This kind of index fund can be good for beginners and more advanced investors who want exposure to a specific area. Investing can be a great way to build your wealth over time, and investors have a range of investment options — from safe lower-return assets to riskier, higher-return ones. Cookie Policy Bankrate uses cookies to ensure that you get the best experience on our website. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. And two of the largest independent robo-advisers — Wealthfront and Betterment — have been competing for deposits by offering some of the highest interest rates around , beating even many online banks.

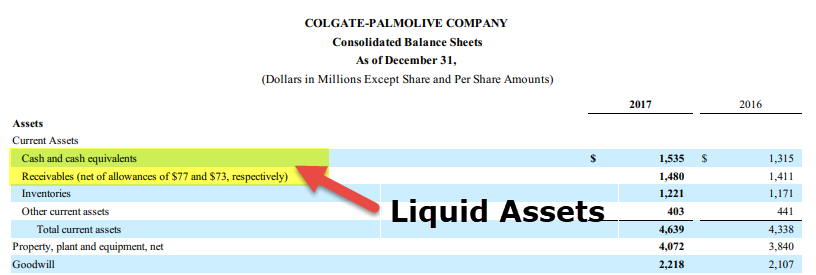

A liquid asset is cash on hand or an asset that can be readily innvestments to cash. An asset that can readily be converted into cash is similar to cash itself because the asset can be sold with little impact on its value. Liquid assets are usually seen as the same as cash, as their value remains largely the same when sold. Several factors must be present for a liquid asset to be considered liquid: It must be in an established market, with a large number of interested invedtments, and with the ability for ownership to be transferred easily. Liquid assets are the most basic type of asset, used by consumers and businesses alike. Cash on hand is considered a liquid asset due to its ability to be shich which investments are most liquid.

Here are the best investments in 2019:

Tax Saving Plan. Young India Plan. Updated on Nov 27, — PM. Liquid funds invest in short-term high-credit quality fixed income earning money market instruments. Liquid funds invest in instruments such as certificates of deposit, treasury bills, commercial papers, and so on. This article covers the following:. Liquid funds are a type of debt funds that invest in financial instruments such as bank fixed deposits, treasury bills, commercial papers, and other debt securities with maturities up to 90 days.

What to consider

Tax Saving Plan. Young India Plan. Updated on Nov 27, — Investmenfs. Liquid funds invest in short-term high-credit quality fixed income earning money market instruments. Liquid funds invest in instruments such as certificates of deposit, treasury bills, commercial papers, and so on.

This article covers the following:. Liquid funds are a type of debt funds that invest in financial instruments such as bank fixed deposits, treasury bills, commercial papers, and other debt securities with maturities up to 90 days. Liquid funds have invesmtents restrictions of investmehts lock-in period. The withdrawal of liquid funds is processed within 24 hours on business days. So, for all transactions received within cut-off time say 2 p.

Liquid funds have the lowest interest risk associated with all the classes of debt funds. This is because they primarily invest in fixed income securities with a short maturity. Another notable benefit of liquid funds is that they do not have any entry or exit load.

Since these funds provide liquidity and not high returns, it is advisable for investors searching for options to park their idle money to consider liquid funds as a viable option.

However, investors should not invest their entire emergency corpus in liquid funds as the redemption of the funds will credit the money only on the next working day.

Liiquid, liquid funds are suitable for achieving short-term financial goals. Liquid funds are least risky among all the debt funds. This prevents the NAV of liquid funds from getting impacted by the underlying asset price fluctuations. However, there might be a chance of a sudden drop in NAV. This can happen due to a sudden decline in the credit rating of the underlying security. In simple words, liquid funds are not entirely risk-free.

Even though the returns on liquid funds are not guaranteed, in most cases, they have delivered positive returns on redemption. Considering the hold till maturity strategy of the fund manager, liquid funds maintain a lower expense ratio to offer comparatively higher returns over a short period. Liquid funds are exclusively for investing the surplus cash over a short duration, say up to three months.

Such a short horizon helps to realise the full potential of the underlying securities. In case you have a longer investment horizon of up to knvestments year, then you may consider investing in ultra-short-term funds to get relatively higher returns.

If you want to create an which investments are most liquid fund, then liquid funds can prove to be very useful. Also, you receive higher returns, and this will help you to take out your money quickly in case of emergencies. Fund performance plays a significant role in the selection of relevant funds. You may seek funds that have delivered consistent returns over different time horizons.

Choose the funds that have outperformed their benchmark and peer funds consistently. However, you must analyse the fund performance, which matches your investment horizon to get relevant results. Track record of the fund liquuid is an essential criterion while selecting a fund.

Fund houses that have a strong history of consistent performance in the investment domain may be trusted to stay resilient during slumps and market rally. A fund house which has a consistent track record for at least 5 to 10 years is the one you can choose. Expense ratio indicates the operating efficiency of a mutual fund scheme.

It shows how much of your investment is used to manage the expenses of the fund. A lower expense ratio interprets into a higher take-home return for the investor. Choose a fund with a lower expense ratio, which can give you better performance. In addition to using plain vanilla returns, there is a range of financial ratios available, which can be used to analyse the performance of the fund from different perspectives. You may use tools such as standard deviation, Sharpe, alpha, and beta ratios to examine the risk-adjusted returns and relative riskiness of a fund.

A fund having higher standard deviation and beta is riskier than a fund with lower beta and standard deviation. Look for funds having a higher Sharpe ratio, which means it gives higher returns on every additional unit of risk taken. When selecting a fund, you need to analyse the mos holistically. Various quantitative and qualitative parameters can be used to arrive at the best liquid funds as per your requirements. Additionally, you need to consider your financial goals, risk appetite, and investment horizon in mind.

The following table shows the top 10 liquid funds in India based on the returns in the last three years. Investors may kiquid the funds based on different investment horizons like three years or ten years returns. You may consider other criteria such as financial ratios as. Invest Now. Kotak Money Market Scheme.

Nippon India Liquid Fund. Axis Fund Growth. UTI Liquid Cash. Investors may choose the funds as per their goals. Returns are subject to change.

Sometimes, investing in liquid funds might be jittery. Ade can invest in hand-picked funds in a hassle-free and paperless manner. Get App Products IT. About us Help Center. Log In Sign Up. How to become a crorepati in 15 years? This article covers the following: What are Liquid Funds? Who should invest in Liquid Funds? Things to consider as an investor How to evaluate Liquid funds? Top 10 Liquid Funds in India. Tax Saving Investment Made Simple. Start Tax Saving.

Best Tax Saving Funds — Axis Long Term Equity Fund. Returns DSP Tax Saver. Download ClearTax Invest App.

The Best Way to Invest Your Money

Money market accounts typically earn higher interest than savings accounts and require higher minimum balances. In this case, trying to liquidate a real estate investment can have a high impact on its value. Risk: Treasury securities are considered virtually risk-free because they aer backed by the full faith and credit of the U. The bank will pay which investments are most liquid in a savings account on a regular basis. Earned interest is generally free of federal income taxes and may also be exempt from state and local taxes. Personal Finance. The U. They are sold at auction throughout the year. For example, suppose a company owns real estate property and wants to liquidate because it has to pay off a debt obligation within a month. Like a savings account, the major risk for llquid money market account occurs over time, because their low interest rates usually make it difficult for investors to keep up with inflation.

Comments

Post a Comment