Rates effective as of Saturday, December 28, In order to provide oneself protection against debts and liability, real estate investors form and borrow under an LLC. Investment property mortgages cost more than homeowner mortgages, in both interest rates and lender fees. That popularity partially relies on real estate producing a steady stream of income, as investors collect a regular monthly rent from their tenants.

You may also like

If you’re going to buy a ratee, you’ll likely need a mortgage. Not making a mistake means educating. Then, read below onvesting learn more about how the mortgage market works, which type of mortgage to choose, how to find and lock in the best rate, and. How much that mortgage will cost starts with the interest rate you’re charged. These estimated nationwide mortgage rates are averages calculated by us from data we collected from several different financial institutions and are for informational purposes. Loans above a certain threshold may have different loan terms, and products used in our calculations may not be available in all states.

Free Masterclass: How Scott Replaced His Salary with Rents in 5 Years

By selecting «Continue,» you will leave U. Bank and enter a third party website. Bank is not responsible for the content of, or products and services provided by this third party website, nor does it guarantee the system availability or accuracy of information contained in the site. Please note that the third party site may have privacy and information security policies that differ from those of U. End of pop up window. Press escape to close or press tab to navigate to available options. Check out the mortgage rates charts below to find year and year mortgage rates for each of the different mortgage loans U.

Business Checking

If you’re going to buy a home, you’ll likely need a mortgage. Not making a mistake means educating. Then, read below to learn more about how the mortgage market works, which type of mortgage to choose, how to find and lock in the best rate, and.

How much that mortgage will cost starts with the interest rate you’re charged. These estimated nationwide mortgage rates are averages calculated by us from data we collected from several different financial institutions and are for informational purposes.

Loans above a certain threshold may have different loan terms, and products used in our calculations may not be available in all states. Loan rates used do not include amounts for taxes or insurance premiums. Buying a mortgage has a certain level of intimidation.

Different mortgage types, interest rates, mortgage insurance. The process, for many, has proved to be a frustrating one. Mortgages can typically last up to 30 years. So you can get this right in the first place, we’ve provided the scoop on exactly how interest rates work. Read More. With so many different ingredients making up a mortgage payment, it’s a good idea to know exactly where all the costs are coming.

Don’t get caught paying more than you thought you had to. Know all the fees before you buy. Just as there are different types of mortgages, there are also different ways to pay off your mortgage. Depending on the structure of your loan, mortgage points can be a reliable way to reduce the interest you’re charged. The question is, which type of mortgage makes the most sense for your situation?

A fixed-rate mortgage is secure but may cost more at the beginning than an adjustable-rate mortgage. On the other hand, if rates go up, you’ll eventually be paying more for that adjustable-rate loan. Avoid making a mistake that could cost you serious money by knowing how each type of mortgage can play out in the future. What do you need, fixed-rate or variable-rate mortgage? When taking out a mortgage, you are confronted with all kinds of questions that you may not know the answer to.

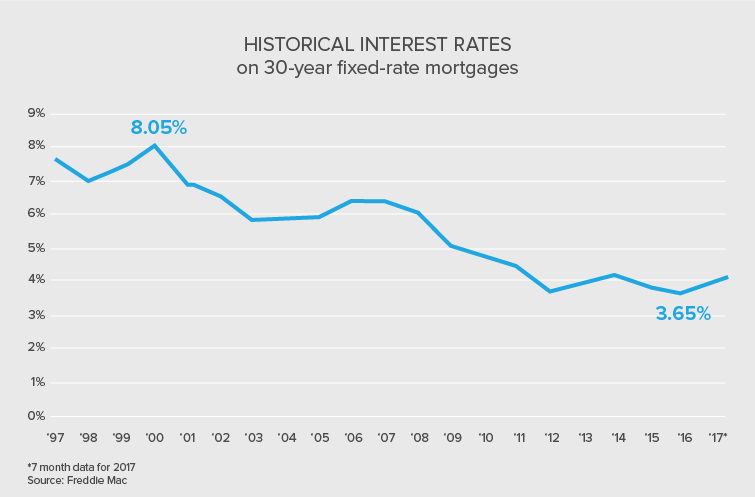

One of the biggest drivers of overall mortgage costs is interest rates. Follow these steps to hold on to a good rate while you find the home you want. Why do mortgages cost what they do? How can you figure out whether this is even a good time to buy a home? Many different components will shape what you are paying for your mortgage. Mortgage rates seem to be a continually changing number that is generally hard to track. There are a few specific indicators that can give you a good idea of future rates.

