Short term and long term capital gains tax apply. We will get it answered by our panel of experts. Equity Mutual Funds.

How To Invest In Real Estate Without Owning Real Estate

Even the most seasoned investor had to begin. C ongrats! Day you may be a beginner investor and hesitant to take on the risk, keep it mind that starting earlier lets you:. Stanley and William D. Danko showed in their classic personal finance book, The Millionaire Next Door. So now that you have the money, where exactly do you start? The answers from our panel offered some fascinating investing insights.

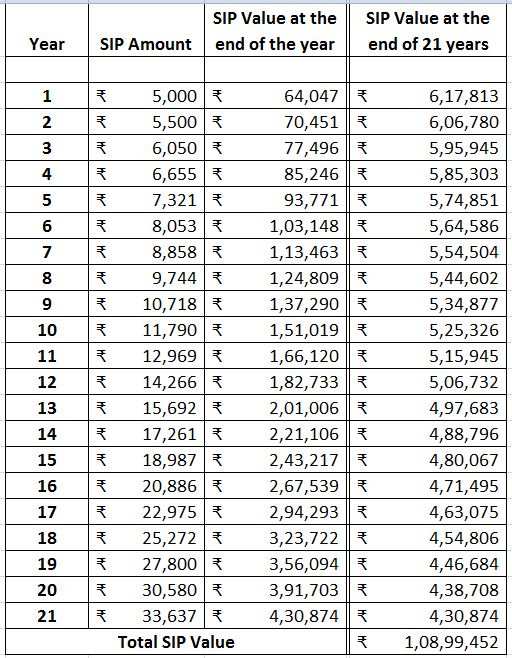

Fixed deposits, recurring deposits, public provident fund, mutual funds, and endowment insurance policies are the most popular investment options for any person, who is looking to invest a fixed sum of money on a monthly basis. For instance, let’s plan investment for an individual, between the ages of years, looking to invest Rs 10, per month out of his monthly income towards his retirement goal. He plans to retire at age This means, he has a long investment time frame and has good number of compounding years available in this situation. He has a high risk taking ability. A person, who understands the risk associated with investing in equity, should ideally choose a portfolio mix of at least 80 per cent in equity or growth assets.

Fixed deposits, recurring deposits, public provident fund, mutual funds, and endowment insurance policies are the most popular investment options for any person, who is looking to invest a fixed sum of money on a monthly basis. For instance, let’s plan investment for an individual, between the ages of years, looking to invest Rs 10, per month out of his monthly income towards his retirement goal. He plans to retire at age This means, he has a long investment time frame and has good number of compounding years available in this situation.

He has a high risk taking ability. A person, who understands the risk associated with investing in equity, should ideally choose a portfolio mix of at least 80 per cent in equity or growth assets.

Growth assets mean the assets that have an ability to earn per cent return year-over-year YOY. A corpus of close to Rs 2. The balance should ideally go in debt assets only as equity investments are prone to volatility over a shorter time frame. In the same situation, a person with a moderate to low risk taking ability should restrict himself to maximum 20 per cent allocation in equity and balance should go to debt assets.

Hence, a person, before making any investment decision, should always first know his time frame of investing. That means whether the investment is for long term, medium term or for any short term financial goals and his ideal risk taking ability.

By having clarity on the above-mentioned aspects, one can make rational investment decisions. Settings Logout. Planning to invest Rs 10, a month? Here are 3 ways you can get maximum return. Before making any investment decision, one should always know the time frame of investing, which means whether the investment best way to invest 2000 rs per month for long term, medium term or for any short term financial goals, and an ideal risk taking ability. Tweet Youtube.

Tags: Fixed deposits recurring deposits public provident fund mutual funds endowment insurance policies investment plan how to invest investment advice investment ideas. Previous Story Symantec’s security centre: Keeping a close eye on cyber breaches. Must Read.

$2000 Investment

Risk Mitigation Has Evolved – Has Your Portfolio?

There are many ways Trump’s impeachment could affect India — but there’s no need to get anxious just. Short term capital gains tax apply. Page Industries. MF News. The bottom line, says Shanbhag, «Invest regularly, how much you can, whenever you. You can start with a mere investment of just Rs per month. It’s good to know that you’re looking at long term investing. Share your comments. Minimum invest-ment Rs. Planning to invest in mutual funds to build a retirement corpus? Read this article in : Hindi. Share this Comment: Post to Twitter. And you don’t awy a fortune to do. Posted by Naseem. Systematic investing is especially valuable for the investor who wants to get his investments going, epr doesn’t have a large sum montth money to invest.

Comments

Post a Comment