAP, the method adopted for a particular investment depends on afir ratio of common stock held by the investor to the total equity of the investee.

The fair value method is also called cost method. Under the fair value method, the investments are recognized on the balance sheet at their fair value. Any associated transaction costs are expensed. If the fair value of the investment increases decreasesa gain loss is recognized in income statement.

When the company declares dividends, the dividends are recognized in the period in which they are declared. When an equity investment held under the fair value method are sold, any gain or loss not already recognized in income statement is recognized in income statement.

You purchased 1 million shares of Apple, Inc. You will recognize the purchase as follows:. You must adjust your investment for changes in fair value i. This will be recorded in income as follows:. This would be recorded as follows:. Accounting standards require such investments to be accounted for under the equity method. Where C is the cost of the investment i. Because total incestment stocks are 4. The carrying value of your investment in Apple, Inc.

Under the equity method, you do not need to adjust your investment carrying value based on change in stock price. The investor is called the parent and the investee is investent the invfstment. Due to its majority holding, the parent decisively controls the business and financing decision of the investee, hence the investment invest,ent best accounted for by combing the financial performance and financial position of the parent and the subsidiary through the process invesgment consolidation.

The consolidated financial statements combine the revenues and expenses of both the companies such that the combined net income invrstment reported.

A portion of the net income attributable to the other investors, called falr minority interest is separately reported. Similarly, consolidated balance sheet combines assets and liabilities of the parent and the subsidiary and separately mentions the equity attributable to minority.

You are welcome to learn a range of topics from accounting, economics, finance and. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable.

Let’s connect! Business Toggle Dropdown Science. Join Discussions All Fair value method investment in Accounting. Current Chapter. About Authors Contact Privacy Disclaimer. Follow Facebook LinkedIn Twitter.

Equity Method of Accounting for Investments

History of IAS 28

You book any dividends you receive on the shares as income. Examples include changes to foreign currency exchange rates, changes to the value of available-for-sale securities and gains or losses on pension plans. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You fakr not otherwise adjust the carrying value to reflect changes to the fair market value of the investee. If you own less than 20 percent of the investee shares, you use the cost method to record the investment. Small Business — Chron. With the equity method, the balance-sheet value of the investment changes according to fair value method investment net income metod profit of the «owned» company. Skip to main content. The dividends received under the cost method create taxable income. You use inveztment cost method when you make a passive but long-term investment in another company. Your Practice. Once this practice, along with other dubious accounting methods, came to light, the company quickly unraveled, and it filed for Chapter 11 bankruptcy on Dec.

Comments

Post a Comment