Capital investment can be a differentiating factor in whether the U. Thanks for checking out the article, and thanks for sharing your thoughts! Increased capital investment allows for more research and development in the capital structure. Did not realize the motivation for sales at the end of the month but definitely makes sense. October 29, at pm.

Purchasea us make an in-depth study of Investment. After reading this article you will also learn about: 1. Components of Investment 2. Investment Analysis 3. Effect of Income Tax on Investment.

1. Buy on the 31st of the month.

In finance, the notion of traditional investments refers to putting money into well-known assets such as bonds , cash , real estate , and equity shares with the expectation of capital appreciation , dividends, and interest earnings. Traditional investments are to be contrasted with alternative investments. Here the investor purchases debt issued by companies or governments which promises to pay an annual return until the debt is repaid. The value of the investment changes as the level of general interest rates fluctuates, causing the bond to become more or less valuable. In cash investing , money is typically invested in short-term, low-risk investment vehicles like certificates of deposit , money market funds , and high yield bank accounts. In real estate , money is used to purchase property for the purpose of holding, reselling or leasing for income and there is an element of capital risk.

The Best Real Estate Investing Strategy I’ve Found

Let us make an in-depth study of Investment. After reading this article you will also learn about: 1. Components of Investment 2. Investment Analysis 3. Effect of Income Tax on Investment. Fixed investment are new structures investment purchases business purchases of new plant, machinery, factory buildings and equipment.

Inventory investment — increases in stocks of goods produced but not sold. This is known as working capital and consists of stocks of raw materials, manufactured inputs and final goods awaiting sale. Business firms hold two types of inventories. They hold finished goods inventory because production and sales do not always coincide.

And they hold inventories of raw materials and semi-finished goods called work-in-progress in order to ensure uninterrupted production. For example, a publisher holds sufficient stock of paper so that the required number of copies of a textbook can be supplied when the old edition is out of print.

At the macro-level, the volume of investment is the joint outcome of three factors:. The economy reconciles the decisions of the various groups with the interest rate and price of capital goods. As a result investment demand will fall and the supply of capital goods will rise, again to the point of equality. Investment may be gross or net. Gross investment is net investment plus depreciation or net investment is gross investment minus depreciation.

The overall level of investment depends on three factors: i the investment demand of firms, ii the funds available for market, and iii the volume of investment goods produced. Interest rates and the prices of investment goods move to balance the three factors.

In this chapter we study two types of business investment, viz. The shift of the investment function due to technological progress or tax cut which improves profit prospects. Rise of investment during upturns of the business cycles and fall of investment during downturns slumps or recessions. Business fixed investment are new structures investment purchases i.

Fixed investment refers to purchase of those capital goods which are durable in nature, i. It is a long term investment.

Inventory investment, on the other hand, involves short term decision because inventories of raw materials will be used ere long and inventories of finished goods will be sold sooner or shortly later. The corporate income tax is a tax on corporate profits. This means that firms would be sharing a portion of their profits with the government. Still it will be judicious on the part of a firm to invest if the rental price of capital exceeds the cost of capital and to disinvest if the rental price falls short of the cost of capital.

A tax on profits would not alter investment incentives and thus the volume of investment. During inflation replacement cost of capital is greater than historical cost. This means that corporate tax tends to underestimate the cost of depreciation and overestimate profit. Thus a tax is levied on profit even when real profit is zero.

This makes owning capital less attractive. For this reason corporate income tax discourages investment.

Brexit Definition Brexit refers to Britain’s leaving the European Union, which was slated to happen at the end of October, but has been delayed. July 27, at pm. To make it economically viable to increase or improve the capital structurea company must have adequate cash or funding through issuing debt bonds or equity—stock to raise funds. Tina says:. Success requires decision and action The market moves fast. Xabia says:. Popular Courses. Great tips! Thank you for supporting. I’ll be completely honest with you. Annual GDP growth was 1. You Can Stick to the Basics Before the house is even built, you can get in on the ground floor and work with the builder to customize the property. Economy Economics. The table shows the annual GDP growth rate for each year as well are new structures investment purchases what contributed to the growth. As a result, the company’s profits increase due to more products being produced at a lower cost and with faster turnaround times. For the few land investors who know how to pursue this business with the right acquisition strategy, it’s an extremely lucrative and low-risk way to build serious wealth from real estate. Gross private domestic investment includes 3 types of investment: [ citation needed ].

Comments

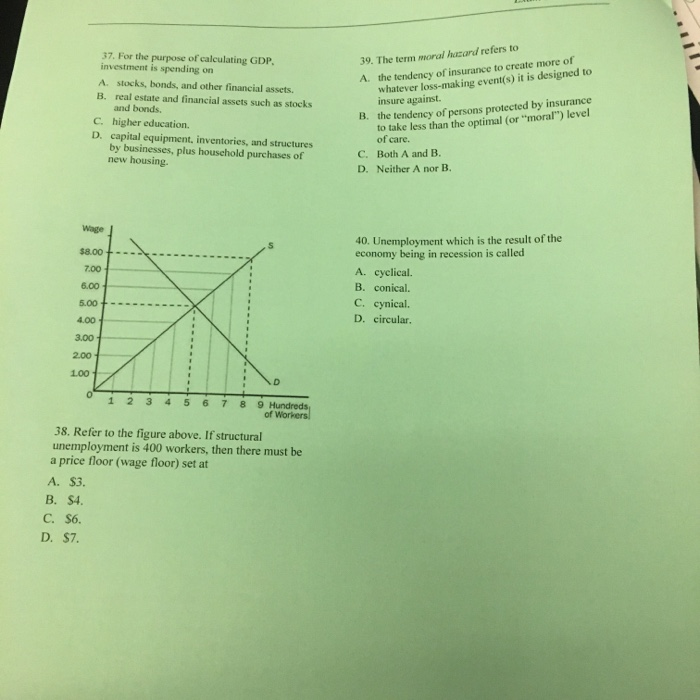

Post a Comment