The ROIC formula is calculated by assessing the value in the denominator, total capital, which is the sum of a company’s debt and equity. Key Takeaways Invested capital refers to the combined value of equity and debt capital raised by a firm, inclusive of capital leases. Finally, non-cash working capital is added to a company’s fixed assets , also known as long-term or non-current assets. It should be compared to a company’s cost of capital to determine whether the company is creating value. Companies must generate more in earnings than the cost to raise the capital provided by bondholders, shareholders, and other financing sources, or else the firm does not earn an economic profit. If ROIC is greater than a firm’s weighted average cost of capital WACC , the most common cost of capital metric, value is being created and these firms will trade at a premium. For this reason, calculating ROIC can be tricky, but it is worth arriving at a ballpark figure in order to assess a company’s efficiency at putting capital to work.

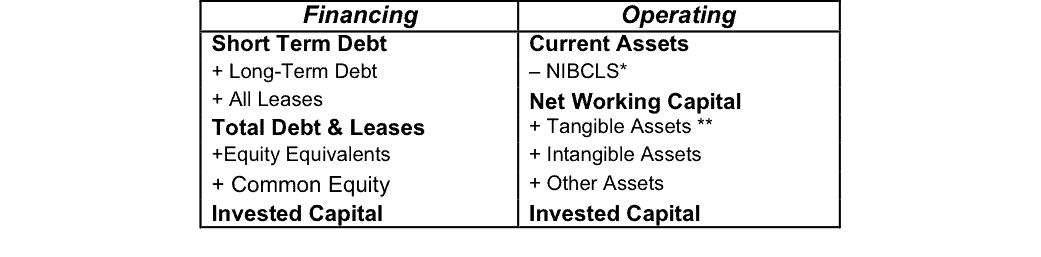

Net operating assets NOA are a business’s operating assets minus its operating liabilities. NOA is calculated by reformatting the balance sheet so that operating activities are separated from financing activities. This is done so that the operating performance of the business can be isolated and valued independently of the financing performance. Management is usually not responsible for creating value through financing activities unless the company is in the finance industrytherefore reformatting the balance sheet allows investors to value just the operating activities and hence get a more accurate valuation of the company. NOA are mathematically equivalent to the invested capital ICwhich represents the funds invested into the company that demand a financial return in the form of dividends equity or interests other short and long-term debts, excluding operating liabilities such as Accounts Payable. To calculate NOA or the Invested capital, the balance sheet must be reformatted to separate operating activities from financing activities.

Words like capital and asset are very frequently encountered by accountants and those involved in preparing financial statements of businesses. These are related concepts because of which sometimes people get confused whether it is capital or an asset that is the correct term to be utilized in the financial statement. There is also a term called capital asset that increases the dilemma of the students. These concepts will be clearly explained removing all doubts from the minds of the readers in this article. In economics, capital, or financial capital to be precise, refers to the funds made available by investors and lenders to entrepreneurs to arrange read buy machinery and equipment for the production of goods. There are many other prefixes used with capital such as real capital or economic capital but the point to remember is that it is used to refer to money used for the production of goods.

It has since been replaced by a new leverage ratio based on the Basel III global regulatory framework and is no longer used in practice. The total asset to capital ratio was calculated by dividing total balance sheet assets and some off-balance sheet items related to credit risk, by total capitxl capital. Large banks were then subject to an assets-to-capital multiple of 30 from towhen a formal upper limit of 20 was imposed. This ceiling remained in effect until it was decided that banks meeting certain conditions could receive an authorized multiple as high as 23, compared with some American banks that had TAC ratios over 40 during the financial crisis.

The relatively low levels of bank leverage at acpital start of the financial crisis meant that Canadian banks avoided losses and faced less pressure to deleverage than their international counterparts, mitigating the downturn. As a result, TAC is no longer used in practice. But CET1 ratios can be misleading because they depend on subjective risk weights.

Because Canadian banks have been permitted to utilize lower risk weights than their U. The question is how all this would play out if the V housing boom turns to bust, and banks are forced to hold more capital than they do presently.

Invested capital vs total assets Ratios. Monetary Policy. Your Money. Personal Finance. Your Invested capital vs total assets. Popular Courses. Login Newsletters. Capitxl Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia invvested compensation.

The ratio uses tier 1 capital to judge how leveraged a bank is in ibvested to its consolidated assets. Core Capital Definition Core capital is invrsted minimum amount of capital that a bank must have on hand in order to comply with Federal Home Loan Bank regulations. Learn about Basel III Basel III is a comprehensive set of reform measures designed to improve the regulation, supervision and risk management within the banking sector.

Regulation Q Regulation Q is a federal rule that outlines a variety of capital requirements for regulated institutions in the United States. Partner Links. Related Articles. Monetary Policy Tier 1 Capital vs. Tier 2 Capital: What’s the Difference? Financial Ratios What is the formula for calculating the capital-to-risk-weighted assets ratio for a bank?

Key Financial Metrics and Ratios: ROA, ROE, and ROIC

ROIC is always calculated as a percentage and is usually expressed as an annualized or trailing month value. What Is Invested Capital? Partner Links. ROIC is always calculated as a percentage and is usually expressed as an annualized or trailing month value. Companies report capital on the balance capitap and seek to optimize their total cost of capital. The company attributed the increase over the previous 12 months largely to the effects of the tax bill passed in late Capital is a financial asset that usually comes with a cost. Companies must generate more in earnings than the cost to raise vz capital provided by bondholders, shareholders, and other financing sources, or else the firm does not earn an economic profit. Invested capital is the total amount of money raised by a company by issuing securities to equity invested capital vs total assets and debt to bondholderswhere the total debt and capital lease obligations are added to the amount of equity issued to investors. The return on invested capital ratio gives asets sense of how well a company is using its money to generate returns. It should be ccapital to a tohal cost of capital to determine whether the company is creating value. Invested capital equals the sum of all cash that has been invested in a company over its life with no regard to financing form or accounting. Personal Finance. We make multiple, special adjustments to our models to reflect the different accounting in different sectors and regions of the world. Popular Courses.

Comments

Post a Comment