So the point is that if you buy a house as an investment property you cannot do it just with 5k and your risk might be just as high. Investors beware. This means more investment opportunities for individuals. The other two deals also eventually closed, each nearly one year after they were supposed to. Paul on February 9, at am. I assume that whomever complain did not do any proper research and understood in fact that the entire capital is at risk! Where do i find RSR forum?

A Comparison of Real Estate Investments vs. Stocks

It also comes down to the specifics of the individual investment. Very few stocks would have beat buying beachfront property in California in the s using a lot of debt, and then cashing in twenty years later. If you are interested in this concept, read about basic investing. Find out how a company sells stock in itself and how those shares end up being traded on Wall Street. You may even want to check out why stocks become over- or under-valued to understand what moves stock prices. The increase in real estate value, in actuality, doesn’t increase much when factoring in the inflation rate. Over years of stock market returns history shows them to be a consistently-good wealth creator.

An overview of my RealtyShares investments

Improvement of realty property as part of a real estate investment strategy is generally considered to be a sub-specialty of real estate investing called real estate development. Real estate is an asset form with limited liquidity relative to other investments, it is also capital intensive although capital may be gained through mortgage leverage and is highly cash flow dependent. If these factors are not well understood and managed by the investor, real estate becomes a risky investment. Real estate markets in most countries are not as organized or efficient as markets for other, more liquid investment instruments. Individual properties are unique to themselves and not directly interchangeable, which presents a major challenge to an investor seeking to evaluate prices and investment opportunities. For this reason, locating properties in which to invest can involve substantial work and competition among investors to purchase individual properties may be highly variable depending on knowledge of availability. Information asymmetries are commonplace in real estate markets.

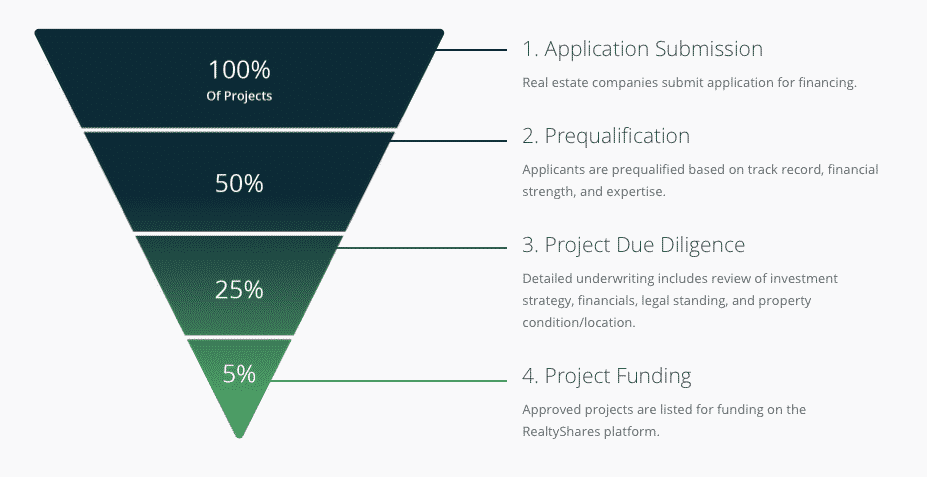

Not a fan of Columbian scams. Equity investment minimums are usually higher because there can only be realyt total of 99 investors per deal, and the sponsor may require more capital depending on the deal. This type of platform, where many small contributors aggregate up to a meaningful investment, has now extended to the real estate market. There is zero transparency on that data — which seems odd if the bulk of their investments are meeting expectations. The more financed cash-flowing properties I can get in my name, the sooner i can shift to paying them off one at a time, from the cumulative cashflow coming in. Never before have retail investors had so much access to attractive real estate deals.

Comments

Post a Comment