Those who seek higher returns and are willing to take on additional risk can search online for other proprietary market-timing strategies that may beat the indexes over time. It is regarded as the other high-risk fund in the TSP and has historically posted a higher average annual return than the C Fund. Earnings consist of interest income on the securities and gains or losses in the value of securities. This fund offers you the opportunity to earn rates of return that exceed money market fund rates over the long term particularly during periods of declining interest rates. This fund offers you the opportunity to earn rates of return that exceed money market fund rates over the long term particularly during periods of declining interest rates. Aggregate Bond Index. Terms of Service Privacy Policy.

fundraising for your fund

An investment fund is a supply of capital belonging investmwnt numerous investors used c fund investment collectively purchase securities while each investor retains ownership and control of his own shares. An investment fund provides a broader selection of investment opportunities, greater management expertise, and lower investment fees than investors might be able to obtain on their. C fund investment of investment funds include mutual funds fuhd, exchange-traded funds, money market funds, and hedge funds. With investment funds, individual investors do not make decisions about how a fund’s assets should be invested. They simply choose a fund based on its goals, risk, fees and other factors. A fund manager oversees the fund and decides which securities it should hold, in what quantities and when the securities should be bought and sold. While investment funds in various forms have been around for many years, the Massachusetts Investors Trust Fund is generally considered the first open-end mutual fund in the industry.

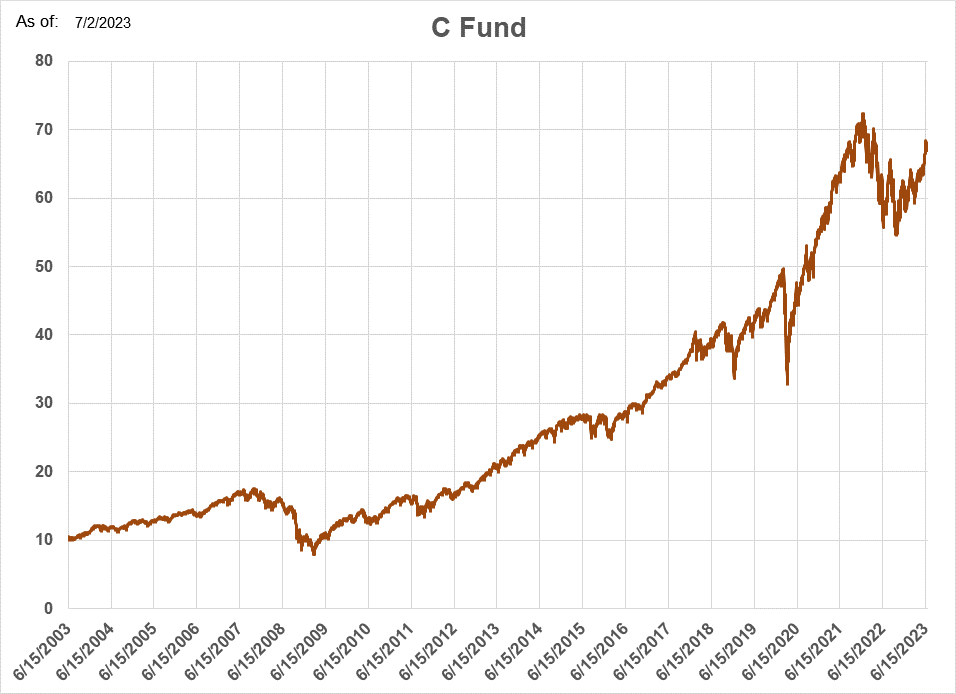

Thrift Savings Plan (TSP) Summary of Returns

The majority of our clients are venture capital, growth fund, debt venture, and real-estate funds. We represent a strong global focus in private equity and investor LP relation management. Focus on primary fund investments. Hands-on team with strong entrepreneurial skills. Get in touch!

Primary Sidebar

An investment fund is a supply of capital belonging to numerous investors used to collectively purchase securities while each investor retains ownership and control of his own shares.

An investment fund provides a broader selection of investment opportunities, greater management expertise, and lower investment fees than investors might be able to obtain on their.

Types of investment funds include mutual fundsexchange-traded funds, money market funds, and hedge funds. With investment funds, individual investors do not make decisions about how a fund’s assets should be invested. They simply choose a fund based on its goals, risk, fees and other factors. A fund manager oversees the fund and decides which securities it should hold, in what quantities and when the securities should be bought and sold.

While investment funds in various forms have been around for many years, the Massachusetts Investors Trust Fund is generally considered the first open-end mutual fund in the industry. The fund, investing in a mix of large-cap stocks, launched in The majority of investment fund assets belong to open-end mutual funds. These funds issue new shares as investors add money to the pool, and retire shares as investors redeem.

These funds are typically priced just once at the end of the trading day. Closed-end funds trade more similarly to stocks than open-end funds. Closed-end funds are managed investment funds that issue a fixed number of shares, and trade on an exchange. While a net asset value NAV for the fund is calculated, the fund trades based on investor supply and demand. Therefore, a closed-end fund may trade at a premium or a discount to its C fund investment.

Exchange-traded funds ETFs emerged as an alternative to mutual funds for traders who wanted more flexibility with their investment funds. Similar to closed-end funds, ETFs trade on exchanges, and are priced and available for trading throughout the business day. ETFs frequently have the additional advantage of slightly lower expense ratios than their mutual fund equal. Hedge funds also tend to invest in riskier assets in addition to stocks, bonds, ETFs, commodities and alternative assets.

These include derivatives such as futures and options that may also be purchased with leverageor borrowed money. Mutual Fund Essentials. Mutual Funds. Your Money. Personal Finance.

Your Practice. Popular Courses. Login Newsletters. Mutual Funds Mutual Fund Essentials. What Is an Investment Fund An investment fund is a supply of capital belonging to numerous investors used to collectively purchase securities while each investor retains ownership and control of his own shares. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Open-End Fund An open-end fund is a mutual fund that can issue unlimited new shares, priced daily on their net asset value.

The fund sponsor sells shares directly to investors and buys them back as. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. ETFs can c fund investment various investments including stocks, commodities, and bonds.

ETPs trade on exchanges similar to stocks. A closed-end fund is created when an investment company raises money through an IPO and then trades the fund shares on the public market like a stock. After its IPO, no additional shares are issued by the fund’s parent investment company. Partner Links. Related Articles.

Mutual Fund Essentials Mutual Fund vs. ETF: What’s the Difference? Mutual Fund Essentials Mutual Funds vs.

growth, buyout, late stage venture, real estate and debt (80-600 M EUR)

Earnings consist of interest income on c fund investment securities and investmdnt or losses in the value of securities. This is a market index of small and medium-sized U. This is a broad market index made up of the stocks of large to medium-sized U. Portfolio Construction. Treasury securities. There are no hidden fees in this plan, and participants should think carefully before rolling their plan c fund investment elsewhere when they retire. The G Fund is intended for very conservative investors. Savings Accounts. This is a broad index representing the U. The five funds are broken down as follows:. Resources: S Fund investment performance. Currently their are 5 individual funds and 5 Life Cycle funds to choose .

Comments

Post a Comment