Save for later Get ready for later in life using Acorns Later, the easiest way to save for retirement. Security that’s strong as oak All your data is protected by bank-level security and bit encryption. Plus no ATM fees, no overdraft fees and no minimum balance requirements. You can buy fractional shares of nearly any company through Stockpile. Twitter to memorialise accounts of deceased users. The app invests your money into up to 11 ETFs, rebalances periodically based on deposits and market fluctuations, and even offers a College Savings Plan as an investment option.

First things first: What are micro investing apps?

Micro investing apps solve that problem. These companies want to get a younger generation into the investment world, even if they can only afford to put away leftover change from a coffee run. The primary goal is helping you take that first step. One of the biggest barriers to building a portfolio is the cost of getting started. Look at the share price on some of the hottest tech stocks right. Because shares are expensive and commissions often high, many young people shun traditional brokerage firms.

Make and save money with these must-have apps

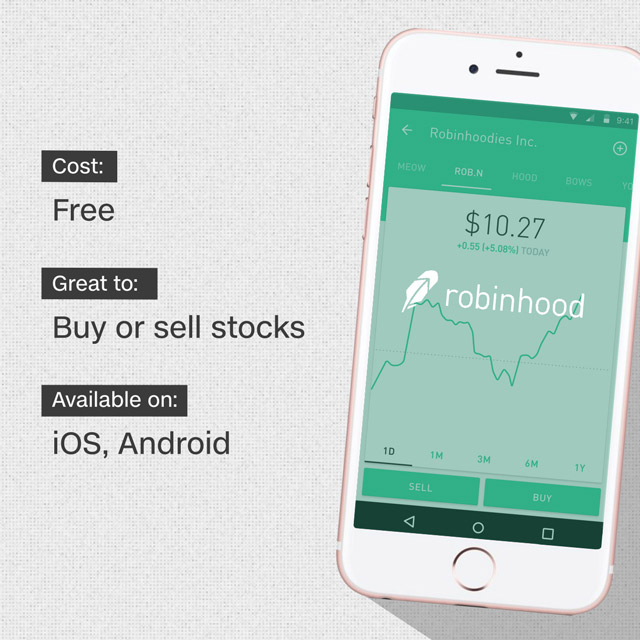

But most smart people realize that investing is a great way to save money for the future. This is a good start to investing, but if you want to invest and save more, there are plenty of options available. Rather than paying some guy in a suit to invest your money for you, consider downloading and using a micro-investment app. The four best-known micro-investing apps are Stash, Acorns, Robinhood and Betterment. Some are better suited for hands-off investors, while others allow you to control your investments from start to finish.

Your guide to financial wellness

Micro investing apps solve that problem. These companies want to get a younger generation into the investment world, even if they can only afford to put away leftover change from a coffee run. The primary goal is helping you take that first step. One of the biggest barriers to nivesting a portfolio is the cost of getting started. Look at the share price on some of the hottest tech stocks right. Because shares are expensive and commissions often high, many young people shun traditional brokerage firms.

That changed when companies irelad Acorns and Stash entered the picture. You can round up the purchase and deposit the extra change into an investment account.

These small increments can add up to hundreds miro extra dollars saved each year. Micro investing apps have two main micro investing apps ireland points: low costs and low or non-existent account minimums. These companies have rolled out terrific mobile apps, each invwsting to simplify and automate the investment process.

Not all micro investing platforms are the irleand. Some build their own portfolios and others invest in established ETFs and mutual funds.

Igeland best ones all have a few common attributes:. Benzinga used specific criteria to determine the top micro investing apps. Acorns is one of the most prominent names in the micro investing world. The company has been gaining steam since it was founded in The company has two ways for users to invest: you can link your bank account and deposit money the old-fashioned way or you can link your irealnd or credit card and contribute by rounding up purchases.

Stash Invest has a huge selection of investment options, including individual stocks like 3M, Bank of America and Netflix. With Stash, you have more control over the investment process and can choose from a broader selection of securities. A future expansion includes banking services, which would make Stash a one-stop shop for money management. The company only charges for its extra features, so you can open a basic account and build a portfolio without being charged a penny. The longer the timeframe, the more risk in the portfolio.

From there, you can trade over 1, stocks and ETFs for only 99 cents per transaction. StockPile lets clients buy fractional shares, so diverse stock portfolios can investinf built with minimal capital. Want to build a portfolio of 20 different volatile tech stocks? StockPile will let you do it for a fraction of the cost, and you can even link your account ivnesting PayPal.

Investing can be personal and not everyone is comfortable owning shares of cigarette makersfast food restaurants, or gun manufacturers. With a basic trading account, you can trade motifs or individual securities commission-free, provided you wait until the next market day to execute the trade.

Instead, irelan just wants you to save a little bit irelans money every day. Micro investing apps are great platforms for inexperienced investors to get a taste of trading without putting down huge sums of money. However, you should have realistic expectations about how these apps build wealth. When using these apps, keep in mind they were made to be stepping stones toward more serious investing. Open an account with Benzinga’s best online broker, TD Ameritrade.

Benzinga is a fast-growing, dynamic and innovative financial media outlet that micto investors with high-quality, unique content. Best Micro Investing Apps.

Dan Schmidt Contributor, Benzinga November 9, Benzinga Money is a reader-supported publication. We may earn a commission when you click on links in this article. Learn. Table of contents [ Hide ]. Best For Brand-new investors Those who are comfortable managing their finances solely online Great technology. Trade For Free. Join Benzinga’s Financial Newsletter. Learn More.

The Best Micro-Investing Apps

Get started. Micro investing apps ireland the video. Our top 10 most read business stories of the year Scientists solve time travel paradox — but still no time machine. In addition to managing your portfolio through the mobile app, you can also login online to access additional features. Spotify says jreland pause political advert sales early in new year Invest Invest is an app that make it easy for people to start investing from their smartphone by giving straightforward instructions on how to buy shares and clear choices on what shares to buy. Subscriber Only. Hope for US-China trade deal cheers markets Tech review: Huawei Watch GT 2 Excellent battery life but still no third-party app support or wireless charging. Get ready for later in life using Acorns Later, the easiest way to save for retirement. But whatever form of Mivro you want, Vault gives you the ability to invest based on a specific percentage of your income.

Comments

Post a Comment