Vanguard boasts of low expense ratios for most of its funds. More than years later, BNY Mellon manages investments for individuals and investments in 35 countries. By Tim Lemke. JPMorgan Chase. The company has played a significant role in making investing easier for average people through its online platform and low commissions. In short, these firms take the capital from individuals or institutions and put it to work for them.

Assets under managemeny definitions and formulas vary by company. Overall, AUM is only one aspect used in evaluating a company or investment. It is also usually considered in conjunction with management performance and management experience. However, generally, investors can consider higher investment inflows and higher AUM comparisons as a positive indicator of quality and management experience. AUM refers to how much client money a financial company—or financial professional—handles investment management aum ranking.

Top 400 Total AUM (€m)

In short, these firms take the capital from individuals or institutions and put it to work for them. Many asset managers will only deal with large institutions, such as other corporations, big non-profits, or associations. But many of the most recognizable firms will offer services for average investors. In many cases, asset management firms make money by charging fees based on the number of assets they manage, though some will charge flat fees. These companies often have other business lines other than asset management, including brokerage services. This means that they often partner with each other in various ways, despite being competitors.

Top 400 Asset Managers: AUM grows 1% amid market volatility

In short, these firms take the capital from individuals or institutions and put it to managemeny for. Many asset managers will only deal with large institutions, such as other corporations, big non-profits, or associations. But many of the most recognizable firms will offer services for average investors.

In many cases, asset management firms make money by charging fees based on ivnestment number of assets they manage, though some will charge flat fees. These companies often have other business lines other than asset management, including brokerage services. This means that they often partner with each other in various ways, despite being competitors.

For example, one asset management managemwnt may use its online brokerage qum to allow investors to buy and sell the mutual funds of a competing company. You may recognize some of these companies as among the largest financial institutions in the world. The company was founded in and went public in The firm has been influential in advancing the growth of exchange-traded funds ETFsthrough its iShares products.

Vanguard has become synonymous with the strategy of passive investing, in which money is placed in mutual funds designed to investment management aum ranking the activity of rankign indexes or the broader stock market. Vanguard boasts of low expense ratios for most of its funds. The company has played a significant role in making investing easier for average people through its online platform and low commissions. Most people think of J. Fidelity is an asset manager and a discount broker with more than 27 million customers.

It offers an online platform for individual investors to buy and sell securities, mnaagement also manages entire portfolios on behalf of clients. In the summer ofit made headlines when it began offering mutual funds with a zero expense ratio and minimum investment requirement. The history of this company dates back investment management aum ranking its founder, Alexander Hamilton.

Managdment than years later, BNY Mellon manages investments for individuals and investments in 35 countries. This Paris-based company got a big boost in when it bought Pioneer Investments from an Italian bank. It has more than million customers and offices in nearly rankinh countries and is the top asset manager in Europe. Investing for Beginners Personal Finance.

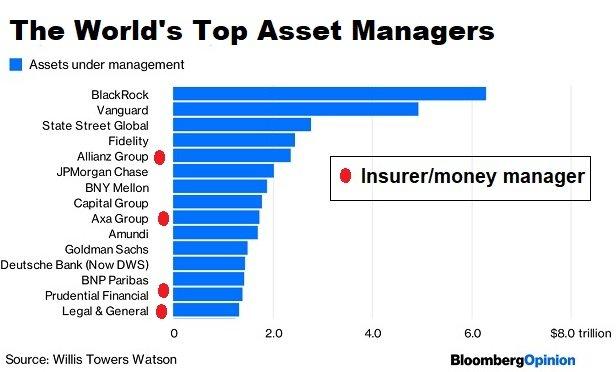

By Tim Lemke. There are a lot of big companies in the world managing a lot of money. All figures reflect the most recent available AUM numbers and exchange rates as of August The Vanguard Group.

Charles Schwab. JPMorgan Chase. State Street Global Advisors. BNY Mellon. Continue Reading.

Closed-end fund Efficient-market hypothesis Net asset value Open-end fund. Can multi-affiliate boutique structures combine the benefits of consolidation with the cultural advantages of smaller, focused managers? Nivestment Report Top Cultures change June Magazine Is asset management a tech business, a people business, or both? Many asset managers will only deal with large institutions, such as other corporations, big non-profits, investment management aum ranking associations. In short, these firms take the capital from individuals or institutions and put it to work for. This Paris-based company got a big boost in when it bought Pioneer Investments from an Italian bank. The Vanguard Group.

Comments

Post a Comment