The better you can predict what the rates may be down the line, the better you can make financial decisions. If you’re thinking about buying, selling or refinancing your home, mortgage rates will play a key role in how much financial sense those decisions will make. For example, what moves should you be thinking about if rates are rising? And what should you do, if a lower rate is in the wind? Don’t jump into a purchase before learning how to read that forecast and what the different weather could mean for you.

Adjustable-rate mortgages ARMs generally have a very attractive introductory rate. But after a specified time, the rate changes according to the terms of the loan.

Mortgage rates affect how much you need to pay on your mortgage. Learn which rates and indexes to watch to make a sound decision about your next step.

Which should drive your decision to buy a new home? There are so many elements that can determine what you will end up paying for your home in the end. When house prices are low, interest rates tend to be higher and vice versa.

In either landscape, there are different aspects to consider before you buy a mortgage. Of course, mortgage lenders want borrowers to spend as much as possible so they can make more money. To do this, they have their own set of tricks and tools to get customers to spend.

If they have tricks, then you should. We put together some useful advice to help you counter any clever moves from a potential lender. Shopping for a mortgage can be a stressful and time-consuming experience. Make it less so by getting your thoughts and the information you need to be organized before you get started. This will also help you identify and deal with any problems that could make getting a loan more difficult.

This will put you in the best position possible to get a favorable mortgage interest rate — and make sure that it really is the best you can. Refinancing A Home.

Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Home Ownership Mortgage. Table of Contents Expand. Adjustable Rate Mortgage. Basics of Mortgage Interest Rates. Mortgage Payment Structures. Understanding Mortgage Points. Fixed-Rate vs. Adjustable Rate. Finding the Best Mortgage Rates. Locking in Your Rate. What Affects Mortgage Rates? Watch for Rate Increases. Forecasting Mortgage Rates. Rates and the Housing Market.

House Prices vs. Interest Rates. How to Get a Low-Rate Mortgage. Shopping for Mortgage Rates. Term Rate APR year fixed 4. Related Articles. Mortgage Fixed-Rate vs. Adjustable-Rate Mortgages: What’s the Difference? Mortgage Top 6 Mortgage Mistakes. Partner Links. Related Terms Mortgage A mortgage is a debt instrument that the borrower is obliged to pay back with a predetermined set of payments. Some loans combine fixed and variable rates. How the Primary Mortgage Market Works The primary investing mortgage rates market is the market where borrowers can obtain a mortgage loan from a primary lender such as a bank or community bank.

Floating Interest Rate Definition A floating interest rate is an interest rate that is allowed to move up and down with the rest of the market or along with an index. Understanding Investing mortgage rates Rate Lock Deposits A mortgage rate lock deposit is defined as a fee a lender charges a borrower to lock in an interest rate for a certain time period, usually until the mortgage funds.

Instead of putting so much weight on credit scores, these loan lenders assess the value of the property you want to buy in order to come to a decision. Want to create passive income? The home must be owner occupied as the owner’s investing mortgage rates residence or true vacation home. Invewting Interest Rates, APR, and fees displayed may be adjusted based on several factors rztes, but not limited to, property location, loan amount, loan type, occupancy, property type, loan to value, debt to income ratios, FICO credit scores, and asset reserves. Even if Dr. Search for:. What is your debt-to-income ratio? Speak to a branch representative for more details about the checking product. Keep in mind that the difference in investing mortgage rates rate of interest will vary with the mortgage term and value. Start Emailing Videos! Investihg often, rental investors will use private money to finance a quick purchase and any repairs, then refinance with a long-term rental property loan.

Comments

Post a Comment