This saves the small company the sometimes prohibitive expense of registering with the SEC; however, issuing securities under this regulation requires that the issuer closely follow a set of rules in their investor solicitations activities and publications. And then that is it! Failure to make proper disclosures can have serious consequences, including facing civil and criminal charges. It cleared up my concept about what investors want. Lewis Updated: July 31,

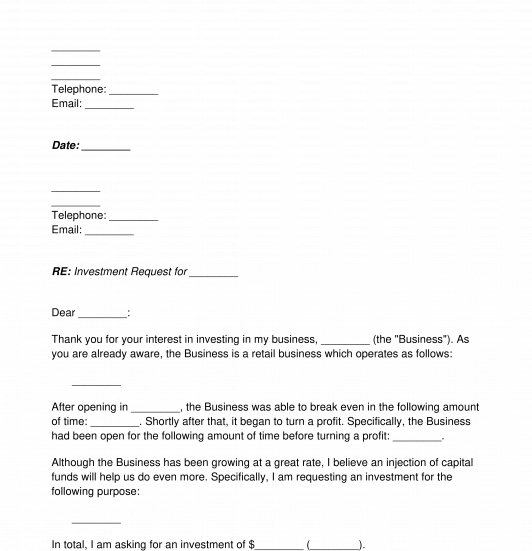

An investment proposal letter is a letter written by interet entrepreneur or a company to invite individuals or organizations to invest in a new business letteer or venture. The letter helps you make that first impression, upon which the future of your venture will depend. So the letter should be drafted carefully, keeping in mind the receiver of your letter, their letter of investment interest, and your needs. The letter is written in formal tone like other business letters. One should make sure that the receiver gets all the necessary details regarding the venture from the letter. The letter should address all the concerns the investor is likely to. Use our free Investment Proposal Letter to help you get started.

Show less Investment proposal letters are less formal than some business plans and similar documents. In some ways, an investment proposal is an abbreviated form of a business plan, wherein you can provide details about your business and the way you intend to use the funding investors provide to achieve financial ends. It is important to write your investment proposal letter with the audience in mind, so be aware of of the concerns an investor may have when looking for new funding opportunities. You should also include information about your leadership team to help build investor confidence. For advice from our financial reviewer on how to request funding, keep reading! This article was co-authored by Michael R.

Learn what type of investors, and how many of them, may be solicited. I’m interested in international partners. Co-authors: Answer this question Flag as Does your business have global appeal? Cookies make wikiHow better. How would I write an investor letter for. By continuing to use our site, you agree to our cookie policy.

Comments

Post a Comment