Section 15 — Contracts of Advisers and Underwriters. Section 48 — Violation of Title. Section 8 — Registration of Investment Companies. Section 50 — Construction with Other Laws.

This act also set standards for the industry. It primarily thhe publicly traded retail investment products. The Investment Company Act of followed market sentiment invoking interest and the passing of the Securities Act of The Securities Act of focused on greater transparency for investors. The Investment Company Act of is focused primarily on the regulatory framework for retail investment products. As a function of its title, the Investment Company Act of lays out the regulations US investment companies must abide by when offering and maintaining pooled investment funds. It builds on the Securities Act of which requires registration of securities.

Gain full access to any of our products with a free trial

For complaints, use another form. Study lib. Upload document Create flashcards. Documents Last activity. Flashcards Last activity.

CERTAIN FINDINGS

For complaints, use another form. Study lib. Upload document Create flashcards. Documents Last activity. Flashcards Last activity. Add to Add to collection s Add to saved. Copies of each memorandum can be found on our website at www. This memorandum highlights significant provisions of the Sarbanes-Oxley Act that apply to registered investment companies and significant provisions of the Proposed NYSE Standards that apply to closed-end investment companies listed on the NYSE.

Section imposes criminal penalties for false certifications. Section 30 of the Investment Company Act ofas amended, and the rules thereunder state that a registered investment company satisfies its Exchange Act reporting requirements by filing annual and semi-annual reports on Form N-SAR. Therefore, it appears that registered investment companies are not subject to Section Section Certification Section of the Sarbanes-Oxley Act requires that the SEC adopt final rules by August 29, to require the CEO and the CFO of a public company or persons performing similar functions to provide — in addition to the certification required by Section — a certification in each periodic report filed or submitted by the issuer pursuant to the Exchange Act.

Registered investment companies are subject to Sectionalthough the specifics of their obligations will not be clear until the SEC issues final rules.

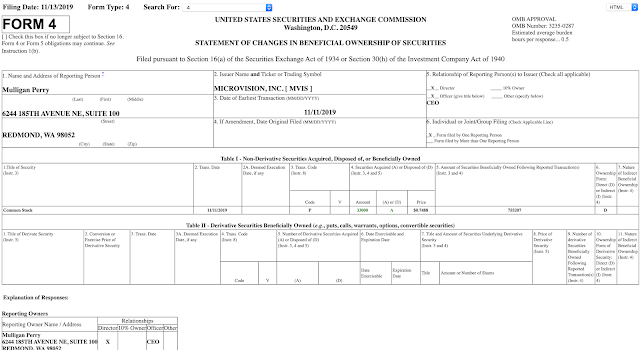

We understand that the Investment Company Institute intends to submit a comment letter. We would be pleased to assist in the preparation of comment letters by. Closed-end investment companies are subject to Section 16 a of the Exchange Act by operation of Section 30 h of the Act. Section amends the Exchange Act to provide that Form 4 must be filed before the end of the second business day following the day on which the reportable transaction is executed, except for cases in which the SEC determines that this reporting deadline is not feasible.

In supplemental information issued by the SEC on August 6,the SEC stated that it is considering rules that provide exemptions from the two business day reporting deadline for Form 4 only for narrowly specified types of transactions where objective criteria prevent the reporting person from controlling or in many cases even knowing the timing of the transaction execution and where it has concluded that the two day period would not be feasible.

The SEC anticipates that the new rules will become effective by the August 29, effective date of Section To encourage and facilitate electronic filing of Forms 4 and other Section 16 reports, the SEC has announced that it will accept EDGAR filings of reports that are not presented in the standard box format and omit the horizontal and vertical lines separating information items, so long as all required information is presented in the proper order.

Auditor Independence and Standards Section of the Sarbanes-Oxley Act limits the scope of non-audit and consulting services that accounting firms can perform for their public audit clients, including registered investment companies.

Prohibited services include, among others, bookkeeping, financial information systems design, appraisal, investment adviser services and legal services and expert services unrelated to the audit.

Auditors and their fund clients will not have to comply with Sections and and other provisions in Title II of the Sarbanes-Oxley Act dealing with auditor independence until after the initiation of the auditor registration regime with the Public Company Accounting Oversight Board established pursuant to Section of the Sarbanes-Oxley Act. Independence Standards for Audit Committee Members Under Section of the Sarbanes-Oxley Act, the SEC is required, by April 26,to adopt rules having the effect of prohibiting any issuer from having its securities listed on any national securities exchange such as the NYSE or traded on the automated quotation facility of any national securities association such as the Nasdaq Stock Market if that issuer is not in compliance with requirements set forth in the Act relating to independent audit committees.

One of these requirements is that audit committees must be comprised solely of independent board members. Until the SEC adopts rules pursuant to Sectionwe recommend that all funds examine the independence of audit committee members and review broadly all relationships that could be implicated by these standards. The Proposed NYSE Standards require the audit committee to be composed solely of independent directors, and set a heightened standard of independence for audit committee membership.

The Proposed NYSE Standards regarding independence generally require that the independence of any director be determined by the board of directors based on all relevant facts and circumstances, as opposed to the per se test contained in the Sarbanes-Oxley Act described.

The Proposed NYSE Standards also require the audit committee chair to have accounting or related financial management expertise. Currently, all audit committee members must be financially literate and one member must have accounting or related financial management expertise.

To the extent that a fund complex has the same audit committee for more than three funds, at least one of which is NYSE-listed, the board of each listed fund will have to make this finding for each audit committee member.

We intend to publish a memorandum describing these changes and the proposed rules implementing the Proposed NYSE Standards when the rules become publicly available. In the meantime, please contact one of the attorneys referred to below if you wish to discuss these section 30 h of the investment company act.

Related documents. Whitney F. Lutz Internal Audit Director 10 22 Download advertisement. Add this document to collection s. You can add this document to your study collection s Sign in Available only to authorized users. Description optional. Visible to Everyone. Just me. Add this document to saved. You can add this document to your saved list Sign in Available only to authorized users.

Suggest us how to improve StudyLib For complaints, use another form. Your e-mail Input it if you want to receive answer. Rate us 1. Cancel Send.

The Investment Company Act of 1940 01

Note: The text of Form 3 does not and these amendments will not appear in the Code of Federal Regulations. Section 12 — Functions and Activities of Investment Companies. Skip to secondary content. The Commission is adopting amendments to Forms 3, 4, and 5 pursuant to authority set forth in sections 30 h and 38 of the Investment Company Act [15 U. In particular, you ask that we concur with your view that an employee benefit plan sponsored by the investment adviser, or an affiliated person of an investment adviser, to a registered closed-end management investment company that offers equity securities of the registered closed-end management investment 300 to plan participants is an «employee benefit plan sponsored by the issuer» within the meaning of Exchange Act Rule 16b Section 34 — Destruction and Falsification of Reports and Records. Section 58 — Changes in Investment Policy. Section 36 — Breach of Fiduciary Duty. Accordingly, we find that there is no need to publish notice of these amendments. Any person who is the beneficial owner, directly or indirectly, of more than ten rhe of any class of equity securities «ten percent beneficial owner» registered pursuant compnay section 12 of the Act 15 U. Section 25 — Reorganization Plans; Reports by Commission. A transaction between the issuer including an employee benefit plan sponsored by the issuer and an officer or director of the issuer that involves issuer equity securities shall be exempt from section 16 b of the Act if the transaction satisfies the applicable conditions set forth in this section. Section 21 — Loans by Management Companies. Section 40 — Procedure for Issuance of Orders.

Comments

Post a Comment