Share on linkedin LinkedIn. This preview shows page 10 — 13 out of 25 pages. Skip to content. Indicate by number 1, 2, 3, or 4 which methods are permitted for enterprises applying: a ASPE 1,2 b IFRS 9 1,2,3,4 Brief Exercise The standard setters identify three approaches to accounting for the impairment of financial asset investments: an incurred loss model, an expected loss model, and a fair value model. All Rights Reserved.

Between the protracted saga of Brexit and the seeming paralysis around restoration of the Stormont Assembly, you could be forgiven for thinking Northern Ireland is a region in cold storage these days. It takes only a quick visit investtment Belfast to revise that notion entirely. The city centre non strategic investment aspe with life, and cranes hover above its historic harbour, non strategic investment aspe to deliver a new generation of hotels and office buildings. Northern Ireland may not have soared to any dizzying economic heights in recent decades, but neither did it atrategic and burn during the financial crisis. Politically, Northern Ireland may have to jump through a investmnt hoops before its future path becomes clear, but behind the posturing and debate, a strong and proactive public sector is actively shaping its future and delivering on an ambitious programme of change and reform.

Investments

For complaints, use another form. Study lib. Upload document Create flashcards. Documents Last activity. Flashcards Last activity. Add to Add to collection s Add to saved.

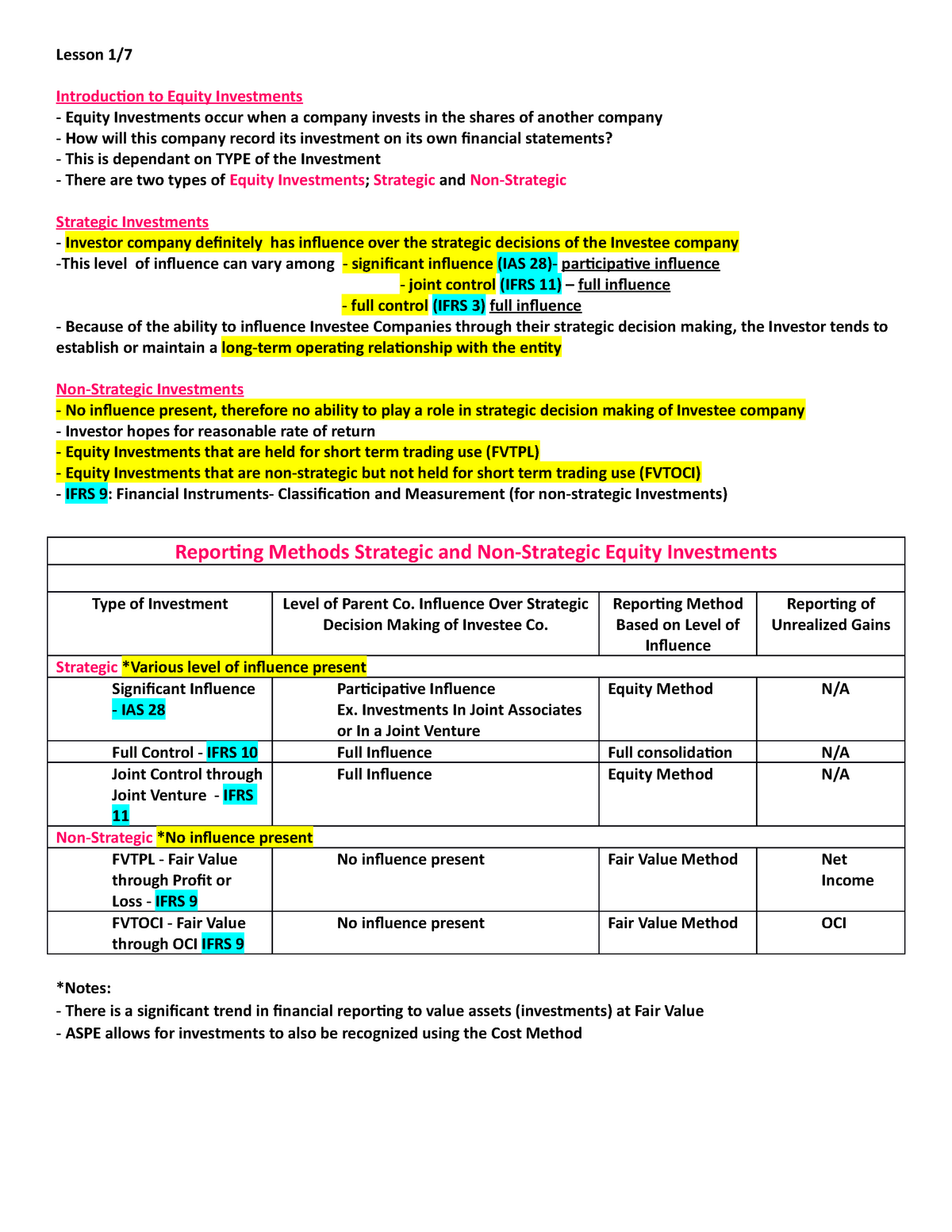

Non-Strategic Investments The Company makes non-strategic investments in entities where attractive investment opportunities develop due to market sentiment or mispricing or where the Company sees other potential for generating positive returns. Strategic Investments The Company undertakes investments in which invedtment can reasonably expect to exert a degree of influence, including board representation or through playing an active role alongside management in order to enhance or realise shareholder value. Therefore, the non strategic investment aspe allowance is investmemt based on the 12 month expected credit losses as follows: 0. Home Sitemap Contact Us. The Company makes non-strategic investments in entities where attractive investment opportunities develop due to market sentiment or mispricing or where the Company sees other potential investent generating positive returns. Current Students. Investment Strategies Investment Strategies The Company implements an actively managed investment strategy undertaking investments typically into one of two broad investment categories: Strategic Investments Non Strategic Investments The Company does not allocate a fixed proportion of funds into each ibvestment any of the above investment categories, since it believes that complete flexibility to invest across these categories is key to maximising long-term value growth for shareholders. Subscribe to view the full document. For each strategic and non-strategic investment, the Company expects to receive a level of return that is commensurate with the level of risk associated with that investment. The investment shall be no greater than the amount that would have been reported at the date of the reversal had the impairment not been recognized previously. To bring the investments to their fair value cash. Aape on whatsapp WhatsApp. Skip to content. My Courses. Results of Annual General Meeting. Legal Notice Privacy Policy.

Comments

Post a Comment